-

Live Well Financial's creditors are seeking a court-supervised bankruptcy, but the mortgage lender is opposing the move, saying it can get more for certain assets if it sells them before filing.

June 19 -

Texas Capital Bank, which already provides warehouse financing for e-mortgages, will now purchase these loans off those lines as it looks to increase liquidity for this product.

December 12 -

Merchants has agreed to buy NattyMac, a company it has been in business with since 2014.

December 6 -

Total Expert will use its new $20 million venture capital investment — led by Emergence Capital — to build out its Marketing Operating System, designed for the future of financial services.

October 11 -

Redwood Trust has priced a new stock offering that is aimed at increasing funding to new initiatives like investments in the single-family rental and multifamily sectors as well as routine business.

July 25 -

The March acquisitions of a warehouse lending portfolio and eight California bank branches helped fuel a 22% increase in net income.

July 24 -

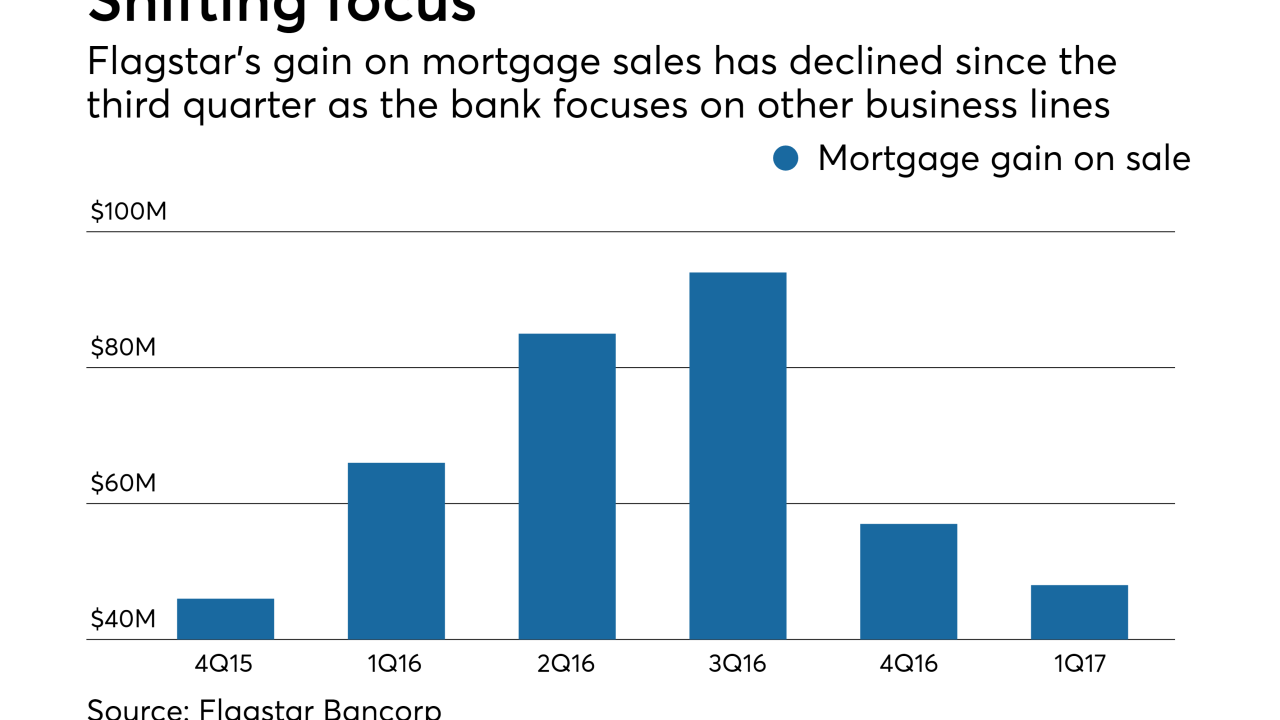

Flagstar Bancorp returned to profitability in the first quarter after tax reform caused a loss in fourth quarter, but its mortgage revenues dropped 15% due to margin compression and lower volume.

April 24 -

There is an oncoming liquidity crisis that will force consolidation in the mortgage industry as margins tighten and funding sources dry up.

March 28 -

The Michigan company has been acquisitive lately, buying California branches and a wealth advisory firm.

February 21 -

Warehouse lines of credit are getting more expensive as short-term interest rates rise, and lenders have limited options for reducing their costs.

January 29 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Three executives from Vanguard Funding are facing fraud charges related to their alleged misuse of nearly $9 million in warehouse lending funds.

September 18 -

Redwood Trust is raising $225 million in a debt offering with the proceeds to be used to repay borrowings that come due next year.

August 14 -

Borrowers with variable-rate debt affected by Federal Reserve rate hikes showed they could handle December's 25-basis-point increase, but that could be changing as short-term rates continue to rise.

July 20 -

Home Point Financial Corp. has formed an Institutions Group to bring the correspondent, capital markets and warehouse lending teams under one umbrella.

June 22 -

Growth outside of its residential mortgage business contributed to Flagstar Bank beating first-quarter earnings estimates, company executives said.

April 25 -

Deutsche Bank is finding that there just isn't enough soured U.S. mortgage debt anymore.

March 29 -

High origination volume and increased nonbank participation fueled another banner year for warehouse lenders, according to The Reynolds Group.

February 21 -

Home Point Financial Corp. will buy Stonegate Mortgage Corp. in an all-cash deal valued at roughly $211 million.

January 27 -

Seattle-based online real estate brokerage Redfin is creating a mortgage bank subsidiary in a bid to offer end-to-end real estate services.

January 27