Elina Tarkazikis is a reporter for National Mortgage News. She is a graduate of Ramapo College of New Jersey, where she was the founding editor in chief of the school's chapter of HerCampus.com and a staff writer for its student-run publication, The Ramapo News. She has previously worked for The County Seat in Hackensack and Elvis Duran and the Morning Show, iHeartMedia's nationally syndicated radio program. Elina is also a licensed real estate agent in New Jersey, adores pets and speaks three languages.

-

As the housing market enters a new era, shifts in the demand for mortgages will ultimately dictate the direction of technology, staffing and GSE reform.

October 4 -

Some lenders are tapping artificial intelligence and machine learning to improve operational efficiency and enhance the borrower experience, but complexities do exist in implementing the technology.

October 4 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

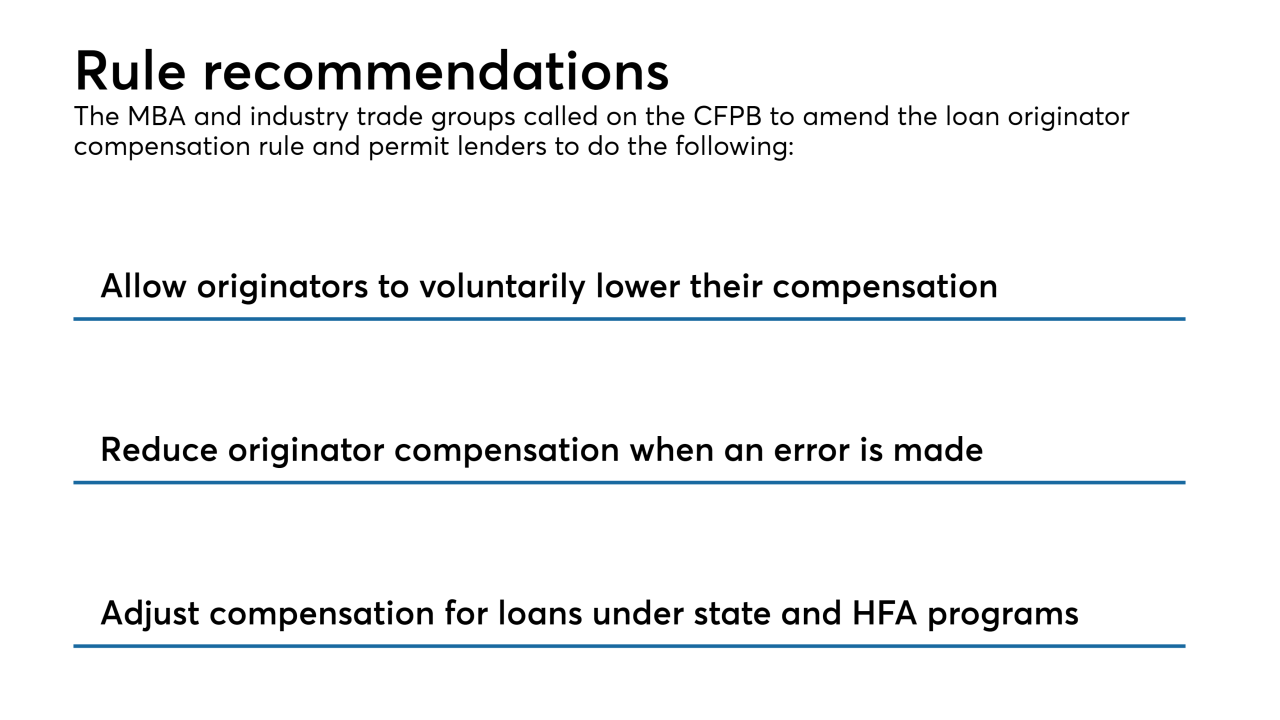

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

From music by Lil Wayne to a quote from Albert Einstein, here’s a look at 17 ways #DigMortgage18 speakers made an entrance.

September 28 -

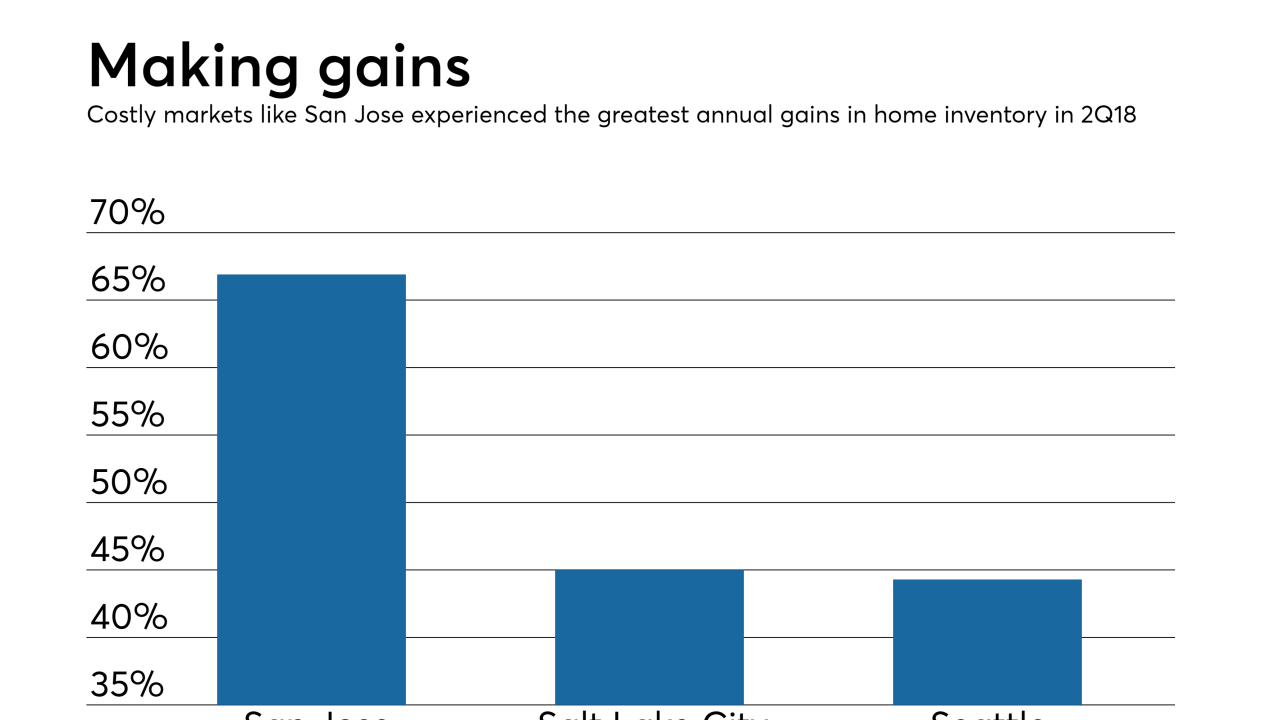

Lenders may start to see more homebuyers enter the market as the number of homes for sale is higher than at any point this year, according to Trulia.

September 27 -

Mortgage application defect risk is down from a year ago, but Hurricane Florence will likely tear through results in affected areas in the coming months.

September 26 -

An artificial intelligence platform that integrates with key industry utilities and keeps critical data at lending professionals' fingertips was selected as the top fintech demo by attendees of the 2018 Digital Mortgage Conference.

September 26 -

Lower corporate tax rates weakened the incentive for developers to use the Low-Income Housing Tax Credit program, which could prompt affordable housing construction to fall by as much as 40% by 2022, according to data aggregator Reis.

September 25 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24 -

Fiserv Lending Solutions' rebrand to Sagent Lending Technologies reflects the company's focus on a more efficient process for mortgage and consumer lenders.

September 20 -

Homebuyers are seeking financing options first before even looking for a house, according to loanDepot.

September 12 -

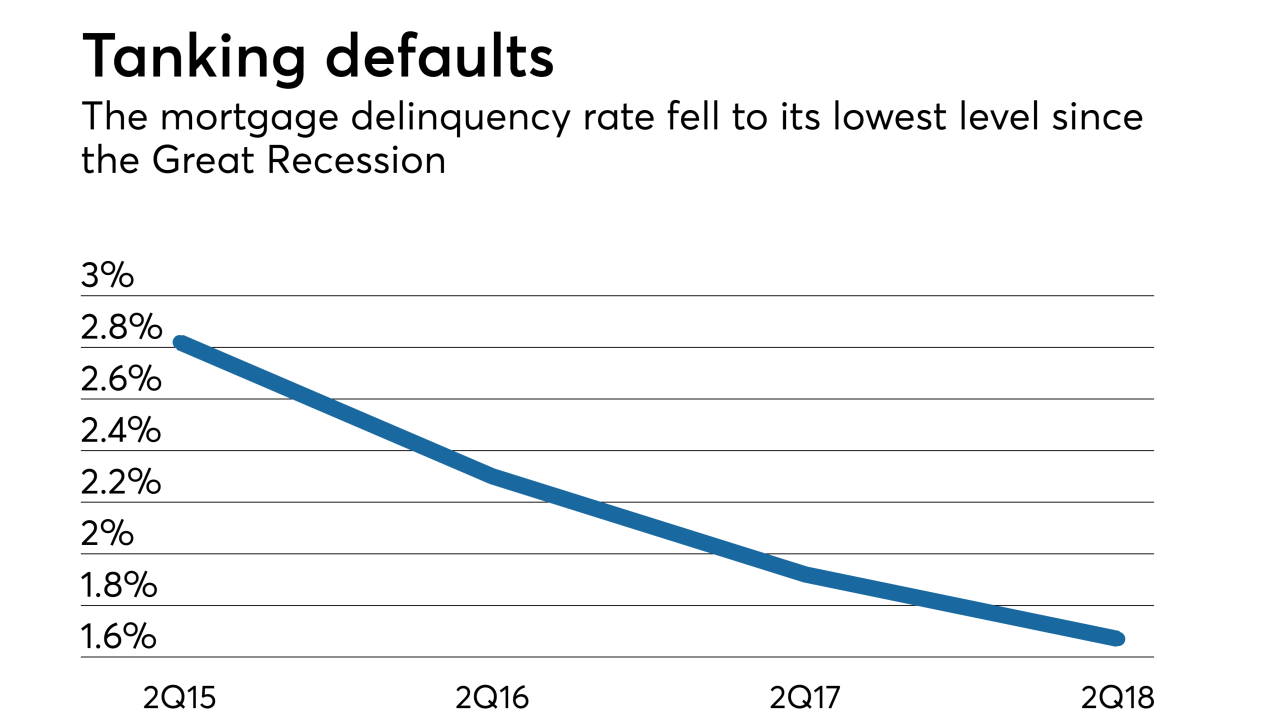

The serious mortgage delinquency rate sank to its lowest June reading in 11 years, though recent natural disasters pose risk to loan performance in affected areas, according to CoreLogic.

September 11 -

Early adopters took digital mortgages from concept to reality. What will it take for everyone else to catch up?

September 10 -

Lennar Corp. closed its first fully electronic digital mortgage with a remote notary, just a few months after the homebuilder made an equity investment in digital mortgage vendor Notarize.

September 4 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

Racial and ethnic discrimination in mortgage lending may be misrepresented by "flawed" denial metrics that suggest a larger gap between the denial rates of racial groups than what actually exists, according to the Urban Institute.

August 27 -

The 30-day delinquency rate dropped to a low not seen in over a decade in July, but foreclosure starts also increased to a three-month high.

August 24 -

Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

August 22