Trump's pick for treasury secretary commits to a thorough and careful recapitalization and release process for Fannie Mae and Freddie Mac.

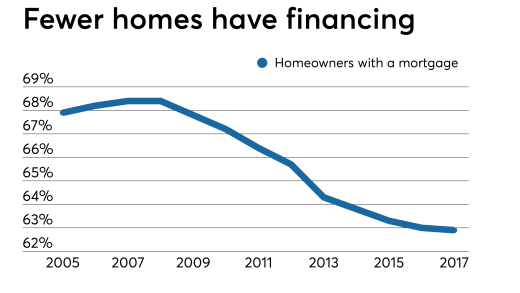

The homeownership gap between Black and white populations has widened in the years since the Great Recession, putting obstacles in the way of achieving wealth for a large percentage of Americans. How did we get here, and what do the housing and home lending industries need to do to change the current course?

An indictment unsealed in a Brooklyn federal court alleged four New Yorkers and one Floridian misled mortgage companies, the government-sponsored enterprises and a government agency regarding short-sale property prices.

The Senate version includes restoration of the mortgage interest deduction, but a tax code revision likely would stifle foreign investment in real estate.

The department's head pointed out that manufactured housing is the most affordable non-subsidized option for building homes.

-

In a packed courtroom, a federal judge parsed whether the Trump administration's aggressive actions to rein in the Consumer Financial Protection Bureau are part of a "normal" transition of power or would impede its statutorily required functions.

-

Toronto-based Simply Approved Mortgages is opening for business in Florida and Colorado, looking for the cross-border success that eluded companies like Rocket.

-

The selloff in US equities accelerated Monday, with major averages tumbling to their worst day this year, as investors braced for a slowdown in the American economy.

-

The legislation is aimed at loosening regulation of new-home construction in the Grand Canyon State, where median prices have shot up by 59% since 2020.

-

A joint venture between the military-focused Palantir and investment conglomerate TWG will sell cybersecurity protection to financial institutions that are wary about the safety of artificial intelligence.

-

The advances pushed the yield on three- to 10-year yields lower by 10 basis points on Monday, with the moves accelerating as US equities sold off.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Is it too early for mortgage bankers to get excited about President Chris Christie?

-

Giving in and looking for someone to help with the loan origination business.

-

Election or not, the fate of mortgage banking hangs in the regulatory balance.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland