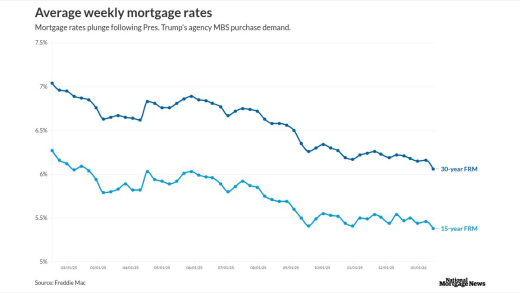

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

Housing affordability will improve by 3% next year, according to First American's September Real House Price Index.

How decisions in construction and property oversight can reshape multifamily loan performance.

Brent McIntosh is Citi's chief legal officer and corporate secretary. Brent leads Citi's Global Legal Affairs & Compliance organization, which includes the Legal Department, Independent Compliance Risk Management, Citi Security and Investigative Services and Citi's Regulatory Strategy and Policy function. He is a member of Citi's Executive Management Team.

Brent served as under secretary of the Treasury for international affairs from 2019 to 2021. From 2017 to 2019, Brent served as Treasury's general counsel. Prior to that, he was a partner in the law firm of Sullivan & Cromwell.

Brent served in the White House from 2006 until 2009, first as associate counsel to the president and then as deputy assistant to the president and deputy staff secretary. Before that, he was a deputy assistant attorney general at the Justice Department.

Susana Ortega Valle is the VP of Product, where she leads the strategic vision for how small business owners engage with insurance. Throughout her two-decade career, she has built a reputation for developing high-performance teams that thrive on innovation and challenge conventional thinking.

Prior to joining Simply Business, Susana held digital product leadership roles at State Street and Santander Bank. Her approach to data-informed, AI-forward product strategy is backed by a robust academic foundation, including two MS degrees in Telecommunications Engineering and an MBA from MIT.

-

A consumer retreat contributed to the trend, which may be getting a closer look as the Trump administration weighs a ban on institutional purchases.

-

Confidence among US homebuilders unexpectedly fell in January, as costly sales incentives outweighed a recent boost from lower mortgage rates and the president's housing proposals.

-

NAHB's remodeling index finished at its highest mark in a year, with the current industry outlook standing in stark contrast to homebuilder sentiment.

-

A pair of fair housing attorneys fired by the Department of Housing and Urban Development testified the agency has stopped enforcement of those laws.

-

The industry vendor SitusAMC has not publicly disclosed how many consumers, nor how many banks and lenders, were impacted in a cyberattack last fall.

-

Bilt's new card caps interest rates at 10% for one year and Affirm is adding BNPL for rent as analysts predict the political environment will benefit fintechs.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

There's quite a bit of inventory out there that would have otherwise been returned to the market but for unduly harsh political theater writes the CEO of the National REO Brokers Association.

-

The Home Loan banks are failing to serve huge numbers of Americans because of their reliance on outdated credit scoring models.

-

We have the tools to address our housing challenges through a mix of regulatory reforms, policy changes, incentives and investment. What's needed is the will and leadership to put those tools to work.

- ON-DEMAND VIDEO

New brands are emerging to improve banking services to targeted consumer segments, and Daylight is one intent on winning over the LGBTQ market. What are mainstream banks getting wrong that leaves an opening for niche brands like Daylight?

- ON-DEMAND VIDEO

As the pandemic continues to weigh on us all, BlueVine shares how it is putting employees first.

-

How consumer attitudes toward privacy threaten to overturn long-standing industry assumptions about customer data and personalization.