Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

In a study of four metro areas, housing supply and demand gained momentum in the second half of April, even where the COVID-19 curve continued to grow.

May 11 -

After ending 2019 on a high note, Ocwen Financial posted an income loss in the first quarter due to the unexpected costs and volatility created by COVID-19.

May 8 -

Consumer sentiment for home buying fell to its lowest point since November 2011, according to Fannie Mae.

May 7 -

With mortgage rates plummeting, the refinance share of closed loans from millennial borrowers rose for the third straight month, to the highest level since Ellie Mae began tracking the data in 2016.

May 6 -

Guild Mortgage's presence in Washington state, the epicenter of the first U.S. outbreak, gave it an early glimpse of the obstacles ahead.

May 5 -

The total coronavirus-related mortgages in forbearance grew by 55 basis points, in lockstep with rising unemployment claims, according to the Mortgage Bankers Association.

May 4 -

With unemployment mounting, new mortgage forbearance requests could sharply increase in early May when payments are due.

May 4 -

As the coronavirus takes a major toll on housing inventory and credit availability, pent-up buyer demand could lead to market recovery, according to Redfin.

May 1 -

While Freddie Mac stabilized liquidity in mortgage markets, coronavirus-related credit losses drove the GSE's income down in the first quarter of 2020.

April 30 -

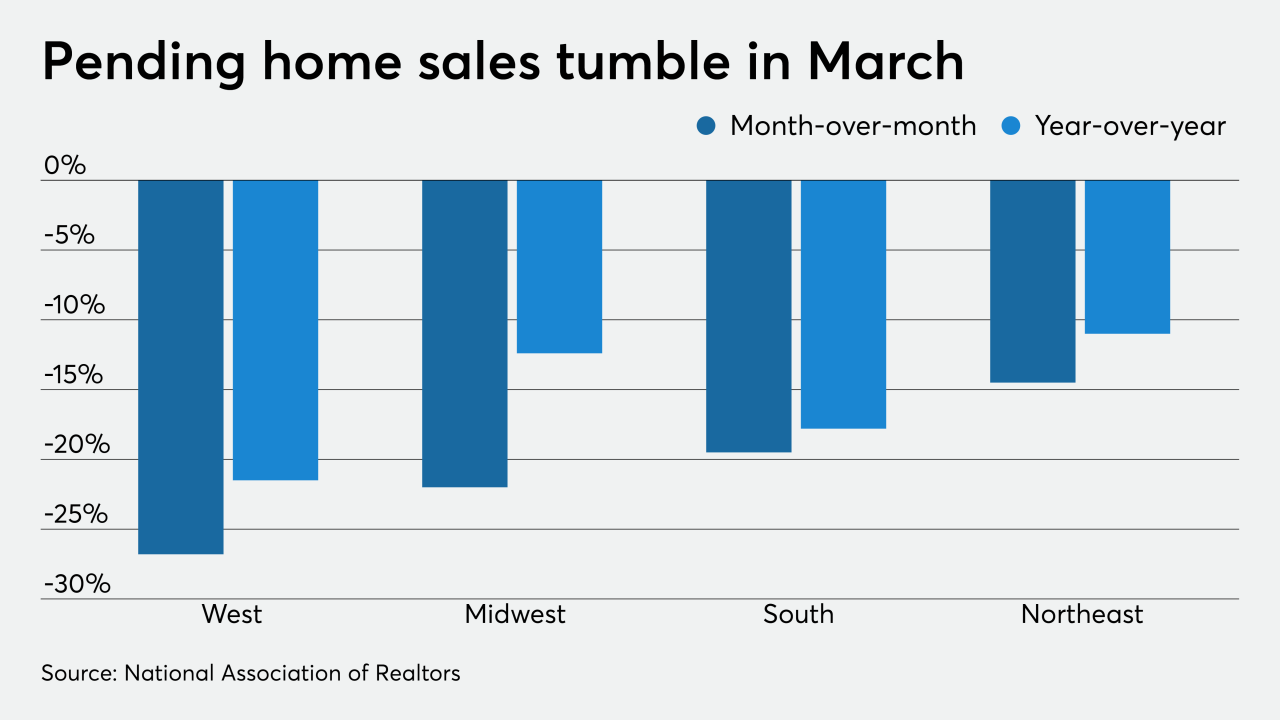

The coronavirus disruption caused March's pending home sales to fall and the losses will reverberate through the rest of 2020, according to the National Association of Realtors.

April 29 -

Mass layoffs and furloughs due to COVID-19 disproportionately affected Asian, black and Latino workers, and, in turn, will impact their housing security the most, according to Zillow.

April 28 -

As lenders scale up on their remote capabilities in response to the pandemic, the software companies that service them see exponential growth.

April 27 -

Due to COVID-19's economic impact, the number of mortgaged properties in default or foreclosure rose in March for the first time since the turn of the century, according to Black Knight.

April 23 -

Sales volumes fell by over 50% in some states since the shelter-in-place mandate started, according to HouseCanary.

April 23 -

Mortgage fraud risk plummeted in the first quarter of 2020 amid historically low mortgage rates and a boom of refinances, but the coronavirus could create a new set of risks, according to CoreLogic.

April 22 -

Surging unemployment from COVID-19 shutdowns brought a rapidly rising tide of forbearance requests, according to the Mortgage Bankers Association.

April 20 -

In March, home sales rose year-over-year for the fourth consecutive month, but the coronavirus inhibited what's typically the biggest monthly boost of the year, according to Remax.

April 20 -

To keep up with demand during the coronavirus pandemic, the mortgage industry must push other initiatives to the side in favor of ramping up the use of tech tools, according to Planet Home Lending.

April 16 -

From the crossroads of America down to the bayou, here's a look at 12 housing markets where it's the most financially prudent to buy a home rather than rent, according to First American.

April 16 -

January saw the lowest mortgage delinquency rate in over 20 years, according to CoreLogic.

April 14