Technology

Technology

-

-

The 2.5 million-member personal-finance app has saved consumers $100 million-plus since its founding in 2015, and could add a similar amount on an annualized basis to fee income.

December 20 -

Experts discuss the latest ways firms are defining their value propositions and evolving their customer communications, experience and support.

December 16 -

CFO Kevin Ryan will handle the day-to-day running of the company, as it works toward going public via its revised SPAC merger.

December 10 -

The three leaders left voluntarily, sources confirmed.

December 8 -

The findings in a new TransUnion study could lend momentum to recent efforts by Fannie Mae and Freddie Mac to encourage the reporting and use of rental-payment information in lending.

December 7 -

LoanLogics, a Sun Capital affiliate, has purchased LoanBeam, a company with approvals from major government-related housing finance investors to provide digital processing and income calculations for tax documents.

December 2 -

The news comes just a day after the company restructured its merger with Aurora Acquisition to put $750 million in cash on its balance sheet right away.

December 1 -

A continuous servicing-to-originations loop keeps and grows customer relationships while increasing MSR values and lowering origination cost. But as with all things mortgage, executing on this is harder than it looks, writes Sagent's CEO and President

November 29 -

The home buying process has undergone significant changes. The pandemic has profoundly altered the mortgage lending market. The continuation of remote work, relocation out of key urban areas, a growing preference for online possibilities, and the deployment of artificial intelligence applications are only a few trends that are shaping the industry. Join Heidi Patalano, Editor-in-Chief of National Mortgage News and Beth O'Brien, Founder and CEO of CoreVest Finance as they discuss how lenders can stay competitive and meet the needs of home buyers in the fast evolving mortgage business.

-

The company appointed regulation and compliance expert Sonny Abbasi to serve as general counsel following a fund-raise of $52.5 million earlier in the quarter.

November 23 -

The residential real estate investment startup, which works with lenders to help investors buy rental properties, will use the money to buy rehab property inventory for its customers.

November 18 -

Announcements from Paramount Residential Mortgage Group and LodeStar Software Solutions are early indications that the company’s aggressive investment in diversified business lines could pay off.

November 17 -

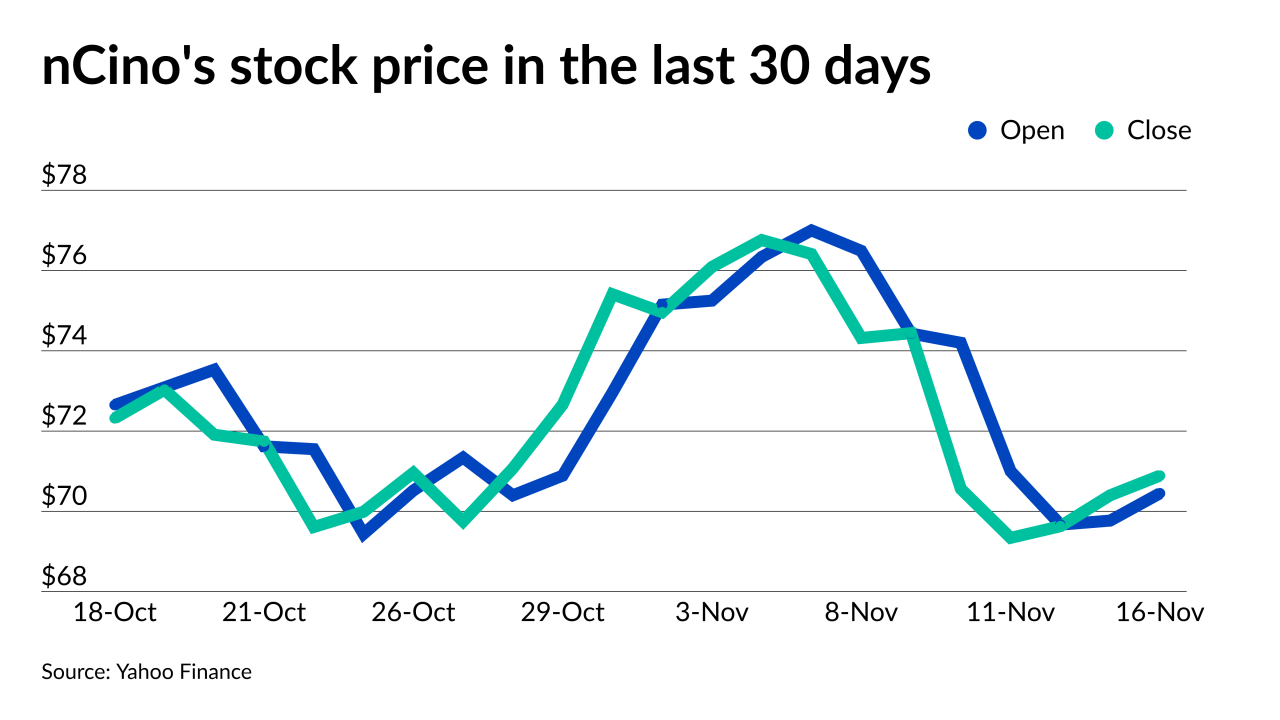

The transaction takes depository-focused nCino into the independent mortgage banking side of the lending business.

November 16 -

The deal between the two fintechs aims to cut mortgage decisioning times for lenders and expand access to financing for consumers.

November 16 -

The data aggregator assembled a group of technology companies that has developed a set of security standards for startups. It is open for comment ahead of an anticipated implementation in the second half of next year.

November 16 -

The fintech’s algorithms are programmed like "Tesla’s self-driving cars," according to the company’s CEO.

November 15 -

The company increased and diversified its income streams beyond the mortgage sector but expenses associated with stock-based compensation and a recent acquisition outweighed these gains.

November 11 -

The two fintechs look to streamline document capture and credit decisioning for lenders.

November 8 -

The company’s six acquisitions since last March will contribute to increased revenue in both of its software and data and analytics segments.

November 8