-

Optimal Blue is expanding its reach in the secondary mortgage market by acquiring Resitrader, a whole-loan trading marketplace that has integrations with Fannie Mae and Freddie Mac.

July 10 -

Freddie Mac will make automation it has been testing in conjunction with servicing-released cash sales available to the broader market next month.

July 3 -

KB Home attributed significant growth in its building and mortgage income to first-time homebuyer activity and new lending technology in its fiscal second quarter.

July 2 -

The measure, which has been compared to the EU’s new consumer privacy rules, grants Californians new rights over how companies collect and use their personal data.

June 29 -

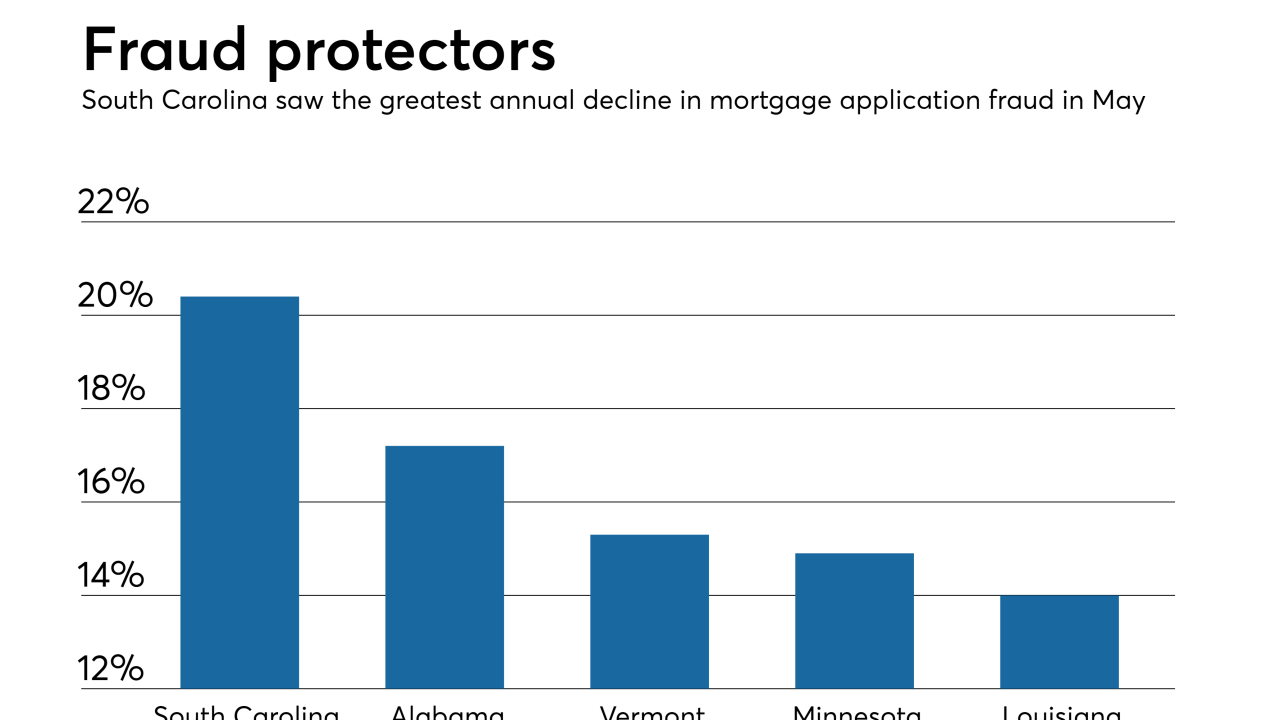

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Fannie Mae and Freddie Mac are making condominium loans eligible for automated appraisal waivers that could reduce mortgage borrowers' fees and shorten closing times for lenders.

June 28 -

Most mortgage lenders and banks do not maintain a comprehensive vendor management strategy, exposing institutions to increased compliance risk, according to a recent survey.

June 26 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Credit reporting firms with significant operations in New York will face new cybersecurity and registration requirements to stave off concerns related to a breach of Equifax's systems last year.

June 25 -

Startup Block66 is using blockchain to create a mortgage audit trail for fraud prevention purposes and also plans to enable trading of securities lenders can use to increase their liquidity.

June 22