-

The stock market's volatility during December helped to improve the potential for existing-home sales, although housing's performance remains well below its capacity, First American Financial said.

January 22 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

Ditech Holding Corp. fired its chief operating officer after nine months, and entered into a forbearance agreement for a debt payment that was due in December, it said in a regulatory filing.

January 17 -

MGIC Investment Corp. responded to the broad-based roll out of "black box" pricing engines from the other mortgage insurers by bringing its version to market.

January 17 -

Bank of America's first-mortgage production dropped almost 26% year-over-year in the fourth quarter of 2018, but it experienced a less severe 10% decline in home equity lending during the same period.

January 16 -

Wells Fargo and JPMorgan Chase had reduced mortgage-related earnings in the fourth quarter as home loan activity continues to fall short of expectations.

January 15 -

Citigroup's residential mortgage originations declined 23% and its home-loan revenue dropped by 35% year-over-year in the fourth quarter of 2018, as the company continued to distance itself from home loans.

January 14 -

Lennar Corp., the first big homebuilder to report in this earnings cycle, surged after its chairman said buyer traffic improved in December as mortgage rates declined.

January 9 -

Older millennials and younger Generation Xers still feel the aftershock of the housing crisis, as more would rather invest in the stock market than real estate, according to Redfin.

January 7 -

Manhattan home prices fell in the fourth quarter, with the median slipping to less than $1 million for the first time in three years, as ample inventory continued to allow buyers to demand sweeter deals.

January 3 -

Rising mortgage rates are helping decelerate home price growth, which is expected to slow further during the coming year, according to CoreLogic. Consumer uncertainty in the economy due to stock market declines may also weaken house values.

January 2 -

D.R. Horton Inc. is planning to buy Terramor Homes' building operations for $60 million in cash, expanding the potential customer base for the larger company's in-house lending unit.

December 11 -

Ditech Holding Corp. is proposing to pay $257,000 and improve governance to settle a stockholder lawsuit alleging that a lack of oversight allowed improprieties to occur in several mortgage-related business lines.

December 10 -

New Penn Financial will change its name to NewRez at the start of 2019, reflecting its acquisition earlier this year by New Residential Investment Corp.

December 7 -

Consolidation is coming in the mortgage industry, but a protracted timetable will continue to constrict industry profits.

December 4 -

Toll Brothers Inc. reported its first drop in orders since 2014, led by a big falloff in California demand, a sign that high-end property markets are cooling. Shares slumped.

December 4 -

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

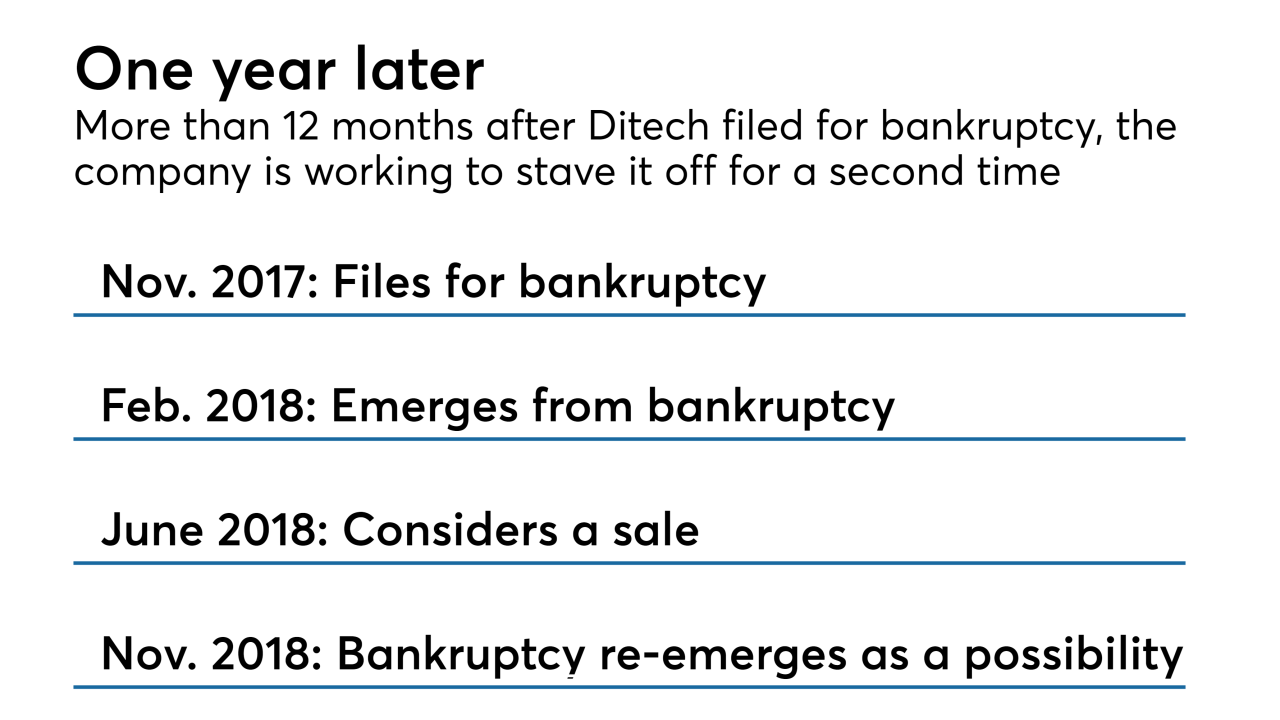

A reduction in Ditech Holdings' quarterly net loss fell short of what the company needed to avoid the possibility of another Chapter 11 filing.

November 15 -

D.R. Horton Inc. fell the most in more than three years after executives at the builder said the market for homes is getting "choppy" and that the pace of order growth may slow next quarter.

November 8 -

Mr. Cooper Group — the new name following the combination of Nationstar Mortgage and WMIH Corp. — posted a $54 million third-quarter profit and announced plans to buy Pacific Union Financial, as well as make other strategic acquisitions.

November 8