-

The company has been making investments in correspondent originations and servicing and “reverse” loans used by borrowers age 62 and up to withdraw home equity.

August 5 -

The $16 billion Champion Mortgage portfolio sale follows Ocwen Financial’s purchase of different assets from MAM a few weeks prior.

July 6 -

The ruling confirms that a state precedent regarding forward mortgages also applies to home equity conversion loans.

July 1 -

The deal will add $7.8 billion in reverse mortgage subservicing to Ocwen $6.7 billion portfolio.

June 18 -

The newly public company expects a 20% overall loss in adjusted earnings this year.

May 13 -

Hild, 46, schemed with other Live Well executives to increase the reported value of a pool of bonds used as collateral for loans, Assistant U.S. Attorney Jordan Estes told jurors in opening statements on Wednesday.

April 14 -

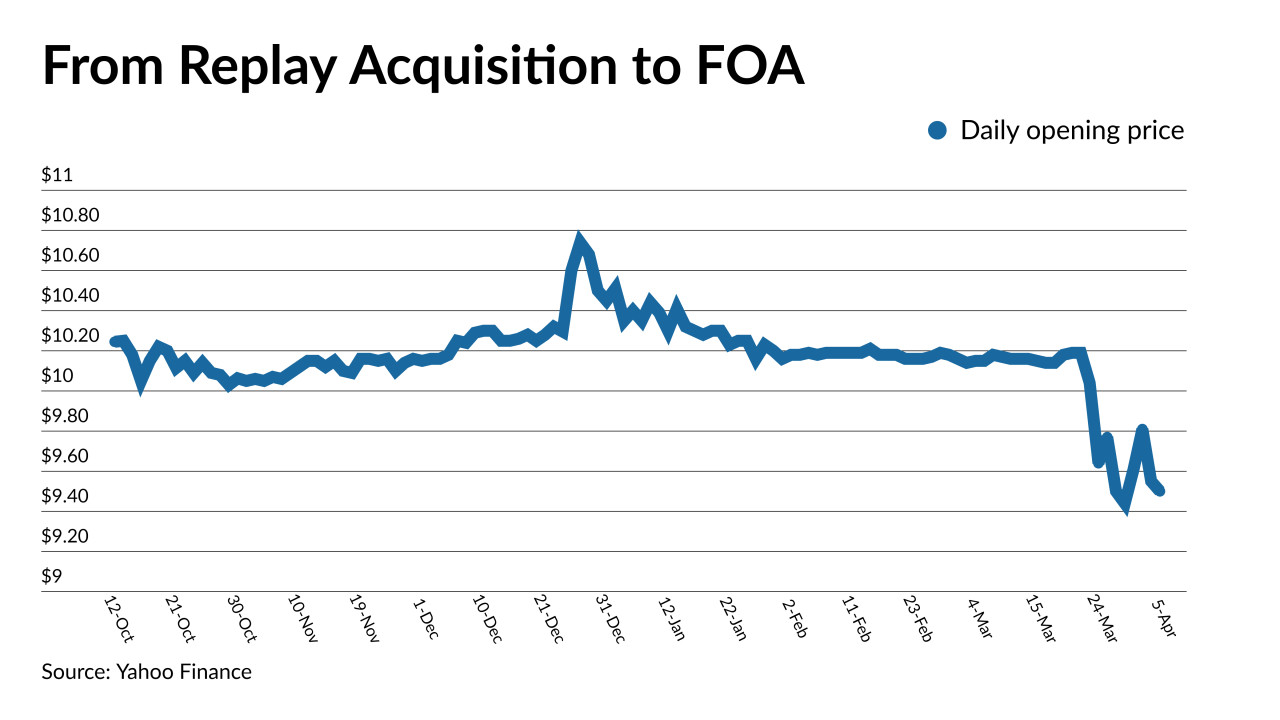

The forward and reverse mortgage lender completed its merger with blank check company Replay Acquisition Corp. on April 1.

April 5 -

Finance of America Reverse's product combines features of a forward mortgage, like 10 years of payments, with parts of a non-recourse reverse loan.

March 10 -

The servicer owned by Mr. Cooper agreed to pay a penalty for allegedly failing to provide its clients with clear information on foreclosure and defaults.

March 3 - LIBOR

The deadline for inclusion in Ginnie mortgage-backed securities has been extended and an exception will be made for some participations.

December 16 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

And how people involved with Replay Acquisition made it more attractive than an initial public offering, according to CEO Patricia Cook.

October 22 -

But current owner Blackstone and FOA management will keep 70% of the company after its merger with a SPAC.

October 13 -

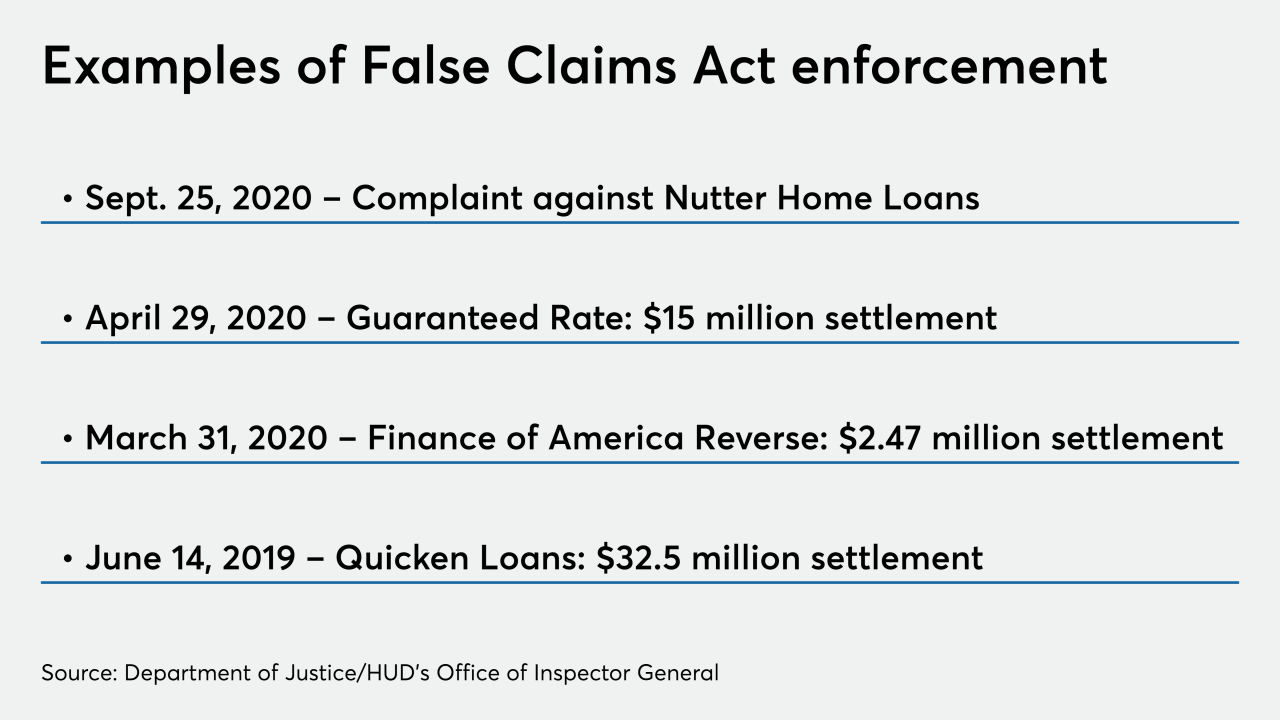

The accusations against Nutter Home Loans, like an earlier settlement with the Department of Housing and Urban Development, center on concerns related to FHA-insured reverse mortgages. The company "strongly disputes" them.

September 30 -

FHA Commissioner Dana Wade offered a preview of ambitions she has for the Federal Housing Administration at a virtual event held by Women in Housing and Finance on Tuesday.

September 22 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

Also the Federal Housing Administration, which is a key contributor of government-insured loans to Ginnie securitizations, recently set new conditions on mortgage applicants that have been in forbearance.

September 14 -

Ginnie Mae helped to fund more than $70 billion in loans aimed at helping low- and moderate-income borrowers in July.

August 10 -

Finance of America Reverse agreed to pay $2.5 million to settle allegations that a company it acquired violated the False Claims Act for loans submitted for Federal Housing Administration insurance in 2010.

April 2 -

The Department of Housing and Urban Development's 60-day foreclosure halt for Federal Housing Administration borrowers is too short to help reverse mortgage borrowers, a letter from consumer groups stated.

March 25