The Rithm affiliate that acquired Specialized Loan Servicing will pay $4.65 million, an amount that includes borrower restitution.

As the government shutdown stalls key housing programs, lenders are shifting tactics to keep loans moving and preparing for bigger challenges ahead.

Despite interest rate volatility, prepayment rates also increased, surging to levels last seen in October, according to a new ICE Mortgage Technology report.

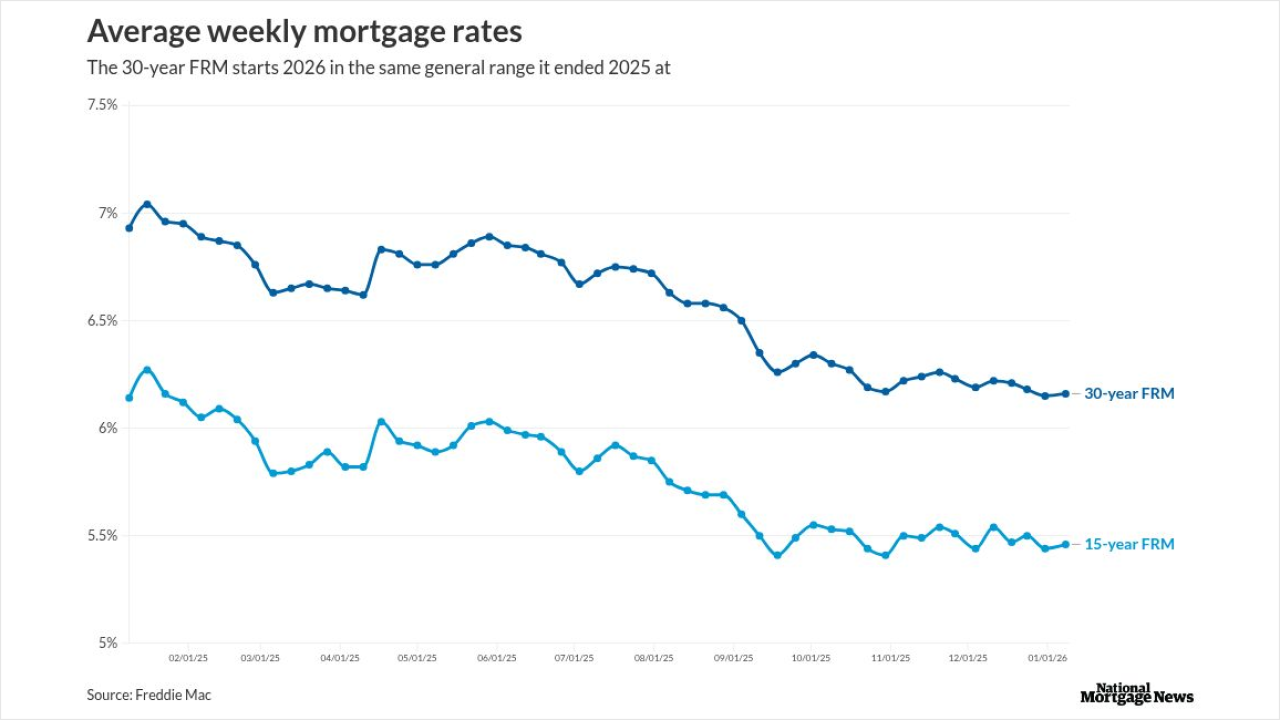

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

-

Mortgage lenders test crypto-backed mortgages as Fannie Mae and Freddie Mac review digital assets in underwriting, weighing risk, non-QM loans and access for nontraditional homebuyers.

-

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

-

CMBS originated between 2017 and 2021 are especially vulnerable. Brighton counsels CMBS lenders to expect clear workout memos.

-

The MBA's Market Composite Index, a measure of mortgage loan application volume, dropped 5% on a seasonally-adjusted basis and 6% on an unadjusted basis.

-

Fannie Mae sees growth in refinance activity pushing volumes upward, but flattening purchases will temper lender momentum, according to its December report.

-

The bank regulator is proposing to strengthen national preemption in the wake of conflicting decisions in related court cases.

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- Origination BulletinDelivered Every WeekdayHeadlines, marketing tips, and opinions for loan officers and origination sector professionals.

- Servicing BulletinTuesday, ThursdayInsights and perspectives for the mortgage servicing professional.

- Technology BulletinThursdayA roundup of the latest headlines and opinions on the mortage technology sector.

-

In assuming that credit unions have the same risk profile as nonbank lenders, the mortgage insurer is now threatening to exclude nearly a quarter of them from being qualified issuers of the securities it backs, writes the Senior Director Of Advocacy and Counsel at the Credit Union National Association.

-

In the midst of ongoing discussions on how to better leverage analytics and digitize the home inspection process, there are some clear actions that we can take to reduce bias in the mortgage industry, writes the executive vice president of corporate strategy at Clear Capital.

-

Ensuring the safety and soundness of Fannie Mae, Freddie Mac and the Federal Home Loan banks is the core responsibility of the Federal Housing Finance Agency. That shouldn't change now that the president has the authority to fire the FHFA's director at will.

- ON-DEMAND VIDEO

Monetary policy remains the key to the markets. The Federal Open Market Committee predicts one rate cut in 2026, but the panel will get a lot of data before

- ON-DEMAND VIDEO

With the government reopened and data flowing, the FOMC may cut rates again in Dec. Steve Skancke, Chief Economic Advisor at Keel Point, will break down the mee

- ON-DEMAND VIDEO

Will the Federal Reserve cut rates in October? BNP Paribas Chief U.S. Economist James Egelhof discusses the meeting and Chair Jerome Powell's press conference.

- Partner Insights from DocMagic

- Sponsor Content from Capacity

- Sponsor Content from First American

- Partner Insights from Snapdocs