The union representing the Consumer Financial Protection Bureau in their suit against mass firings at the agency said the Supreme Court's ruling allowing President Trump to proceed with mass reductions-in-force elsewhere does not impact the union's lawsuit.

The assumption process is highly manual and time consuming and the change from Dark Matter enables lenders to pull data from MSP back into the Empower system.

"To talk about 95% of issuers by count being compliant without recognizing that a very large number of issuers hold few MSRs is disingenuous," one industry executive told the chairman of Whalen Global Advisors.

How decisions in construction and property oversight can reshape multifamily loan performance.

-

With federal oversight easing, Rhode Island joins states pushing cybersecurity laws for finance companies not covered by federal bank regulators.

-

The mortgage numbers are a welcome boost to a market that has struggled to overcome high costs and prolonged economic uncertainty.

-

Prior to the earnings release, Finance of America announced it was buying out Blackstone's equity stake in the mortgage lender for $80 million.

-

Groups like the Mortgage Bankers Association and National Housing Conference welcomed the decision to increase the secondary market for the credits.

-

Americans now hold $34.5T in home equity, fueling a surge in home equity loans as lenders race to capitalize on rising property values.

-

President Trump in an interview Tuesday morning railed against big banks for allegedly discriminating against conservatives, a notable shift in tone that puts more responsibility for the debanking debacle on banks rather than regulators.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Nearly twice as many direct lenders are offering electronic disclosures to consumers now as they were only one year ago, and most of the consumers are opting to use them.

-

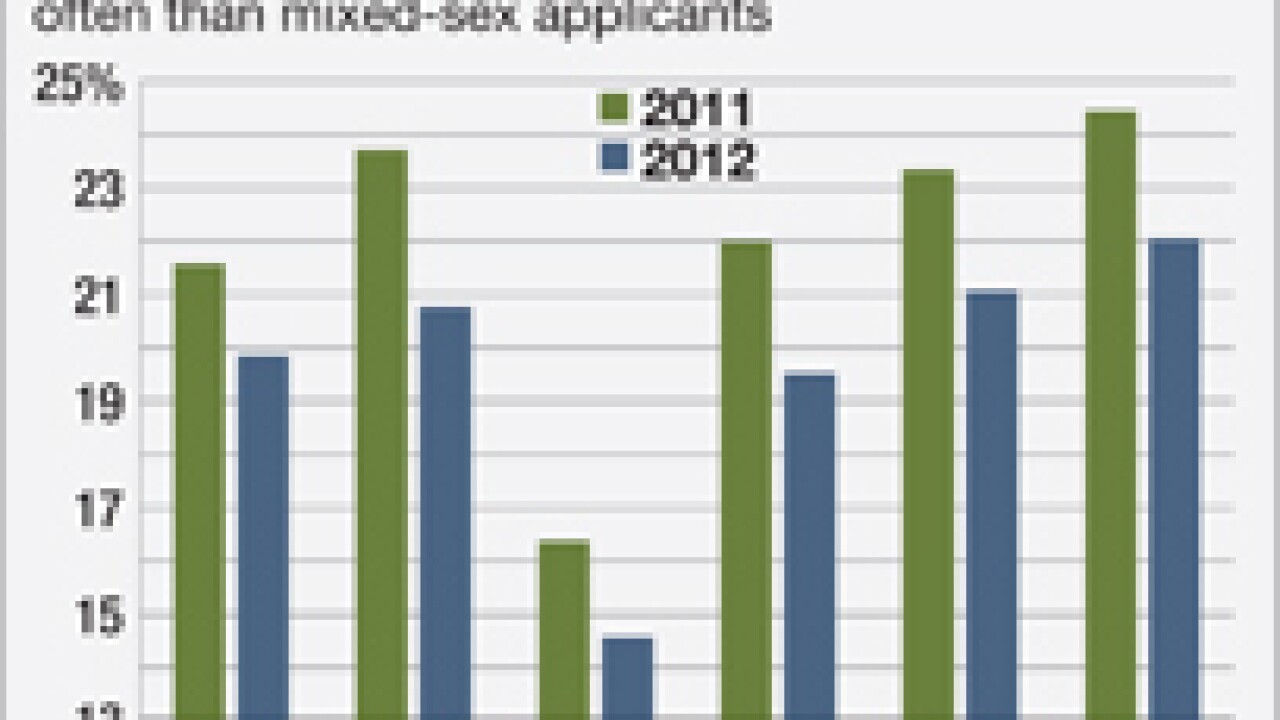

While lenders do not survey applicants on sexual orientation for their Home Mortgage Disclosure Act reports, a look at the data on same-sex couple applicants is intriguing.

-

The Supreme Court agreed last month to resolve a stark divide in the United State Courts of Appeals regarding the time bar for residential mortgage borrowers to file suits related to mortgage loan rescissions under the Truth in Lending Act.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland