Mr. Cooper is set to launch a pilot program by midyear, integrating previously released components into a unified platform.

The value of New York City's 1.1 million properties is projected to rise 6.1% for the next fiscal year, boosted by single-family home prices.

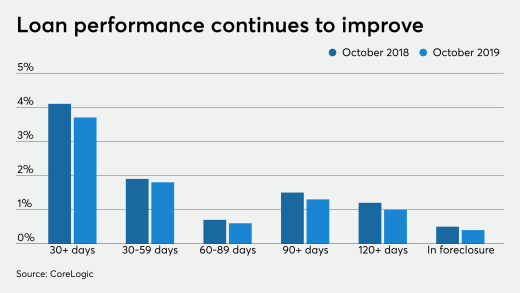

The nationwide mortgage delinquency rate had its best October in at least two decades, while the foreclosure rate remained at a 20-year for the twelfth straight month, according to CoreLogic.

The Federal Reserve's preferred measure of inflation moved further from its 2% target, underscoring the central bank's reluctance to cut rates.

Subservicer Cenlar moved into the O'Fallon, Missouri offices Citigroup's mortgage business occupied until the latter deemphasized servicing in 2017.

-

Sales of so-called social bonds, which direct proceeds to areas like health, housing and education, jumped about 130% to $657 billion globally last year, and continued at a similar pace in the first quarter.

-

The Trump administration is considering an executive order on housing that may push for the privatization of home loan giants Fannie Mae and Freddie Mac, the Wall Street Journal reported, citing a person familiar with the matter.

-

The so-called spec home, a spin on the American dream home with standardized color schemes and toilet fixtures, is falling out of favor with some US builders.

-

Recruiting veterans urge originators to track their future employer's pricing for a longer period of time, and to seek more details about the firm's culture.

-

Digital Insurance spoke with Jonathan Collura, president and CEO of Specialty Risk RE, about how reinsurers could stabilize the home insurance market in areas affected by natural disasters.

-

Wall Street is weighing in on the possible fate of home loan giants Fannie Mae and Freddie Mac, after a fleeting suggestion by Treasury Secretary Scott Bessent earlier this week that the government's stakes could eventually become part of the proposed US sovereign wealth fund.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

It appears the wholesale channel has stabilized, which is good news for mortgage brokers.

-

In a time where integrity of data is more important than ever, mobile technology allows for greater control and monitoring to ensure that time value is increased and costs decreased.

-

HUD will interview current employees, ex-employees and borrowers to validate data or its findings.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland