The portfolio of offerings includes a buy-before-you-sell product as well as loans geared toward small-business owners, gig workers and real estate investors.

American Bank of Oklahoma agreed to a consent order in August to settle allegations from the Department of Justice over redlining. However, the institution strenuously objected to references to the Tulsa Race Massacre in the agreement and asked that the language be stricken.

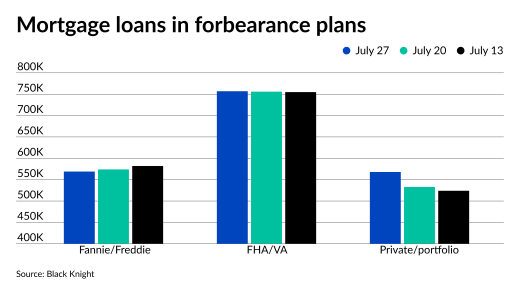

However, 8% fewer borrowers are still in a plan compared with a month ago, Black Knight said.

The 30-year fixed rate mortgage ended the week unchanged as the 10-year Treasury ended Wednesday about 5 basis points higher than seven days before.

The giant lender and servicer which acquired Home Point Capital in 2023 did not say whether it would still pursue damages in the repurchase dispute.

-

A group of Democratic senators, including Elizabeth Warren and Chuck Schumer, asked the director of the Federal Housing Finance Agency to pause any efforts to privatize mortgage finance companies Fannie Mae and Freddie Mac.

-

However, some aspects of the latest employment statistics from the Bureau of Labor Statistics point to gradual weakening in the economy.

-

Afordal unifies the home search process for consumers by giving them access to live rates, pre-approvals and property-specific special financing.

-

Loans with alternative documentation and high combined loan-to-value ratios had more performance concerns, according to a new KBRA study.

-

Following an appearance on Fox Business by NAHB's CEO this week, the U.S. Lumber Coalition labeled the homebuilding trade group a Canadian ally.

-

A group of lawmakers questioned why the FTC and DOJ didn't step in to prevent Rocket Companies' acquisition of Redfin. They want answers by June 17.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

Now more than ever, lenders have to pay attention to their contracts with employees to avoid a loan officer compensation audit or other regulatory concern.

-

Mounting regulationsand legislation still to unfoldcontinue to cause an extraordinary amount of concern for servicers.

-

Being prepared to secure the Wild Wild West means you will need to be well-armed.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

-

-

-

- Partner Insights from Hyland