Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Borrowers gained over $6 trillion in home equity since the Great Recession ended and the relative health of the housing market should stave off a coronavirus-induced collapse, according to CoreLogic.

June 11 -

Looming economic uncertainties forced mortgage lenders to tighten underwriting standards in May.

June 9 -

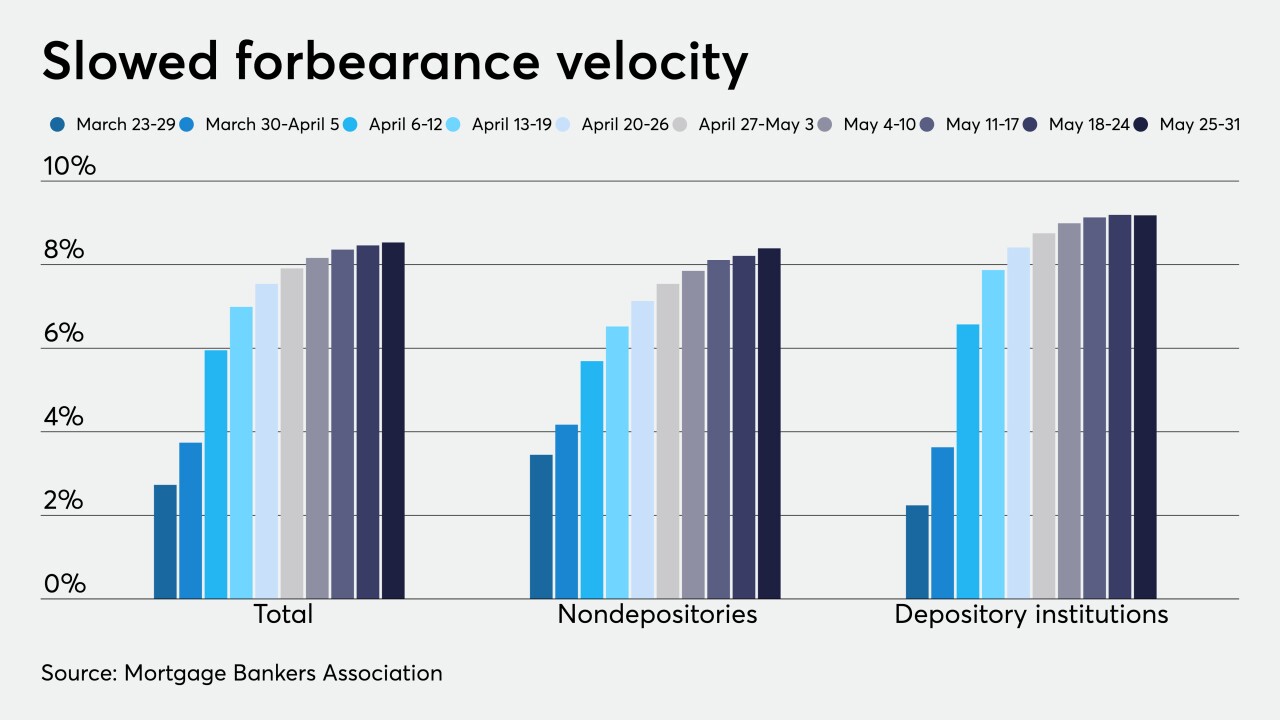

The number of loans going into coronavirus-related forbearance slowed to a rate of 7 basis points between May 25 and May 31, according to the Mortgage Bankers Association.

June 8 -

After bottoming out at a 10-year low in April, consumer sentiment for home buying rebounded in May, according to Fannie Mae.

June 8 -

With the impacts of the coronavirus in full bore, housing market experts predict home prices to fall in 2020.

June 8 -

Independent mortgage banks started 2020 strong after three quarters of high profits, according to the Mortgage Bankers Association.

June 4 -

Millennial refinance activity hit a new high-water mark behind historically low mortgage rates, up 40 percentage points from the year before, according to Ellie Mae.

June 3 -

With would-be sellers too spooked to list their homes and would-be buyers held up due to social distancing orders, home price appreciation accelerated in April. And it could continue into the summer.

June 2 -

Coronavirus-related mortgages in forbearance grew 10 basis points between May 18 and May 24, according to the Mortgage Bankers Association.

June 1 -

The Federal Reserve's actions should keep interest rates down and bring home sales back in June, according to NerdWallet.

June 1 -

The social distancing related limitations on home appraisals is inspiring some companies to find new ways to advance the process.

May 29 -

In addition to the potential wave of mortgage defaults resulting from coronavirus-driven forbearances, hurricane season could put nearly 7.4 million homes worth $1.8 trillion at risk.

May 28 -

The temporary approval of remote ink-signed notarizations gives mortgage companies another tool for closing deals during coronavirus lockdown.

May 27 -

Coronavirus-related mortgages in forbearance grew 20 basis points between May 11 and May 17, according to the Mortgage Bankers Association.

May 26 -

Some cities saw drops in annual housing supply nearing 40% in early May, according to Zillow.

May 26 -

With the recent acceleration to cloud computing, how can mortgage companies, who constantly deal with sensitive personal information, maintain safety?

May 26 -

As the growth rate in forbearance requests downshifts, a vast stockpile of loans await modifications.

May 22 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21 -

From the Midwest to mid-Atlantic, here's a look at 12 housing markets where first-time homebuyers find the most affordability, according to NerdWallet.

May 20 -

Total forbearance driven by the coronavirus rose by 25 basis points, which suggests it is still growing but at a slowing pace, according to the Mortgage Bankers Association.

May 18