Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

- NMN - DEI

Industry professionals share their experiences of racism and sexism on the job and offer the best ways to help eliminate it.

October 6 -

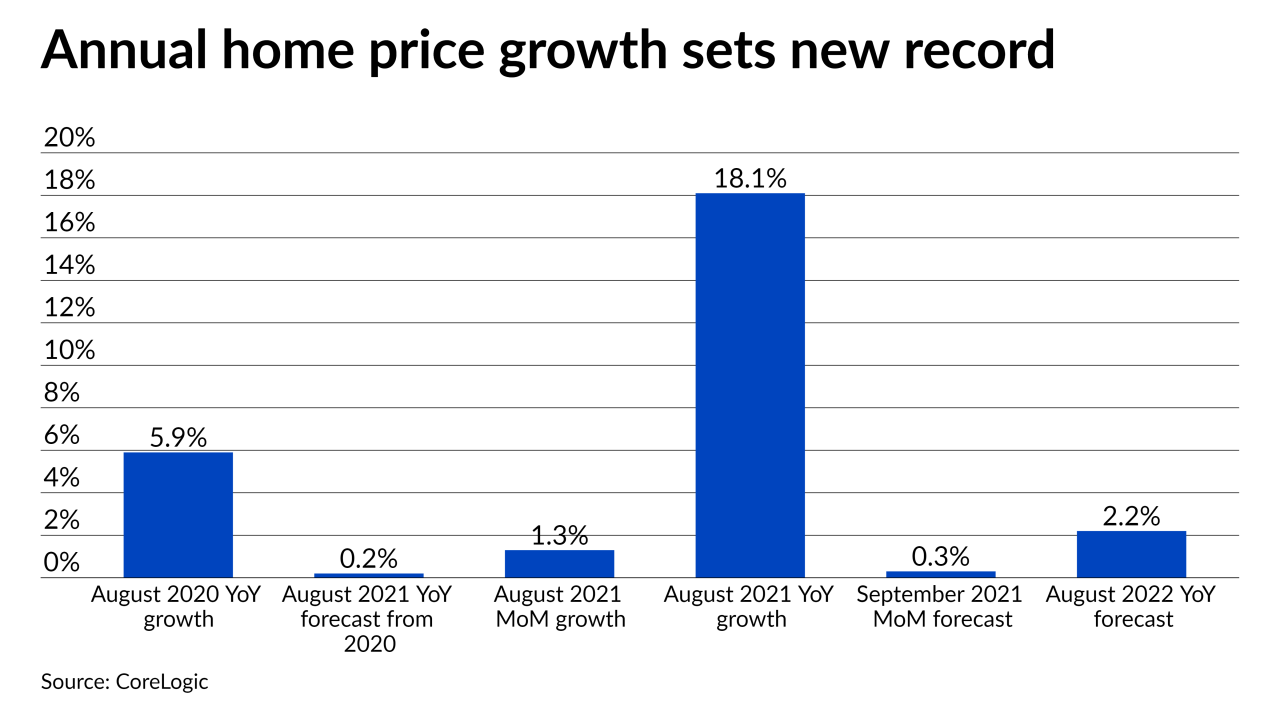

Appreciation more than tripled the year-ago rate, according to CoreLogic.

October 5 -

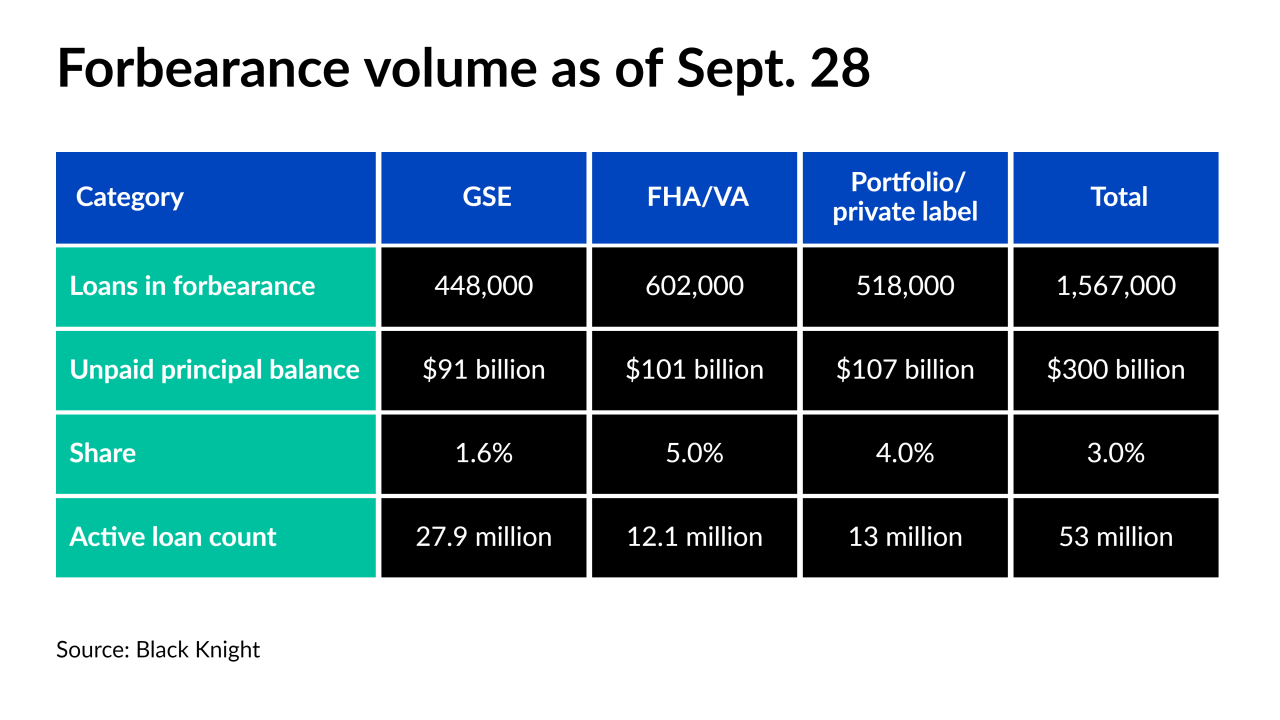

While record price appreciation led to trillions of dollars in equity, forborne borrowers still face the risk of losing their properties, according to Black Knight.

October 4 -

Although over 1.5 million forborne borrowers remain, a fifth could exit their plan in the next week, according to Black Knight.

October 1 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

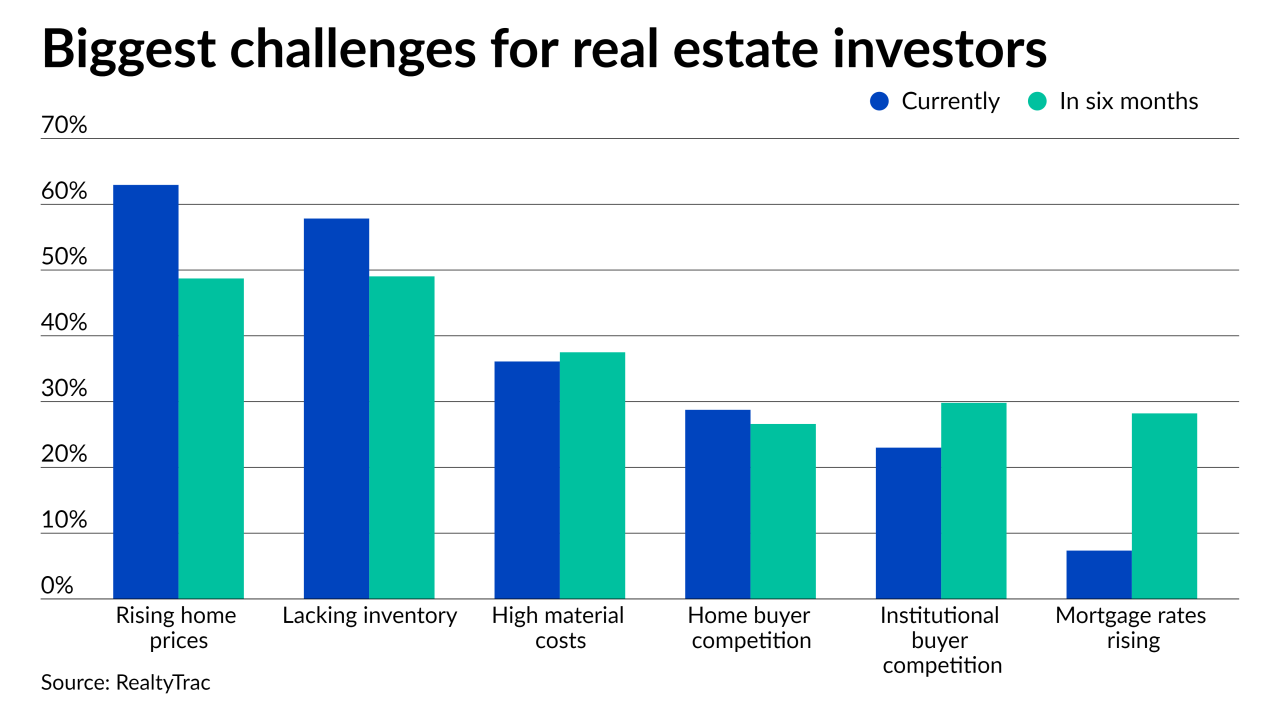

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

The sharp increases of the pandemic era have added nearly a year to the amount of time the average consumer needs to save for a 20% down payment, according to Tomo.

September 28 -

Meanwhile, nearly half of consumers are more worried about severe weather now compared to five years ago, according to Realtor.com.

September 27 -

While nearly 1.6 million forborne borrowers remain, about 460,000 are up for review at the end of September.

September 24 -

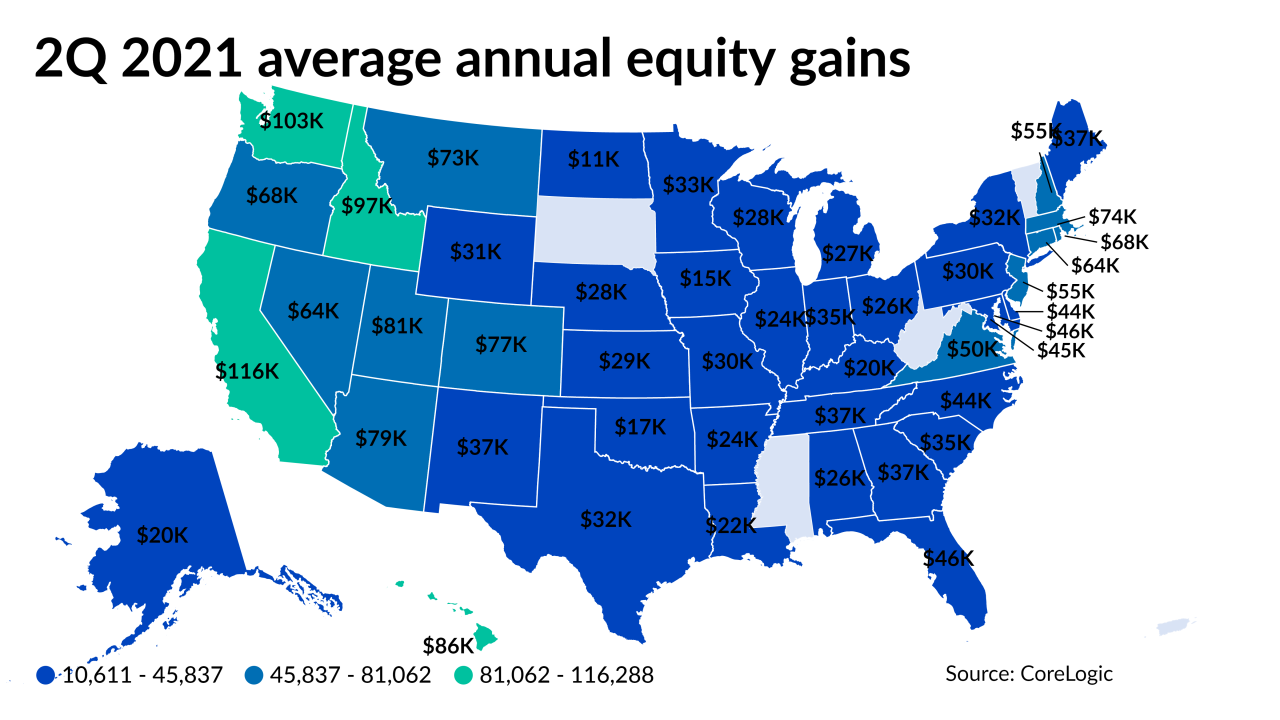

Price appreciation over the past year also dropped the share of underwater mortgage borrowers to an all-time low, according to CoreLogic.

September 23 -

Possible existing home sales exceeded what was forecasted as coronavirus-related uncertainty gave borrowers increased purchasing power, according to First American.

September 22 -

Growing confidence that they’ll be able to find a new place to live will finally push homeowners to put their homes up for sale, the survey of real estate experts found.

September 21 -

Large companies competing to become the Amazon or Google for home lending products discuss their use of acquisitions and targeted marketing to cultivate the image of being a one-stop-shop innovator.

September 20 -

The government-sponsored enterprise also expects purchase and refinancing volumes to drop in 2022.

September 20 -

Last month’s housing market reversed a trend in purchases, but it wasn’t enough to stop the double-digit price growth, according to Redfin.

September 16 -

The builder was found guilty of stealing over $1 million from home buyers, lenders, businesses and a family member’s special needs trust between 2016 and 2020.

September 16 -

The platform, built off a recent acquisition, looks to create efficiency in the growing wholesale lending market.

September 15 -

The fintech projects the Series C capital will enable $10 billion in annual housing transactions through its system and expansion to half the U.S.

September 14 -

August’s increase in that loan type drove refinancings to take up a slim majority share of origination volume for the first time since February, according to Black Knight.

September 13 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10