-

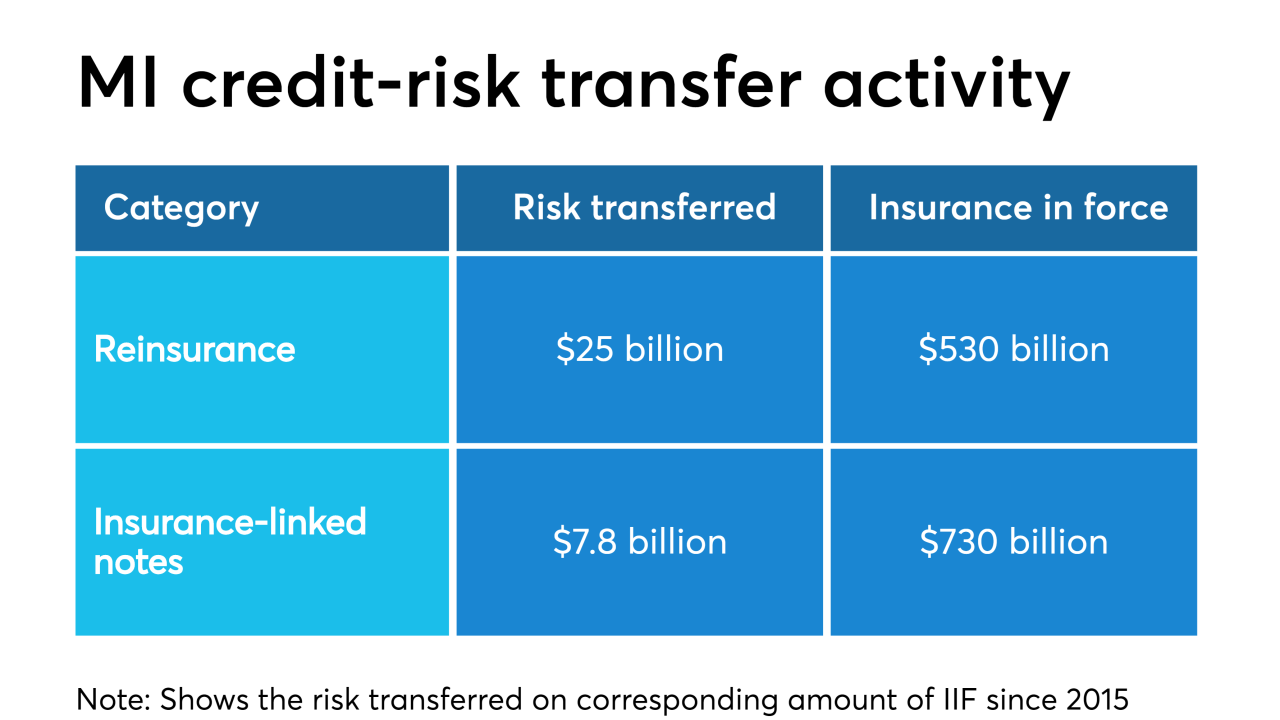

An increase in credit risk transfer activity since 2015 signifies a sea change for private mortgage insurers that may be about to intensify, according to an industry trade group.

November 5 -

A risk management model revision that decreased single-family loan-loss allowances and a strong mortgage lending environment contributed to consistent earnings results at Fannie Mae in the third quarter.

October 31 -

Freddie Mac will make haste to leave conservatorship in line with new regulatory directives, but it's uncertain how quickly it can move, CEO David Brickman said in an earnings call.

October 30 -

The average number of attempts to defraud mortgage companies each month increased by 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions.

October 29 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

The credit union regulator has spent 20 years asking lawmakers for greater oversight of third-party vendors. Here's why it might finally happen.

October 24 -

The outlook for hotels and suburban offices is still questionable, but the prognosis for other property types in the securitized commercial real estate market remains fairly strong, according to Moody's Investors Service.

October 23 -

The housing finance industry supports a proposed rule revision that would exempt banks regulated by the Federal Deposit Insurance Corp. from an RMBS disclosure requirement.

October 22 -

The Department of Veterans Affairs distributed more than $400 million in refunded home loan fees after finding exempt borrowers were mistakenly charged due to clerical errors related to their disability status.

October 10 -

David Lowman, executive vice president of the single-family business at Freddie Mac, has informed the company he will be stepping down from his position on or about Nov. 1.

October 8 -

It would cost nearly $30 billion to rebuild the tens of thousands of homes that are most vulnerable to wildfires in the Sacramento metropolitan area, a projection that ranks California's capital region fourth highest in the nation for wildfire risk, according to CoreLogic.

September 17 -

A final rule on residential appraisals published this month could save depositories time and money in the short term, but potentially increase collateral risk.

August 30 -

The second half of 2019 is a prudent time to examine the CRE market in the context of an inevitable slowdown, taking into account how the current landscape is impacting lending practices.

August 29 EDR Insight

EDR Insight -

Ginnie Mae followed through with plans to look more closely at secured debt ratios in its latest round of new and revised issuer requirements.

August 23 -

Wide short-term swings in interest rates — and loan prepayments — that we've all witnessed have serious secondary effects on consumers, lenders, investors and also policymakers.

August 19 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The potential for negative long-term mortgage rates is surfacing around the world, and with global tensions building in the U.S. market, there's a small but growing chance it could happen here, too.

August 7 -

Essent Group continued to benefit from the volatility in private mortgage insurers' market share, remaining in second place among the six active underwriters at the end of the recent quarter.

August 2 -

Freddie Mac continues to churn out steady financial returns, with the growth in first-time home buyers and credit risk transfers providing the GSE stable footing when a recession comes, according to new CEO David Brickman.

July 31 -

Mortgage fraud risk took a serious dive in the second quarter amid lower interest rates, which brought more refinance transactions into the market, according to CoreLogic.

July 25 -

Ginnie Mae is requesting feedback on a new proposed stress test for mortgage-backed securities issuers that would take into account the government agency's increased nonbank counterparty risk.

July 24