Investment purchases surged to their highest share in five years in the second quarter, even though total volume decreased from 12 months earlier.

Meanwhile, home prices are set to grow 3 to 4% in 2025, a Fitch report predicts.

Many other organizations have turned to sales of this asset class in order to enhance cash flow or liquidity.

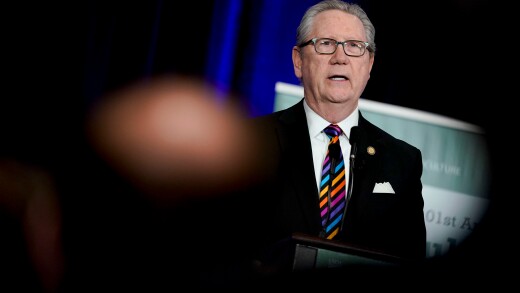

Federal Reserve Gov. Christopher Waller said in a speech Monday that private and public-sector data suggests that the labor market is continuing to weaken, making a 25 basis point rate cut in December a prudent choice.

Quality Control Advisor Plus is an integrated system which brings together previously separate units, cutting months off of Freddie Mac's current QC process.

-

Retroactive interpretations have bedeviled mortgage servicers and the market for older loans. The industry will be watching other cases in New York closely now.

-

If Experian eventually charges for VantageScore 4.0, it will be offered for at least a 50% discount compared to what Fair Isaac Corp. charges for its FICO score.

-

The San Francisco-based banking giant reported a 9% annual jump in quarterly profits. It also made official its appointment of CEO Charlie Scharf as chairman.

-

The megabank's multiyear effort to simplify its business model and improve its risk management is starting to pay off in the form of more consistent profitability and improved returns, CEO Jane Fraser told analysts.

-

Fannie Mae and Freddie Mac's credit risk-transfers and some older private-label mortgage-backed securities have exposures to the Washington DC area.

-

Lebda, who died over the weekend in an ATV accident, built one of the first online financial marketplaces in 1998.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

A Massachusetts court's recent ruling affirming homeowners associations' right to super lien priority highlights the importance of preserving condominium properties and some banks agree.

-

Without the Consumer Financial Protection Bureau setting specific debt collection guidelines including what technology agencies can use the industry will continue a practice that harms consumers: lawsuits.

-

A popular misconception is that homeownership would decline if mortgage subsidies were done away with, but the truth is homeowners are better off without them.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland