Regulation and compliance

Regulation and compliance

-

New licensing rules for mortgage professionals servicing loans secured by New Jersey properties will go into effect this summer, adding to a trend toward tighter state regulation of standalone servicers.

April 30 -

Director Kathy Kraninger said the agency will emphasize a confidential supervisory process instead of just doling out public enforcement actions. But skeptics worry this will let companies escape punishment.

April 29 -

The debt collection proposal is expected to address how debt collectors can use text messages and emails to track down debtors.

April 29 -

Along a stretch of South Los Angeles near the Expo light rail line, investment dollars are pouring in.

April 26 -

Two Sacramento, Calif., defendants were found guilty of wire fraud stemming from a fraudulent real estate company that targeted members of Sacramento's Latino community, according to the U.S. Attorney's Office.

April 26 -

New FHFA Director Mark Calabria isn't just charting a future for Fannie Mae and Freddie Mac, but also fixing problems resulting from the "qualified mortgage" exemption for the GSEs and taking a "deep dive" into problems in the mortgage servicing market.

April 25 -

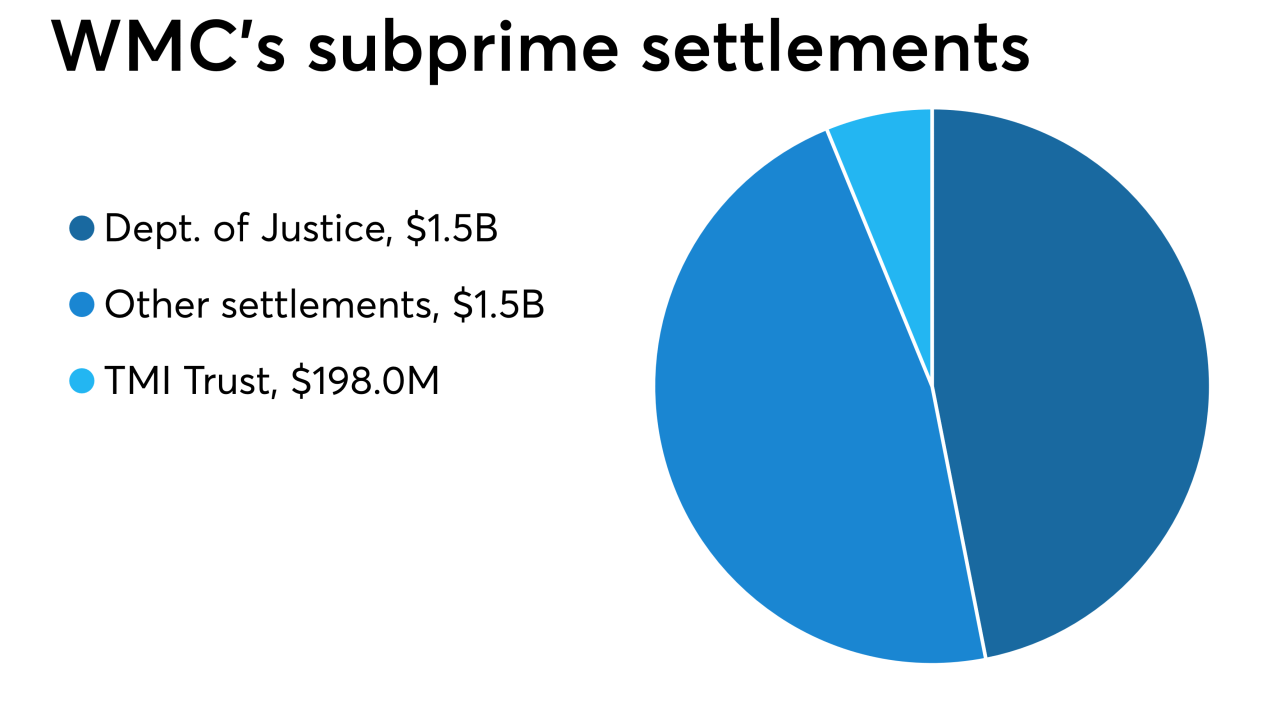

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

Under a new policy, a company subject to a civil investigative demand will learn from the agency about what conduct the probe is targeting and what legal provisions the firm may have violated.

April 23 -

Economic growth will slow in 2019, but conditions will help home sales hold steady, with mortgage volume now being projected to rise over 2018, according to Fannie Mae.

April 18 -

In her first policy speech since being confirmed as the agency's director, Kathy Kraninger promised less focus on enforcement actions and more emphasis on consumer education.

April 17 -

Tax reform leaves mortgage-related deductions far too low to help the average homeowner this tax season, in contrast to last year, when they slightly exceeded the standard deduction.

April 15 -

The new head of the agency regulating Fannie Mae and Freddie Mac will be at the forefront of reforming the housing finance system.

April 15 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

A bipartisan proposal would allow for the removal of the FHFA director if the agency approves CEO salary increases at Fannie and Freddie beyond $600,000.

April 12 -

Caliber Home Loans settled a grievance with the Massachusetts attorney general over allegations of providing distressed borrowers with unaffordable loan modifications.

April 11 -

A judge in Michigan has ordered the Justice Department and Quicken Loans attempt a settlement in a years-old lawsuit in which the federal government accused the mortgage lending company of fraud.

April 9 -

A Staten Island, N.Y., man involved in a $2.5 million real estate investment scheme that targeted investors, many of whom were elderly and some of whom had dementia, was sentenced to three years in prison.

April 8 -

B. Riley FBR initiated equity coverage on Fannie Mae as the chances for privatization of the government-sponsored enterprises improved in a housing finance reform package.

April 5 -

The administration official will serve a five-year term as Fannie Mae and Freddie Mac's chief regulator.

April 4 -

After a brief delay, the agency’s acting director signed off on Fannie Mae and Freddie Mac contributing to the National Housing Trust Fund and Capital Magnet Fund.

April 3