Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

The race enters a complicated phase that could impact financial markets.

November 4 -

With a dearth of inventory, September generated the largest price growth in the housing market since May 2014, according to CoreLogic.

November 3 -

Getting ahead of the next wave of mortgage fraud calls for rock-solid systems with several protective tools deployed at once. But that only goes so far without the proper employee preparation.

November 3 -

The forbearance rate improved to the a level not seen since early April, but getting back to pre-COVID levels will require employment gains or additional government stimulus measures, according to the Mortgage Bankers Association.

November 2 -

Meanwhile, the delinquency rate is up 89% year-over-year, according to Black Knight.

November 2 -

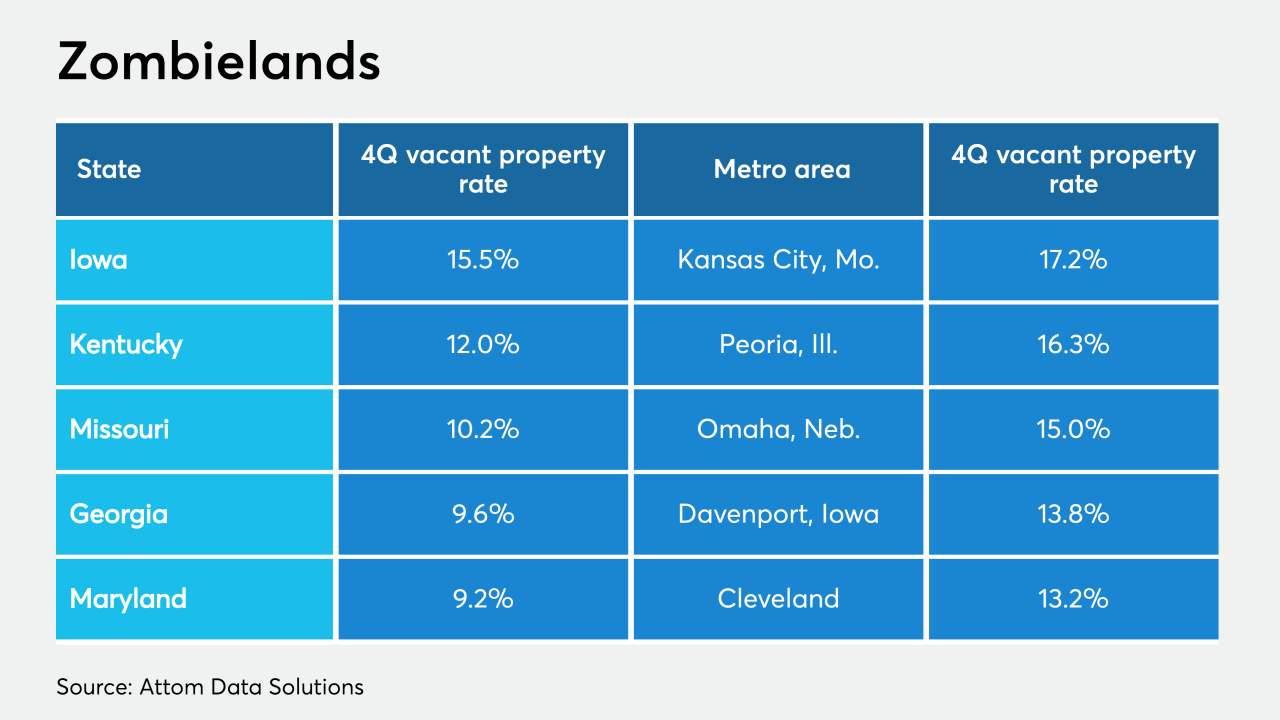

While the total foreclosures continued to fall with coronavirus moratoria in place, the share of zombie properties rose in the fourth quarter, according to Attom Data Solutions.

October 30 -

Mortgage application fraud risk dropped drastically from 2019 with the spike in refinances, but the fallout from the coronavirus means next year could come with more risk, according to CoreLogic.

October 28 -

Black borrowers locked in an average mortgage rate of 4.44% for conventional loans — 15 basis points higher than white borrowers, according to an analysis of HMDA data by the National Association of Real Estate Brokers.

October 28 -

With the real estate market in desperate need for more housing stock, some industry leaders are pinning their hopes on governmental policies to make building more affordable. But how the two presidential candidates may approach these issues varies greatly.

October 27 -

A booming housing market contrasts with a slow-to-improve job market, making for lopsided improvement in the number of troubled mortgages, according to numbers from the Mortgage Bankers Association.

October 26 -

After nearly a year in the works, Roostify takes a "strategic bet" on a partnership with Google, aiming to unlock a fully automated loan process.

October 23 -

To continue providing liquidity for lenders, Fannie Mae lengthened the period in which it would continue the purchase of forborne mortgages and pools of mortgage-backed securities into 2021.

October 22 -

Mortgage volume continues to surge, driven by borrowers refinancing behind record-low interest rates, according to Ellie Mae.

October 21 -

The number of bidding wars increased for the fifth straight month, with Salt Lake City posting the highest rate of competitive listings in two years, according to Redfin.

October 20 -

The overall forbearance rate was under 6% for the first time since April as another large swath of loans fell out of CARES Act coverage, according to the Mortgage Bankers Association.

October 19 -

With record low mortgage rates driving buyer demand, home sales and prices spiked in September, shrinking the supply and days on market, according to Remax.

October 19 -

As financial distress mounted, 12.4% of mortgagors missed payments across the second and third quarters of 2020 — and it could get worse, according to a study from the Mortgage Bankers Association.

October 16 -

While spiking from the year before, mortgage applications to purchase new homes fell in September from August, with low supply and high unemployment keeping it in check, according to the Mortgage Bankers Association.

October 15 -

A surge of mortgage originations allowed Ginnie Mae to surpass its high watermark for mortgage-backed security issuance by nearly 33%.

October 14 -

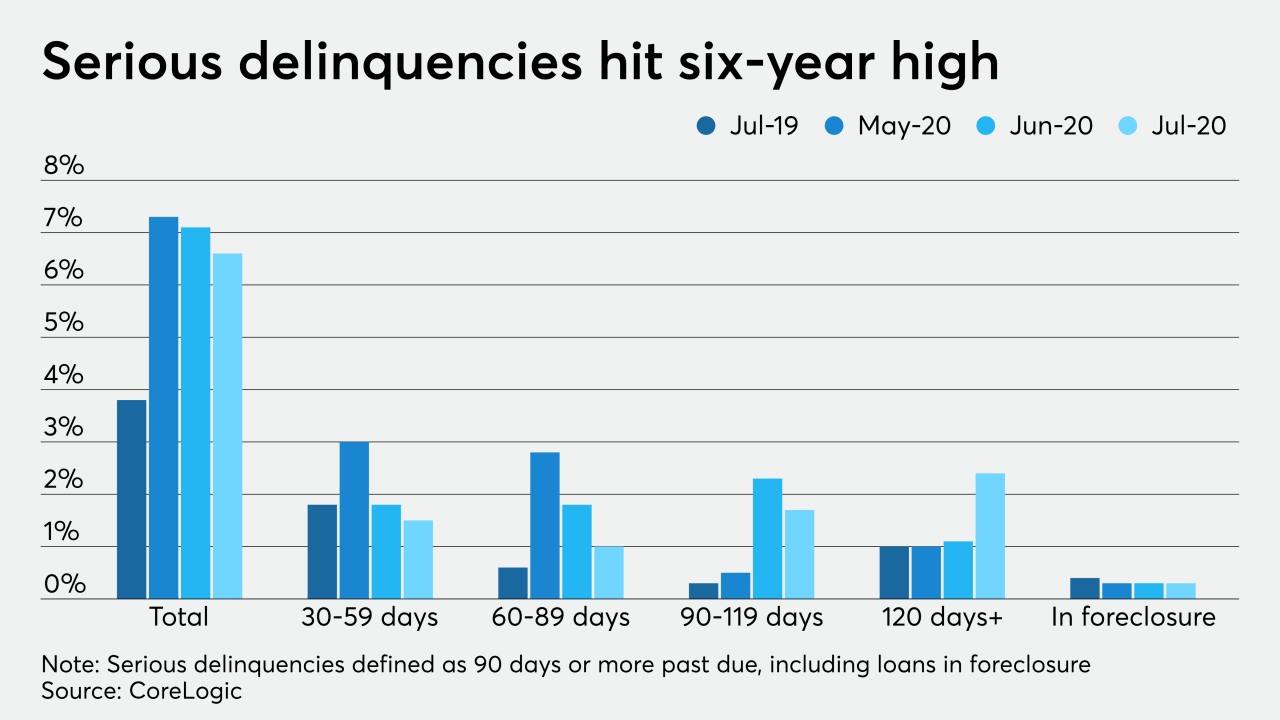

While overall mortgage delinquency rates slowly descend, serious delinquencies — especially loans past 120 days due — jumped in July, according to CoreLogic.

October 13