-

Payoffs of maturing office loans in securitizations may be delayed more often in the next few years if increasing inventory constrains occupancy and rent growth, according to Morningstar.

May 8 -

Investors can now exchange certain existing Freddie Mac bonds for to-be-announced uniform mortgage-backed securities in preparation for the full launch of UMBS next month.

May 8 -

Live Well Financial, a reverse and traditional mortgage lender that abruptly stopped originating on May 3, will lay off 103 employees, according to a Virginia Employment Commission filing.

May 7 -

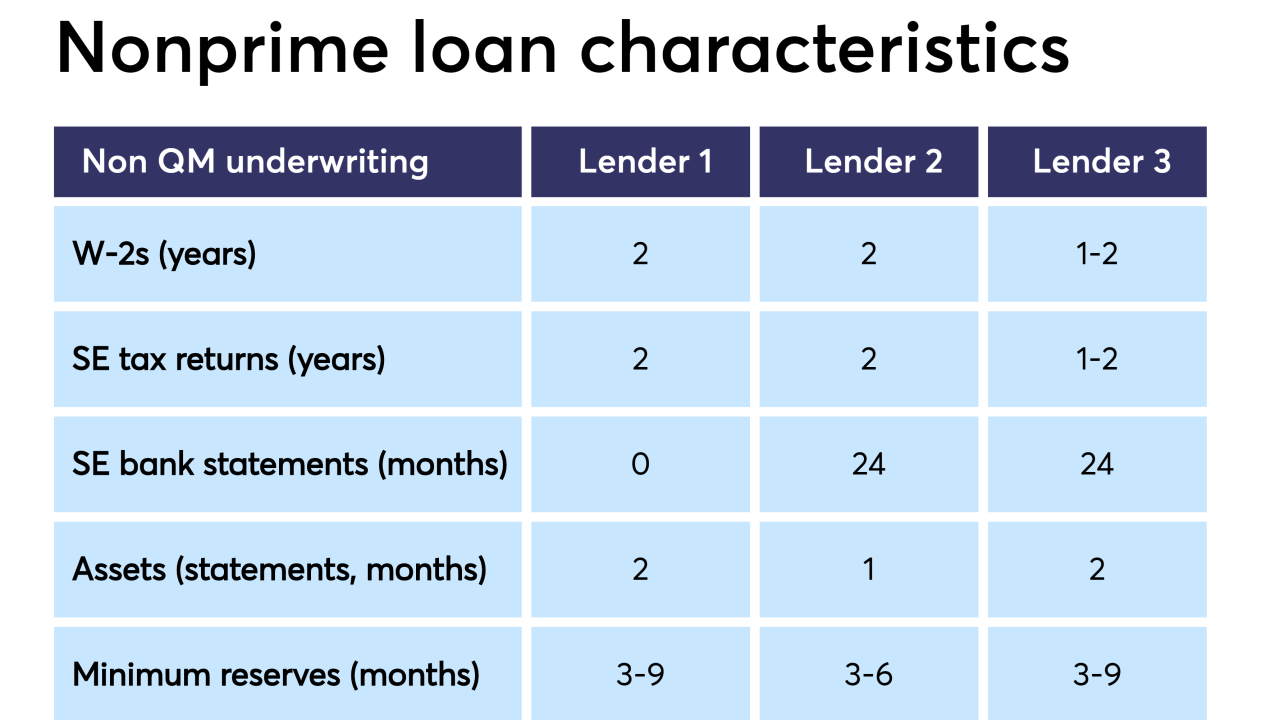

Securitized loans originated outside the Qualified-Mortgage rule's parameters have looser underwriting guidelines than mainstream loans do today, but are more tightly underwritten than past subprime or alternative-A products, according to DBRS.

May 6 -

Private-label mortgage securitizations with variable servicing fee arrangements could become more common going forward as issuers look to increase investor cash flow while reducing the loan servicer's economic exposure, Fitch said.

May 6 -

Alarmed about continued high nonmarket-based prepayment rates, Ginnie Mae is requesting input from lenders on how to make the mortgage-backed securities it guarantees fairer to investors without hurting borrowers.

May 3 -

With nearly $90 million added in the past two months, Goldman Sachs marched closer to its $1.8 billion consumer-relief mortgage settlement with the U.S. Department of Justice.

May 2 -

BX Trust 2019-IMC is a cash-out refinancing for an existing mortgage secured by 16 showrooms used exclusively for the home furniture and decor industry.

April 30 -

Commercial mortgages placed into special servicing grew last year, but default and foreclosure dollar volume fell as legacy loan resolutions outpaced newly distressed loans, according to Fitch Ratings.

April 29 -

A renovated office complex in Florida and a recently built Great Wolf Lodge resort in Orange County make up two of the largest loans in Wells Fargo's latest conduit.

April 25 -

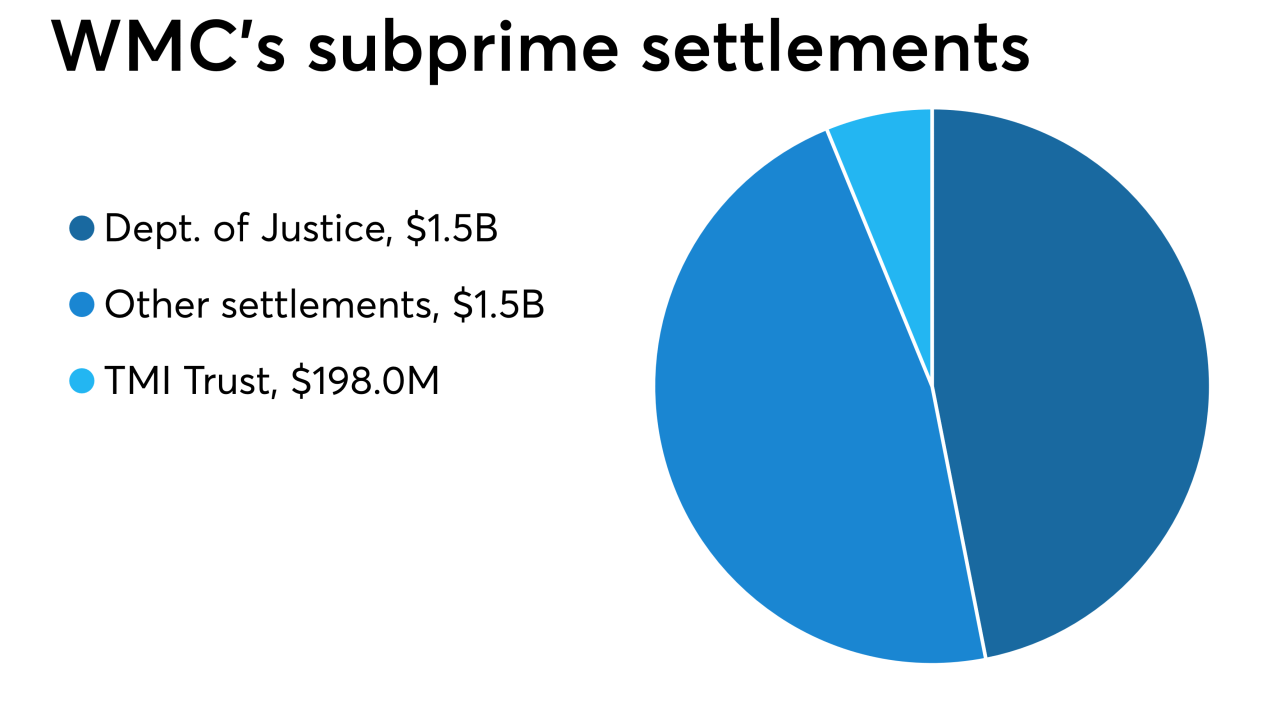

General Electric placed its WMC Mortgage unit into Chapter 11 bankruptcy protection as it has nearly $1.7 billion in legal settlements agreed to or pending.

April 24 -

The trio of malls collateralizing the new mortgage include two well-performing mall as well as a troubled Florida super-regional shopping center.

April 23 -

An industry working group might seek legislation to eliminate the need for investor consent in the shift to a new benchmark interest rate. But any legislative fix is almost certain to be challenged because choosing an alternative to Libor will inevitably favor one party in a transaction over another.

April 21 -

Investors include New Orleans sports franchise owner Gayle Benson, placing the hotel under local ownership for the first time since it was built in 1976.

April 16 -

General Electric Co. finalized an agreement to pay $1.5 billion to settle a U.S. investigation into the manufacturer's defunct subprime mortgage business.

April 12 -

Non-qualified mortgage-backed securities record issuance in the first quarter puts it on pace to top full-year volume predictions, according to Keefe, Bruyette & Woods.

April 9 -

The bank agreed to modify loans to struggling U.S. borrowers as part of a 2017 settlement. Instead, it’s receiving credit for financing new mortgages that likely would have been made anyway.

April 8 -

HomeStreet Bank could receive nearly $190 million in total for selling $14 billion in mortgage servicing rights to New Residential and PennyMac, and selling its home loan centers to Homebridge.

April 8 -

The commercial mortgage-backed securities delinquency rate increased for the first time since October lead by a 31-basis-point rise in late payments for loans secured by retail properties, Fitch Ratings said.

April 8 -

Controlling classes of investors in commercial mortgage-backed securitizations can replace a special servicer, but before they do, they should make sure the long and potentially expensive process is worth it.

April 3 Alston & Bird

Alston & Bird