While mortgage employment is lower year-over-year, the mixed bag of data makes it more likely that borrowing rates will remain higher for longer.

The private mortgage insurer is purchasing Agents National and Boston National from Incenter, which itself is a unit of Finance of America.

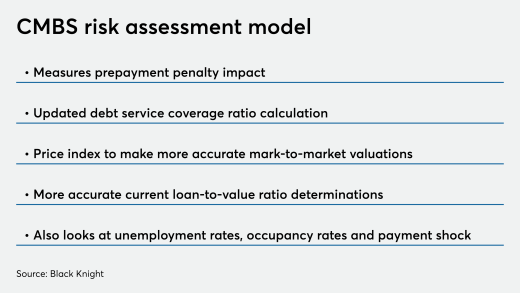

Black Knight introduced a model to gauge prepayment speeds and credit risk for investors that purchase commercial mortgage-backed securities.

Bill Pulte, regulator and conservator of entities that buy and securitize many mortgages, also reaffirmed he's 'not happy with" lenders' main score provider.

Dan Rubin is the founder and CEO of YELO Funding, a fintech company that offers income-contingent financing to U.S. college students of all backgrounds. Mr. Rubin has 25 years of principal investing, investment banking, restructuring and operational experience, including roles as co-founding partner of YAD Capital, a private credit investment firm, private equity real estate investor at Halpern Real Estate Ventures and JEN Partners, investment banker at Lehman Brothers and turnaround consultant at Deloitte. He holds an MBA from NYU Stern School of Business.

-

The top five insurance companies have an average homeowners market share of 9.15% as of December 31, 2024.

-

In a paper, former central bank researchers make the case that the Federal Reserve could better support the Treasury market from disruptions in the cash-futures basis trade by hedging its asset purchases.

-

The company turned to automation to address pain points it found in working with lines of credit that mortgage lenders are increasingly originating.

-

FHFA director Pulte called these programs inappropriate for regulated entities, which are in government conservatorship, but said others are still able to offer them.

-

The Consumer Financial Protection Bureau asked a federal judge to vacate and set aside a settlement against a Chicago mortgage lender, accusing the CFPB of misconduct in a case brought under former Director Kathy Kraninger, a Trump appointee.

-

The Federal Reserve, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency took a measured approach to developing the international capital standards, according to a Government Accountability Office report.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Finding good strategic partners and vendors by mortgage lenders is not just sound business strategy anymore but the law.

-

Trailing docs can be particularly painful when lenders try to foreclose upon a mortgage default.

-

Homeowners who buy into certain myths can actually impair their ability to save, or at least remain longer, in their homes.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland