-

The second-quarter jump in provisions may be three to four times higher than a year earlier and will be mostly for loans that have yet to go bad, analysts said.

May 22 -

DBRS Morningstar and Moody’s Investors Service have assigned preliminary ratings to the Classic RMBS Trust, Series 2020-1 transaction sponsored by Home Trust Co.

February 24 -

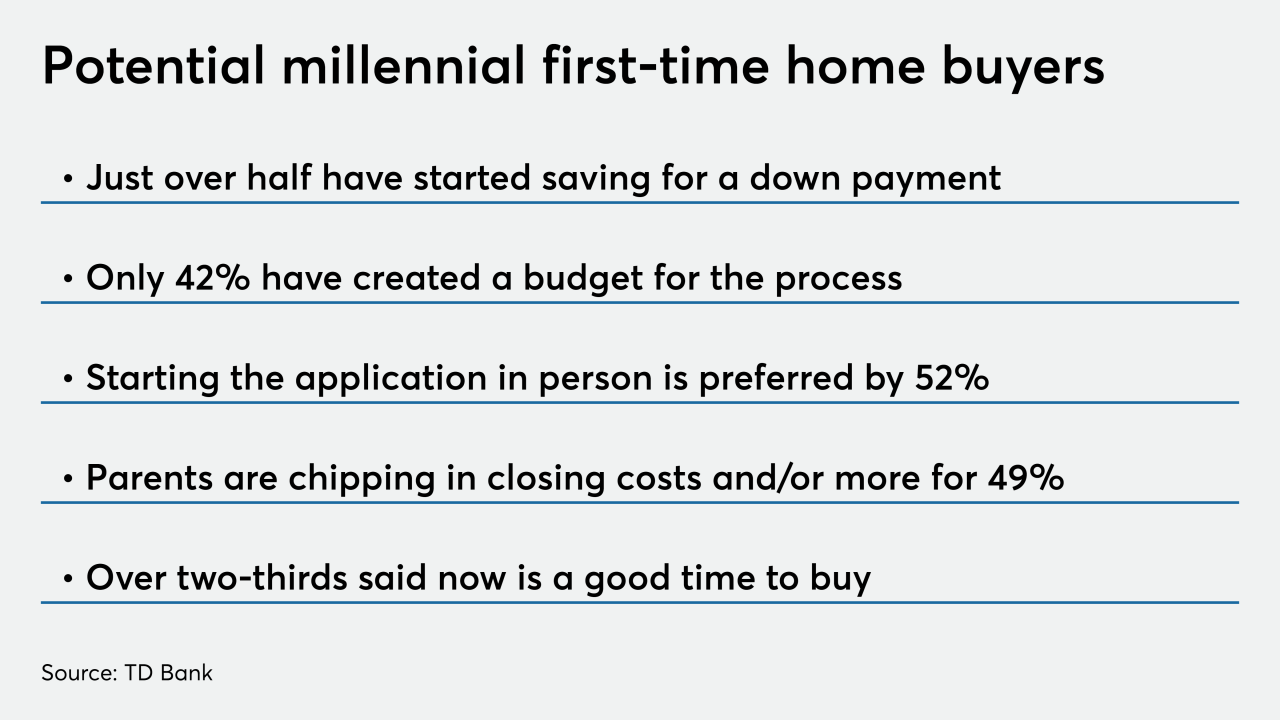

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

A bank, a drug store, another bank: Odds are, a stroll down a random Manhattan avenue devolves quickly into a retail snoozefest.

January 24 -

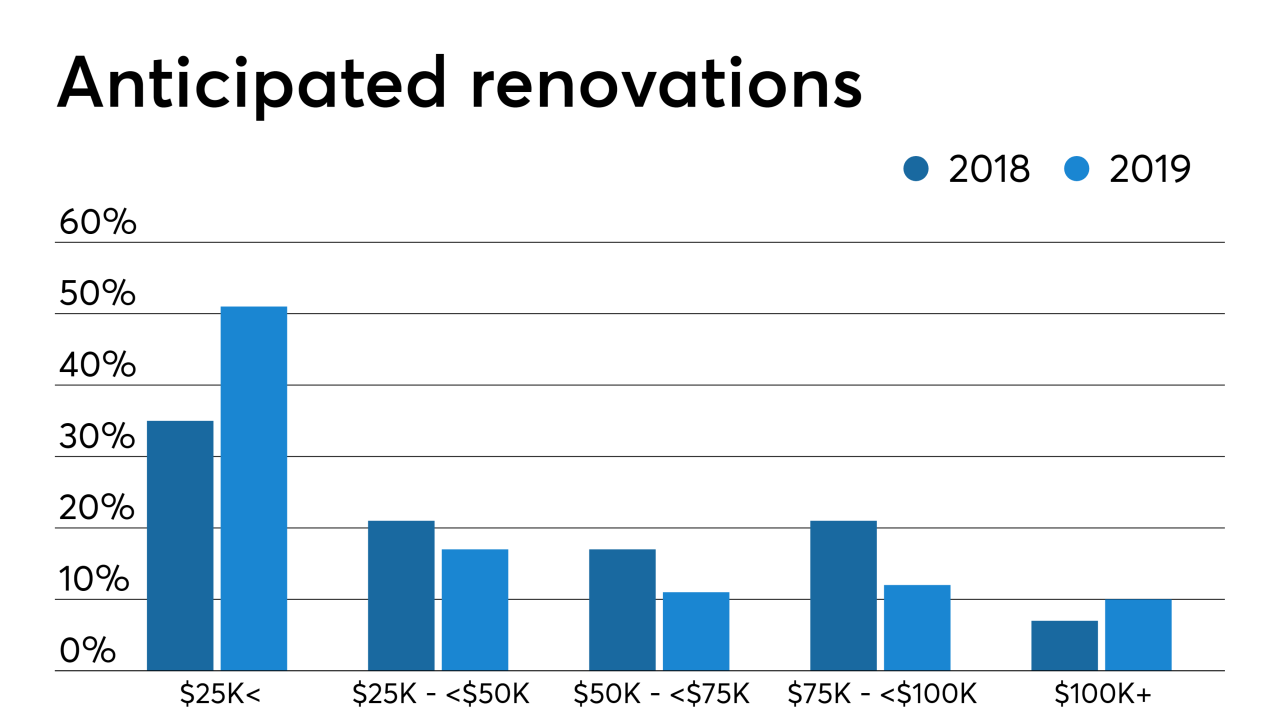

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

Mandate for loan officers is to be able to inform on customers' specific financial needs in areas that extend well beyond the home loan.

July 9 -

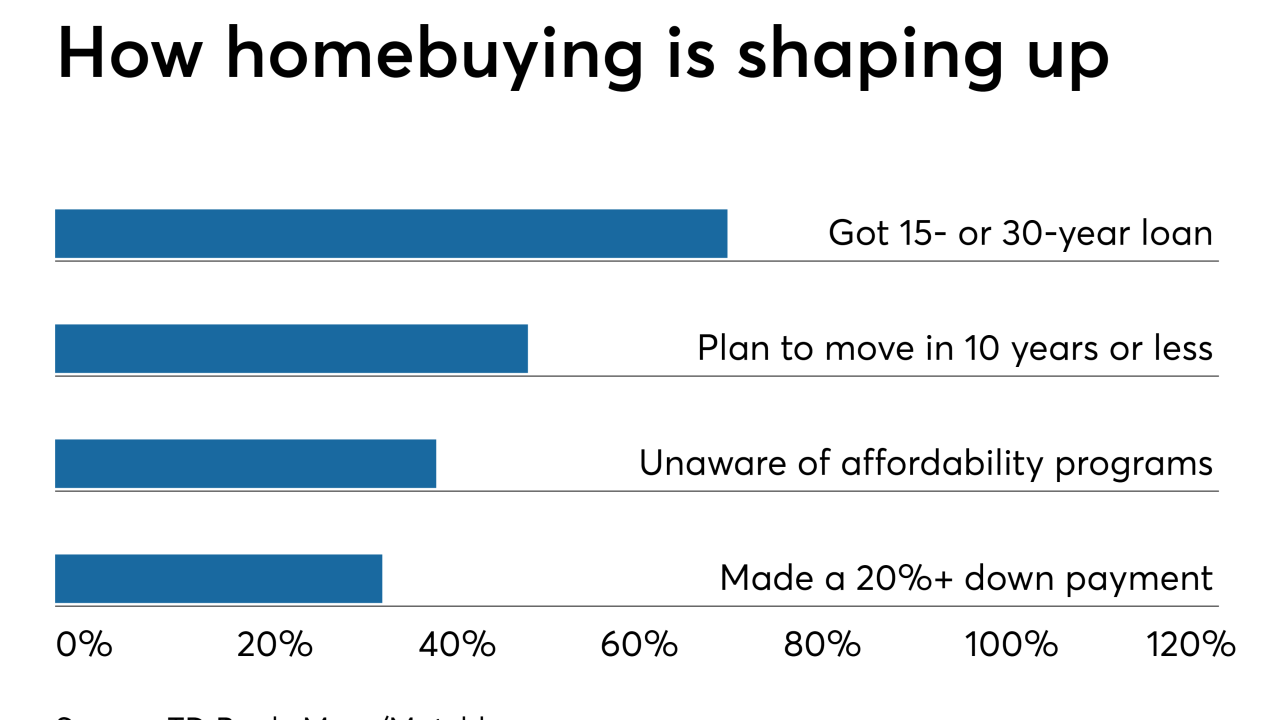

Increased use of the digital mortgage process contributes to improved closing times, but falls short when it comes to borrower education, according to a TD Bank survey.

May 30 -

The two lenders are bucking the trend for the overall industry, which saw year-over-year mortgage growth slide to a 17-year low in March, according to the Bank of Canada.

May 23 -

With the launch of its Medical Professional Mortgage Product, TD Bank is leveraging an opportunity to attract new customers and to address what it says is a knowledge gap among this group of professionals.

March 22 -

Millennials make up the largest cohort of homebuyers, but a quarter of them don't even know their credit score, which could be a call for mortgage lenders to help them prepare to enter the housing market.

March 13 -

Mortgage growth has shrunk to a 17-year low in Canada, increasing pressure on the country's big banks to find business elsewhere.

February 5 -

Toronto-Dominion Bank is seeking to win back customers with home-equity loans — even as concerns grow over elevated consumer debt amid a slowing Canadian economy.

January 29 -

Cash-strapped lenders need to find a way to consistently fund marketing that resonates with more cultures if they really want to be able to replace lost volume by reaching underserved borrowers.

December 21 Cultural Outreach

Cultural Outreach -

A deal between TD Bank and a Vermont nonprofit is just one example of how banks are getting creative in addressing affordable housing needs while reaping financial and regulatory benefits.

October 30 -

The Canadian banks' second-quarter profits were also boosted by double-digit income growth at their U.S. operations.

May 24 -

Bank of Montreal is wooing homebuyers with a variable mortgage rate with the biggest discount ever by a large Canadian bank, according to one market watcher.

May 8 -

Canada's big banks don't seem keen to follow Toronto-Dominion Bank's lead on mortgage hikes – at least not all the way.

May 1 -

Some Wells Fargo customers on social media Thursday afternoon expressed frustration with not being able to log in to accounts digitally. The San Francisco bank responded in a tweet acknowledging the problem.

February 22 -

It’s too soon to gauge the true impact of recent tax cuts on loan demand, but anecdotes from bankers suggest that, after months of stagnation, pipelines are filling up again.

February 14 -

The vast majority of consumers with a home equity line of credit said they are considering using it to pay for planned home renovations this winter.

December 6