Technology

Technology

-

The mortgage real estate investment trust has been a first-mover regarding innovations in the private securitized market, and others tend to follow its lead.

April 19 -

A private equity capital raise earlier this year gave the company a $3.3 billion valuation.

April 16 -

An interactive dialogue with Founder and CEO of NorthOne on the fintech industry, the growing needs of challenger banks, and the future of SMB banking.

-

Artificial intelligence (AI) is increasingly gaining ground in a number of areas of banking and financial services. However, there is growing evidence that AI systems are biased.

-

In the nonstop deluge of loan volume, last year’ highest producing loan officers leaned on tech — though sometimes reluctantly — to adapt in the digital marketplace.

April 14 -

Nonbanks claimed more of the top slots based on loan volume, while the origination gains experienced by Hispanic, Black and Native American borrowers were weaker than those of other groups.

April 9 -

One year after its internal merger, the fintech and fulfillment services provider’s COO Debora Aydelotte discusses the company’s support for community banks and its placement in the ranking of Best Fintechs to Work For.

April 6 -

The financial-technology firm Plaid is close to a new round of funding at a valuation of about $13 billion, almost three months after scrapping its sale to Visa, according to people familiar with the matter.

April 5 -

Also: Fairway fires back at UWM, private equity goes big with mortgage deals, manufactured homes aid the inventory crisis and how servicers will navigate the CDC's eviction ban extension.

April 2 -

Top executives from the 49 companies that earned a spot in this year's ranking of the Best Fintechs to Work For cite the need for nimble shifts in business strategy, leadership style and recruiting tactics among the lessons they took away from the challenges of the coronavirus crisis.

March 31 -

Small, often intangible quality-of-life perks are a big part of what makes some fintechs the best ones to work for.

March 31 -

The Utah fintech encourages a playful attitude by devoting the first floor of its offices to entertainment and comfort with video games, Ping- Pong, a pool table and a lounge area.

March 31 -

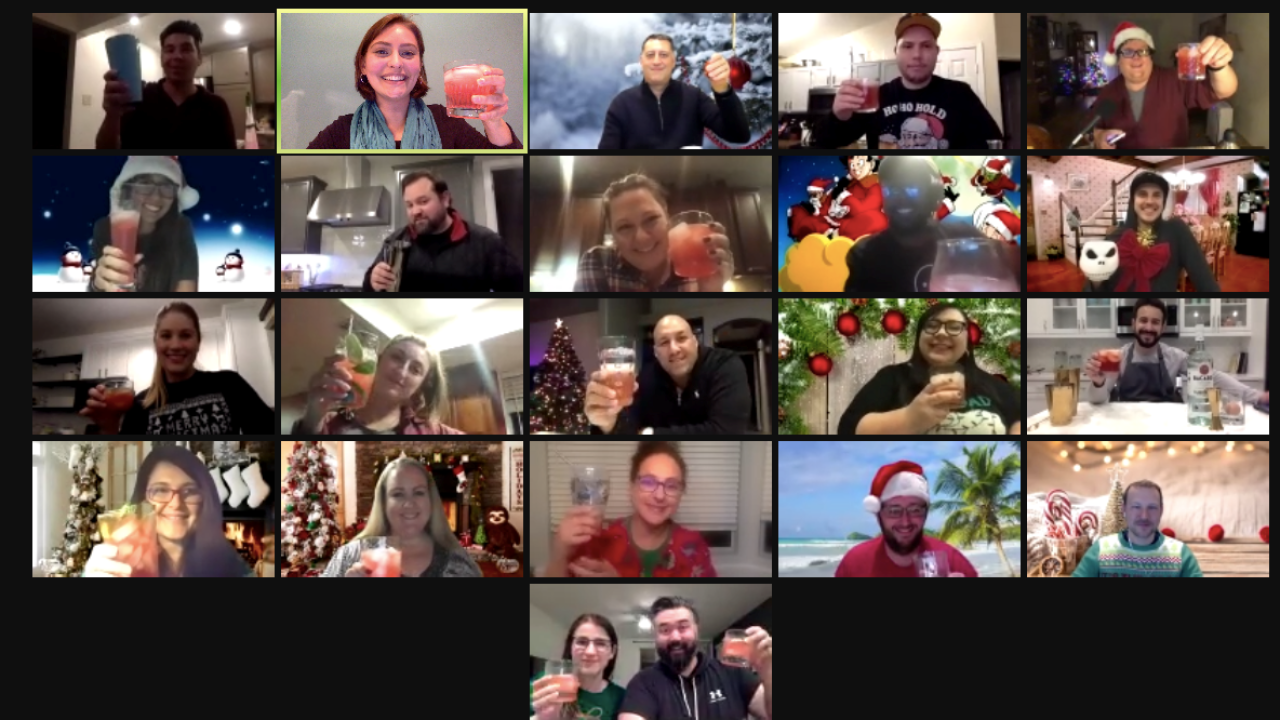

Without its funhouse office, annual trips or volunteering events, the executive found ways to engage his staff virtually.

March 31 -

Known for giving away its signature canary-hued Converse to employees and clients, this small API-centric fintech is poised to become a significant player in open banking thanks to parent company Mastercard and its vendor status with Fannie Mae and Freddie Mac.

March 31 -

Half of Facet Wealth’s employees haven’t met face-to-face. Here is how the fintech is working to strengthen community.

March 31 -

This venture-backed company, which specializes in creating banking and payment platform APIs for other fintechs, attracts new recruits through a culture of learning.

March 31 -

As credit remains tight, Opportunity Financial’s work with consumer financial services Brightside firm aims to offer a wider swath of borrowers access to small loans.

March 31 -

Point of sales providers are bringing improvements to their systems as loan officers look for ways to keep their pipelines active.

March 30 -

-

New entrants in the market may believe: “We’re doing everything right. Fraud isn’t a problem, and we have a fraud alert tool in place anyway.” This, of course, is exactly when fraud risk grows, warns Paul Harris of First American Data & Analytics.

March 29