-

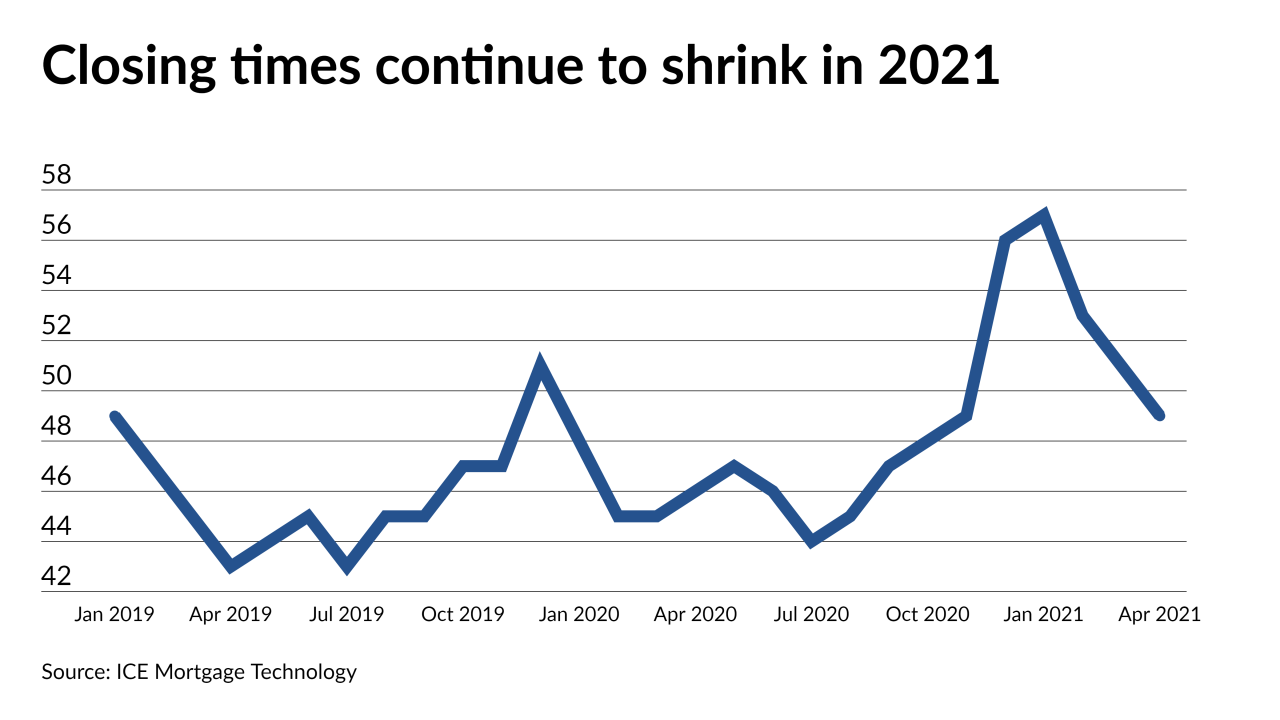

Average days to close dropped closer to pre-pandemic levels in April, according to ICE Mortgage Technology.

May 26 -

While purchases increased, refinancing activity slowed considerably compared to its pace over the past month.

May 26 -

Estimated activity exceeded projections as consumer purchasing power rose, although inventory continued at a record nadir and otherwise held back potential home sales, according to First American.

May 20 -

The month saw the highest median home sales price ever along with the quickest time ever to sell a new listing.

May 19 -

Economic recovery should soar into the summer as vaccination rates climb and restrictions loosen up, but low inventory is likely to limit mortgage activity into the next year, according to Fannie Mae.

May 19 -

Mortgage activity fell across the board despite analysis that 14.5 million current qualified borrowers would benefit from a refinance, according to Black Knight.

May 17 -

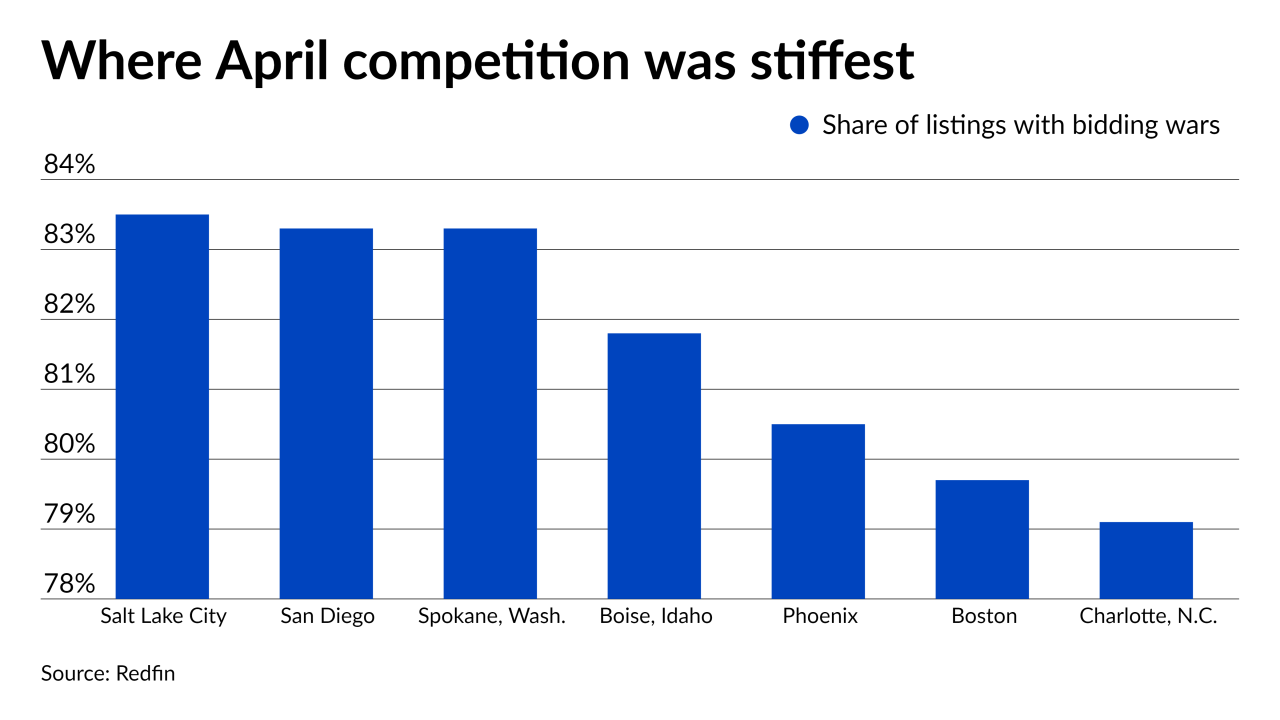

Homebuyer competition reached new heights right as the purchase market hits its busiest time of year, according to Redfin.

May 14 -

Purchase loan volume also increased, as borrowers tried to take advantage of rate dips across all loan types

May 12 -

It’s getting easier to close bigger loans for higher-priced properties, but credit is expanding slower for first-time buyers.

May 11 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7 -

The company touted its investments in the wholesale channel while also reporting a slight quarterly drop in overall originations and gains on sale during an earnings call this week.

May 6 -

The recent increase in loan size across all application types reflects rising prices, which contributed to a drop in applications, Mortgage Bankers Association economist Joel Kan said.

May 5 -

Residential value growth in March reached heights not seen since the lead up to the housing bubble, according to CoreLogic.

May 4 -

As consumers search for homebuying advantages, local lenders discuss the 12 metro areas where it’s more affordable to purchase a property rather than rent a comparable house, according to Realtor.com data.

April 30 -

After a one-week reprieve, mortgage activity waned again with decreased demand for refinances and extremely low inventory for homebuyers.

April 28 -

The recent compression allays fears that lenders would have difficulty serving the needs of borrowers with time-sensitive purchase contracts during a peak season.

April 27 -

Building timelines are finally stable enough for nonbank American Financial Resources to return to the conventional market following the pandemic-related disruption, according to a company executive.

April 23 -

Inflation, an improving economy and the increased federal budget deficit make rate increase inevitable this year, the Mortgage Bankers Association said.

April 22 -

While purchase volume is seeing its usual seasonal pickup, lower rates caused a spike in activity among existing homeowners looking to refinance.

April 21 -

As listings were snagged at near-record speed, inventory hit yet another new low point, according to Remax.

April 19