-

Banks' lowering of origination fees and loosening of underwriting standards often foreshadow a downturn.

February 11 Nations Lending Corp.

Nations Lending Corp. - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

Despite a drop in multifamily loan volume, industrial, health care, office and retail originations pushed overall multifamily and commercial mortgage lending to unprecedented heights, according to the Mortgage Bankers Association.

February 10 -

Default rates for prime jumbo mortgages will increase, but a strong economy and rising home prices will bail most borrowers and lenders out, Moody's said.

February 3 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

The loan participation is part of a debt refinancing package that paves the way for expanding the Parkmerced mega-development.

January 28 -

Trade associations representing mortgage lenders and securities market participants are asking the Federal Housing Finance Agency to rethink a plan to restrict pooling options for loans sold into uniform mortgage-backed securities.

January 22 -

Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings.

January 22 -

Fannie Mae is sponsoring a $1.03B CRT transaction, while Caliber Homes Loans, New Residential and Onslow Bay fill the non-QM pipeline

January 14 -

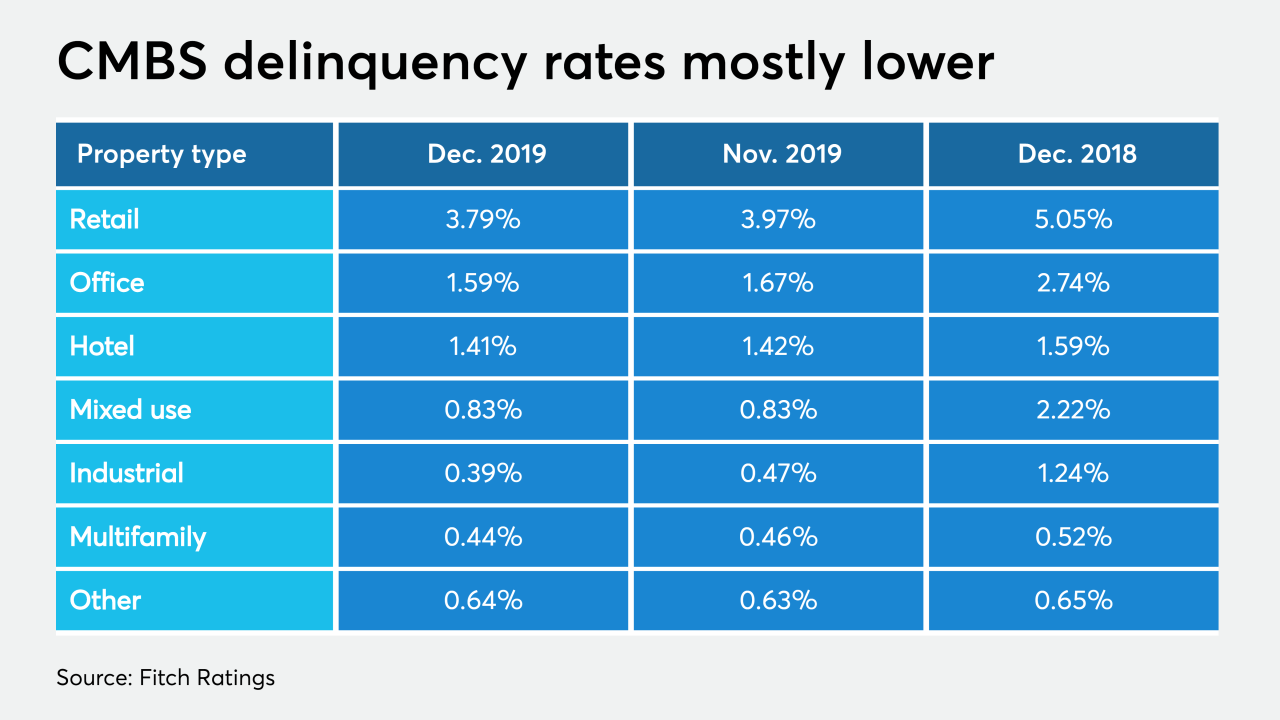

The delinquency rate for commercial mortgage-backed securities ended 2019 at its lowest point in nearly 11 years, aided by increased issuance and the resolution of legacy transactions, Fitch Ratings said.

January 10 -

A New York-based real estate investment firm is financing its acquisition of a portfolio of nationally branded hotels via the commercial mortgage securitization market.

January 9 -

Goldman Sachs is sponsoring a $1.33 billion bond offering backed by commercial mortgages, in the first rated conduit deal of the year.

January 7 -

Bridge REIT LLC is sponsoring a $449.6 million bridge-loan securitization backed mostly by transitional multifamily properties.

January 6 -

High-grade corporate bonds bested mortgages by a wide margin in 2019 and are likely to outperform them again this year, according to JPMorgan Chase & Co.

January 6 -

Instability among foreign relations typically drags down long-term interest rates and the latest crisis with Iran could be a catalyst for a drop in 2020, according to NerdWallet.

January 3 -

Redwood Trust’s next mortgage-backed securitization consists almost entirely of older mortgages it originally sold off, but has since reacquired to assign to its first deal of the new year.

January 3 -

DBRS Morningstar's presale report raises concerns that the securitized loan for Onni Group's Wilshire Courtyard faces considerable risks from the business volatility of its largest tenant.

December 20 -

The $458.87 million HalseyPoint CLO1, via JPMorgan, is the first deal by the firm that was launched in May 2018 by two former Columbia Asset Management portfolio managers.

December 18 -

Fitch may use a new Structured Finance Association framework aimed at prioritizing only riskier TRID errors to assign grades to loans sold into residential mortgage-backed securities, reducing rating-related compliance burdens.

December 17 -

Issuance of Ginnie Mae mortgage-backed securities slipped after several months of gains, but high volume still pushed the year-to-date total for 2019 ahead of 2018’s full-year figure.

December 16