Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Arizent's latest survey finds that respondents are sharply divided on key issues regarding the upcoming election.

September 25 -

As part of the revamp, Rocket’s referral network, technology and marketing tools will now be available to QLMS users, EVP Austin Neimeic told NMN.

September 22 -

Outside the densely populated coastal hubs, annual home sales grew by leaps and bounds, as buying patterns shifted toward more space with less emphasis on proximity to urban centers, according to Redfin.

September 22 -

Taylor, Bean & Whitaker's former chairman and CEO, Lee Farkas, led a $2.9 billion mortgage fraud scheme during the housing crash but was released early from prison due to susceptibility of COVID-19 transmission.

September 18 -

Although it moved from the glitz of Las Vegas to a fully virtual event, the 2020 Digital Mortgage Conference delivered insights and acumen from the industry.

September 17 -

Quicken Loans president and COO, Bob Walters, provided the first keynote of the 2020 Digital Mortgage Conference and gave insight into how this year changed the industry.

September 15 -

After flattening over the three prior weeks, the number of loans going into coronavirus-related forbearance dove at a rate not seen since early August, according to the Mortgage Bankers Association.

September 15 -

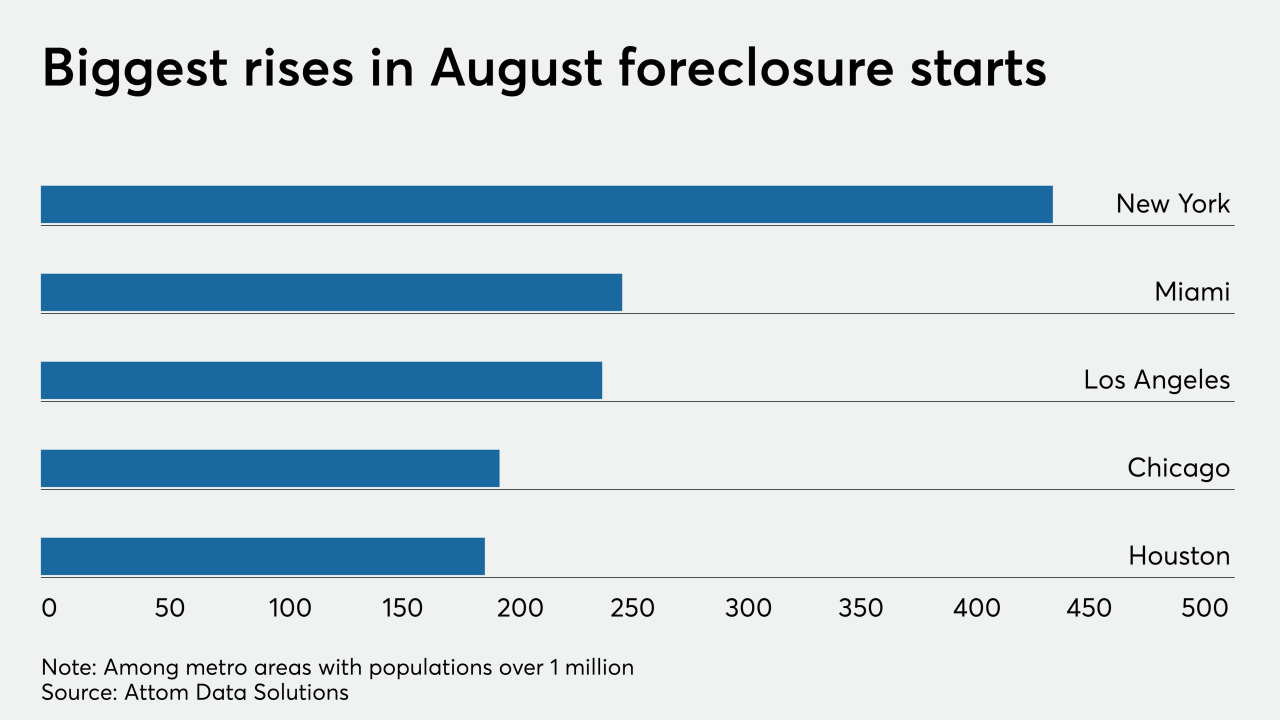

While still greatly trailing year-ago numbers, mortgage foreclosure activity jumped in August from July as moratorium restrictions started lifting and courthouses reopened, according to Attom Data Solutions.

September 11 -

Uncertainties in the job market drove mortgage credit availability down again, falling to the lowest point since March 2014, according to the Mortgage Bankers Association.

September 10 -

The company's remote online notarization provider, Notarize, says it's on track to close $100 billion in mortgage volume over the next 12 months.

September 10 -

"The current economic crisis continues to disproportionately impact borrowers with FHA and VA loans," said Mike Fratantoni, the MBA's senior vice president and chief economist.

September 8 -

As bidding wars raged on and mortgage rates remained near historic lows, housing market confidence grew in August, according to Fannie Mae.

September 8 -

More than half of listings underwent bidding wars in August with some housing markets peaking above 65%, according to Redfin.

September 4 -

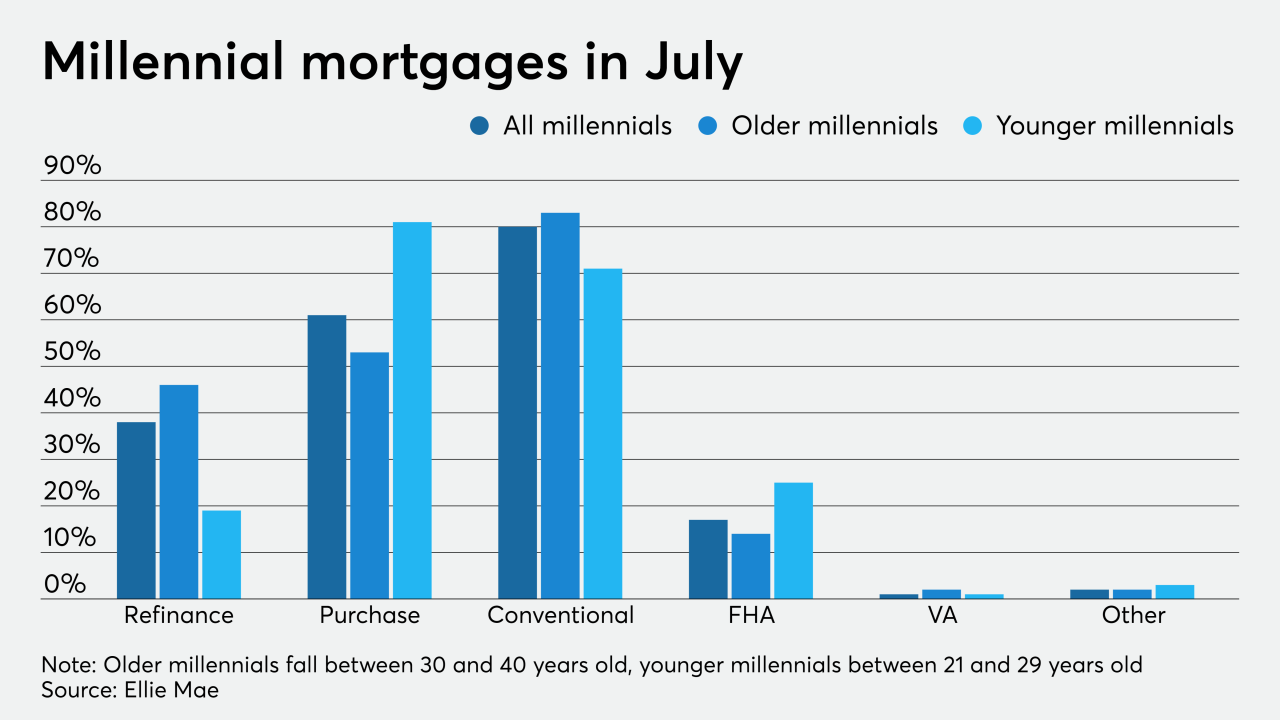

Millennials locked in the lowest mortgage rates on record and kept the summer housing market hot, according to Ellie Mae.

September 2 -

Driven by robust purchase demand and tight housing supply, housing price growth reached a two-year high in July, according to CoreLogic.

September 1 -

For the first time since June 7, the number of loans going into coronavirus-related forbearance didn't decrease from the week before, according to the Mortgage Bankers Association.

August 31 -

The refinance boom kept mortgage loan application defect risk flat, with record-low levels in July, but fraud risk for purchases climbed again, according to First American Financial.

August 31 -

The DocVerify deal adds to Black Knight's goal of providing tools for each step in the home-buying and mortgage processes.

August 28 -

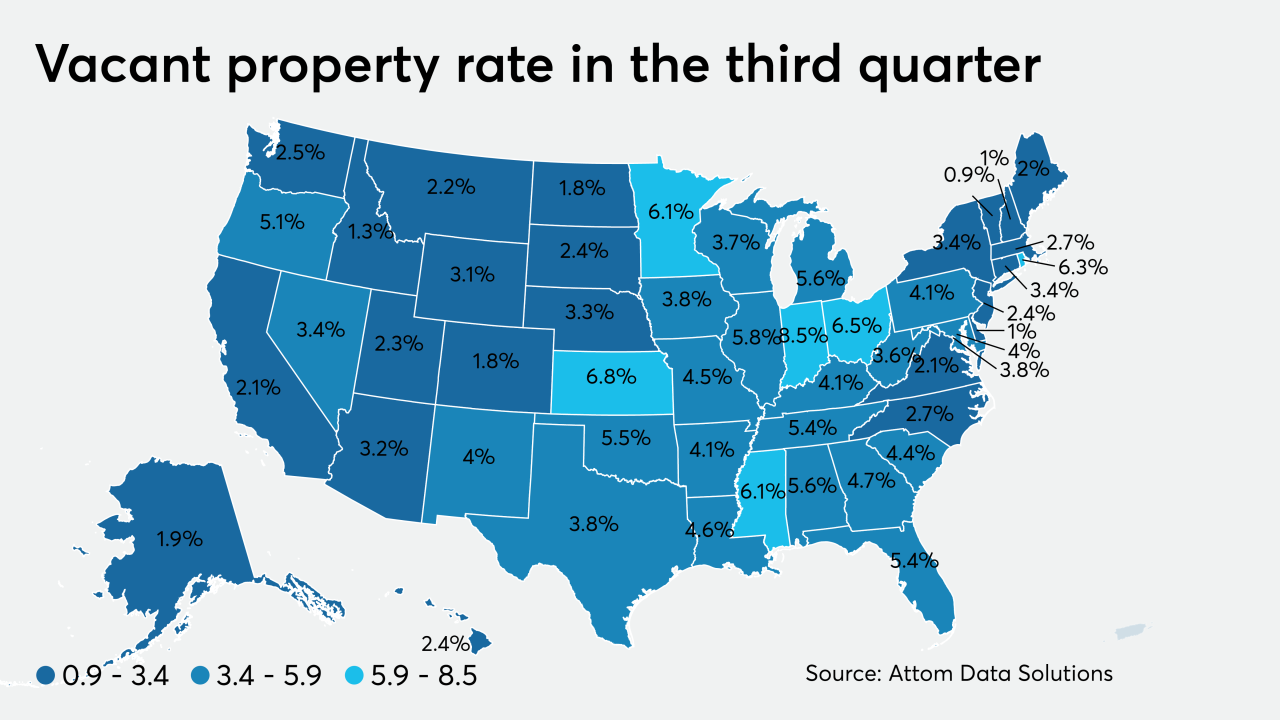

While the overall amount of foreclosures continued to decline due to the coronavirus moratorium, the share of zombie properties grew during the third quarter, according to Attom Data Solutions.

August 27 -

With mortgage rates and housing inventory both at all-time lows, the majority of consumers would overshoot their budgets for the right home without accounting for future costs, according to LendingTree.

August 26