-

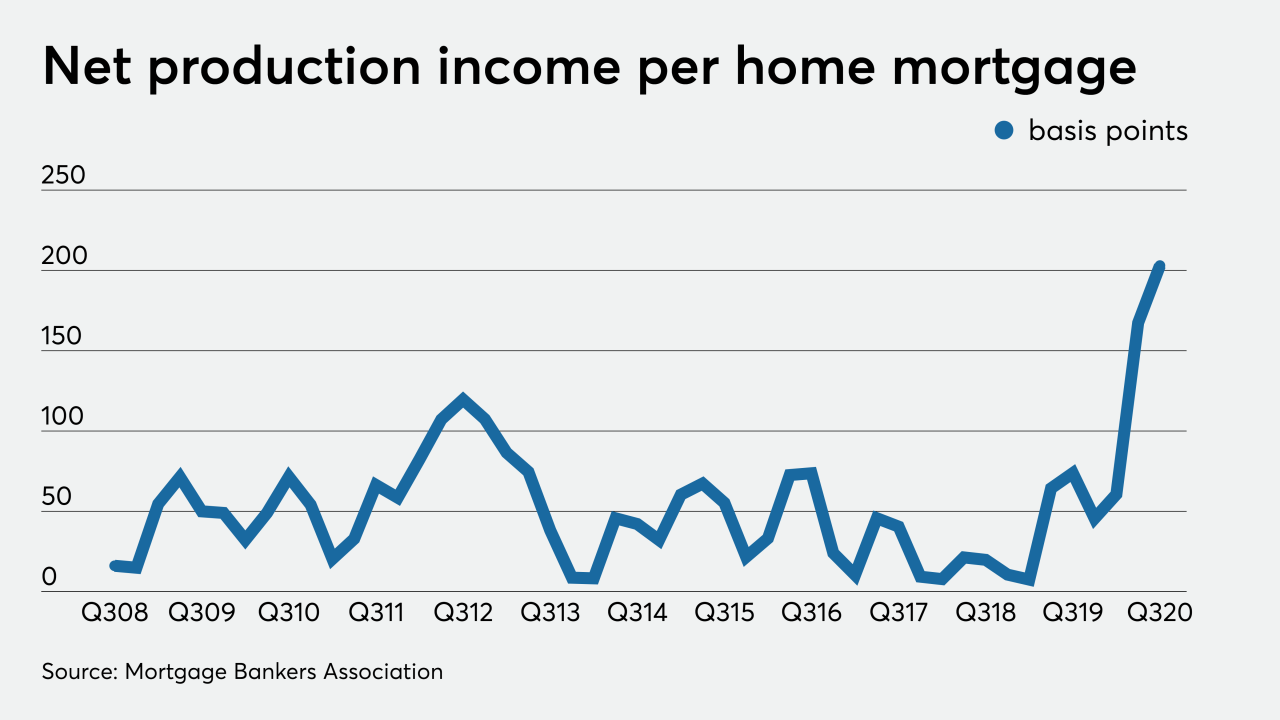

The average per-loan profit margin remains incredibly strong, but the share of senior executives expecting it to fall has risen markedly.

December 9 -

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

If CMBS litigation picks up in earnest in the aftermath of the pandemic, lessons gleaned from over a decade of RMBS litigation could pay dividends, Bilzen Sumberg lawyers Philip Stein and Kenneth Duvall say.

December 8 Bilzin Sumberg

Bilzin Sumberg -

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick.

December 1 -

Experts in the field predict how some aspects of the market will develop in the coming year.

November 30 -

The Structured Finance Association fears Treasury Secretary Steven Mnuchin may release the government-sponsored enterprises from conservatorship ahead of the change in administration, and that doing so could disrupt the mortgage-backed securities market.

November 24 -

To truly manage risk, banks must invest in more sophisticated modeling, reporting and analytics to track market movements and ultimately maximize profitability, Vice Capital Markets’ Christopher Bennett says.

November 19 Vice Capital Markets

Vice Capital Markets -

The Term Asset-Backed Securities Loan Facility was brought back to inject $100 billion into the pandemic-battered economy, but only a fraction has been disbursed. Yet experts, pointing to its calming effects on markets, recommend that it be extended into next year.

November 17 -

Lenders also increased jumbo product availability as well as rolling out new SOFR-indexed ARMs.

November 16 -

There have been several extensions of the policy since it was put into place as a way to sustain originations amid a wave of forbearance allocated to borrowers with government-related loans.

November 13 -

The sector’s leaders are hoping for better in 2021, while not forgetting lessons learned about the market’s risks in 2020.

November 12 -

FHA volumes, a key contributor to Ginnie Mae issuance, could fall as long as the refinancing boom continues — unless the FHA takes a step that could reverse that trend.

November 10 -

The company is finding it challenging to ramp originations back up after spending most of the second quarter on the sidelines.

November 5 -

Smaller lenders should consider positioning themselves for acquisition at a time when they can be making the most money.

November 4 -

The technology rolled out by the Department of Housing and Urban Development aims to provide lenders with immediate and expanded responses related to Federal Housing Administration insurance eligibility.

November 2 -

How we resolve millions of delinquent mortgages due to COVID is the only question that matters.

October 30 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The upcoming shift may help to prepare the government-sponsored enterprise for a conservatorship exit by reducing interest-rate volatility in Fannie’s earnings.

October 29 -

The government-sponsored enterprise also saw a 22% increase in net worth from the second quarter.

October 29 -

The Libor transition is creating huge headaches for the industry; harnessing AI technologies may be the key to tackling it.

October 23 ABBYY

ABBYY