-

SunTrust’s merger with BB&T is the largest bank deal since the financial crisis, and mortgages will play a critical role in the execution of this transaction.

February 7 -

To bring millennials to the table, mortgage lenders must overcome misconceptions about the role technology plays in the way this generation buys homes.

February 6 Blend

Blend -

A significant percentage of consumers are willing to turn to technology companies for their financial needs, including applying for a mortgage, although they have trust issues with them, a Fannie Mae report said.

February 5 -

Community banks generally make digital a consumer play, but TransPecos Bank, with its BankMD brand, is focusing on doctor practices, which tend to weather economic downturns well.

February 1 -

Mortgage and real estate professionals are navigating new technology to support a better consumer experience and grow their customer base, but those who lose sight of the end goal are in danger, according to Remax CEO Adam Contos.

January 31 -

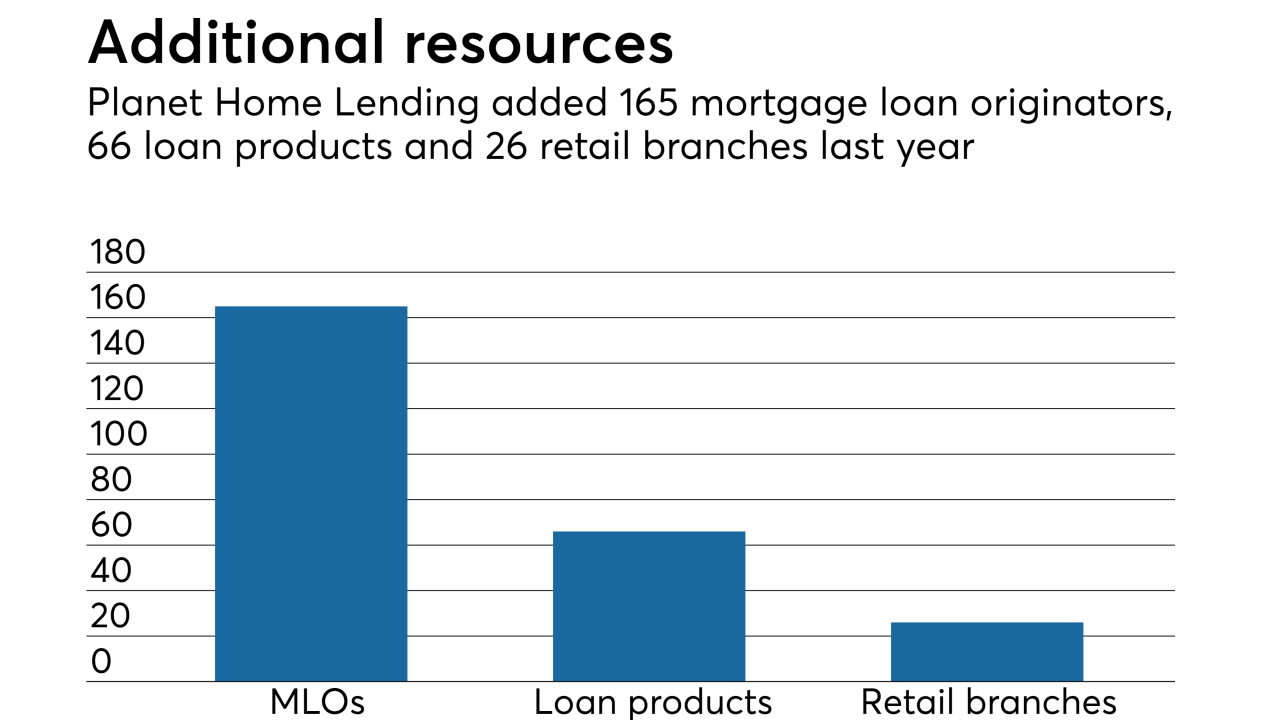

Planet Home Lending is finding ways to grow in an uncertain rate environment by diversifying its products and expanding its retail branch network.

January 30 -

Fixing the housing finance system is "the last piece of unaddressed business from the financial crisis," according to a summary of to-do items released by the Banking Committee's chairman.

January 29 -

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

January 29 -

CrediFi helps bankers pursuing commercial real estate loan growth minimize the risk in lending to customers they historically haven't served.

January 29 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27