Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Sagent Lending Technologies has agreed to buy ISGN Corp. in a deal that would enlarge the company's loan servicing division.

December 24 -

Homebuyer purchase power took another big jump in October as wages grew and mortgage rates stayed low despite continuously tight housing inventory, according to First American Financial.

December 23 -

From the heart of Texas to the coast of Florida, here's a look at the 15 housing markets that experienced the largest home price growth of the last 10 years, according to Redfin.

December 20 -

Despite home prices continuing to rise faster than household income, affordability gains inched up due to the low mortgage rate landscape, according to Attom Data Solutions.

December 19 -

With housing projected to grow hand-in-hand with the economy, Fannie Mae boosted its single-family mortgage origination outlook for 2019, 2020 and 2021.

December 18 -

Better.com saw huge growth in mortgages to traditionally underserved customer bases in 2019 and believes digital applications led to the avoidance of discriminatory lending.

December 17 -

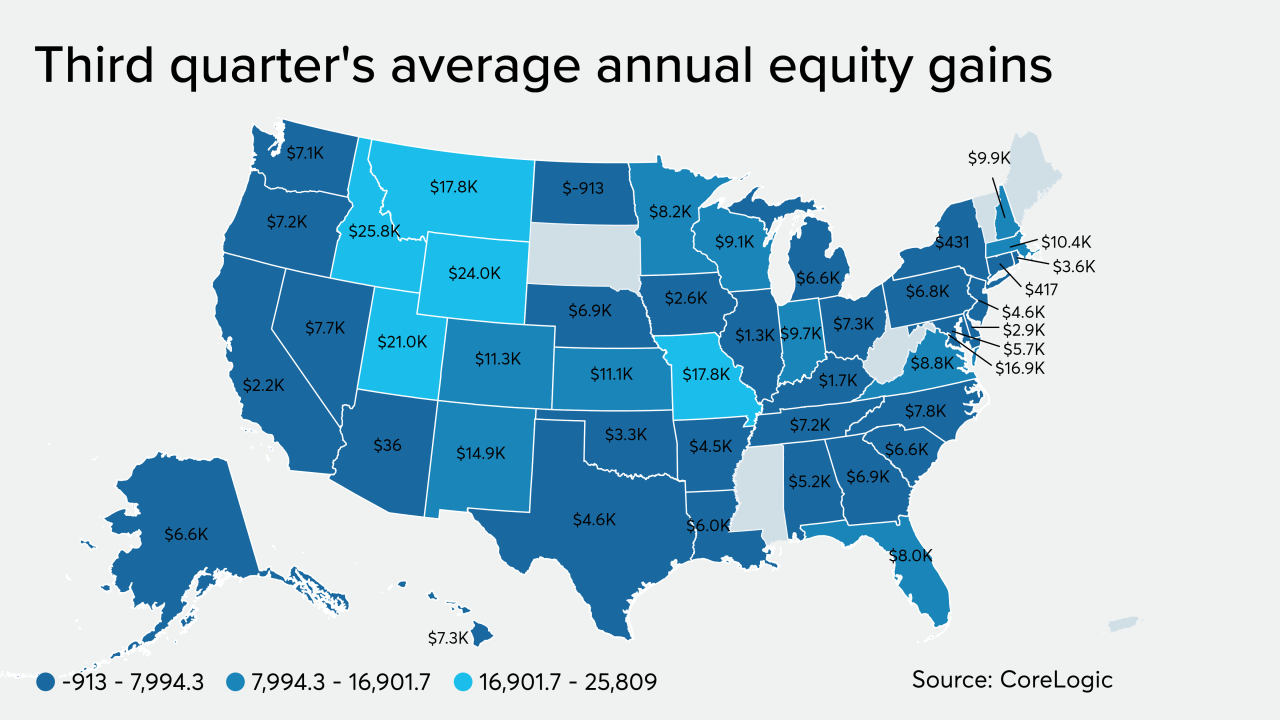

As home value appreciation keeps churning, the share of those upside down on their mortgage grows smaller than ever, according to CoreLogic's Home Equity Report.

December 13 -

From the Southeast to the Midwestern plains, here's a look at the 12 cities where first-time homebuyers can afford the largest share of houses for sale, according to First American.

December 12 -

President Trump lets his thoughts be known through Twitter and those tweets can have a direct impact on the economy and interest rates, according to Clever Real Estate.

December 11 -

With more consumers believing it’s a great time to buy a home, the Home Purchase Sentiment Index had its best November since the index's release in 2011, according to Fannie Mae.

December 9 -

Most commercial and multifamily loan delinquency rates remained near record lows in the third quarter extending a long run of declines in the securitized market, according to the Mortgage Bankers Association.

December 6 -

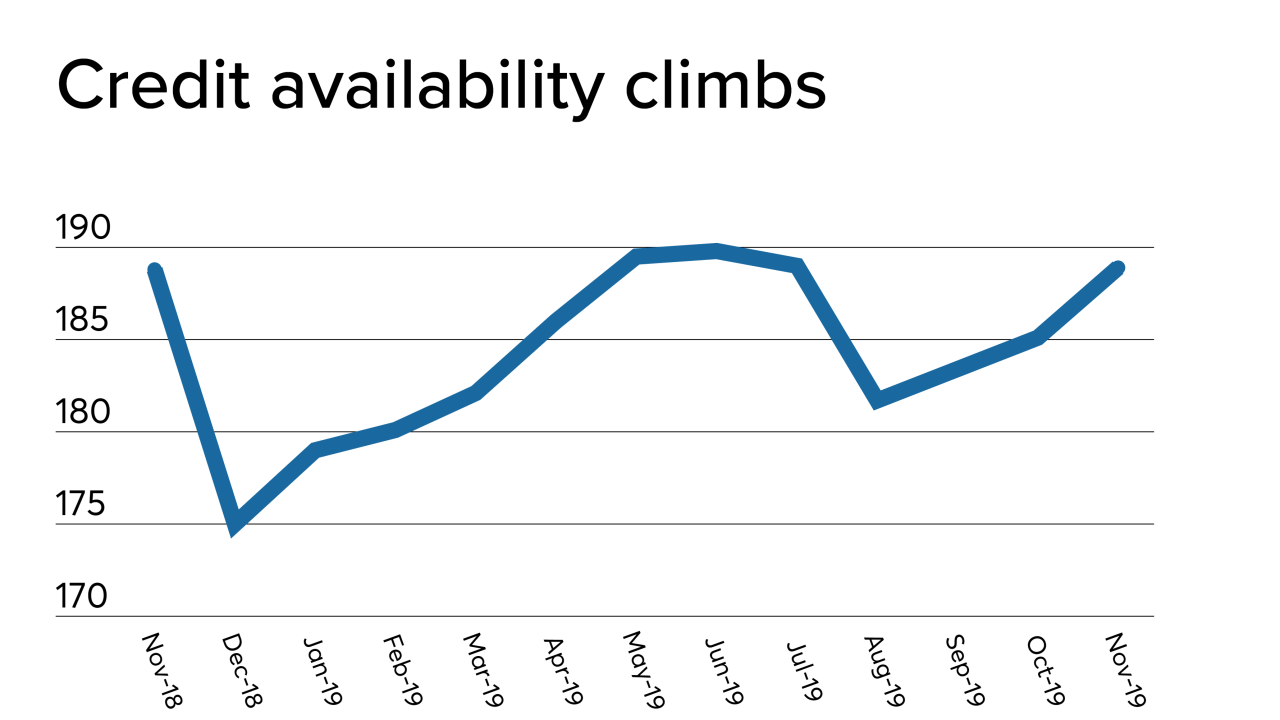

The availability of mortgage credit jumped in November from the previous month as jumbo activity and refinancing in the government market increased, according to the Mortgage Bankers Association.

December 5 -

Millennials took advantage of the low mortgage rate landscape in October, boosting their refinance share to a survey-record high, according to Ellie Mae.

December 4 -

October's deceleration in housing values could be followed by acceleration in 2020, but a growing subset of millennials nevertheless plan to become homeowners in the new year, according to CoreLogic.

December 3 -

What the initiation of the California Consumer Privacy Act means for the mortgage industry.

December 2 -

While affordability remains a challenge with the continued strain on housing supply, purchasing power took a big leap in September thanks to a rise in income and descending interest rates, according to First American Financial Corp.

November 27 -

Among the hustle and bustle of the holiday season, home prices hibernate and offer consumers the best time to buy a house, according to Attom Data Solutions.

November 26 -

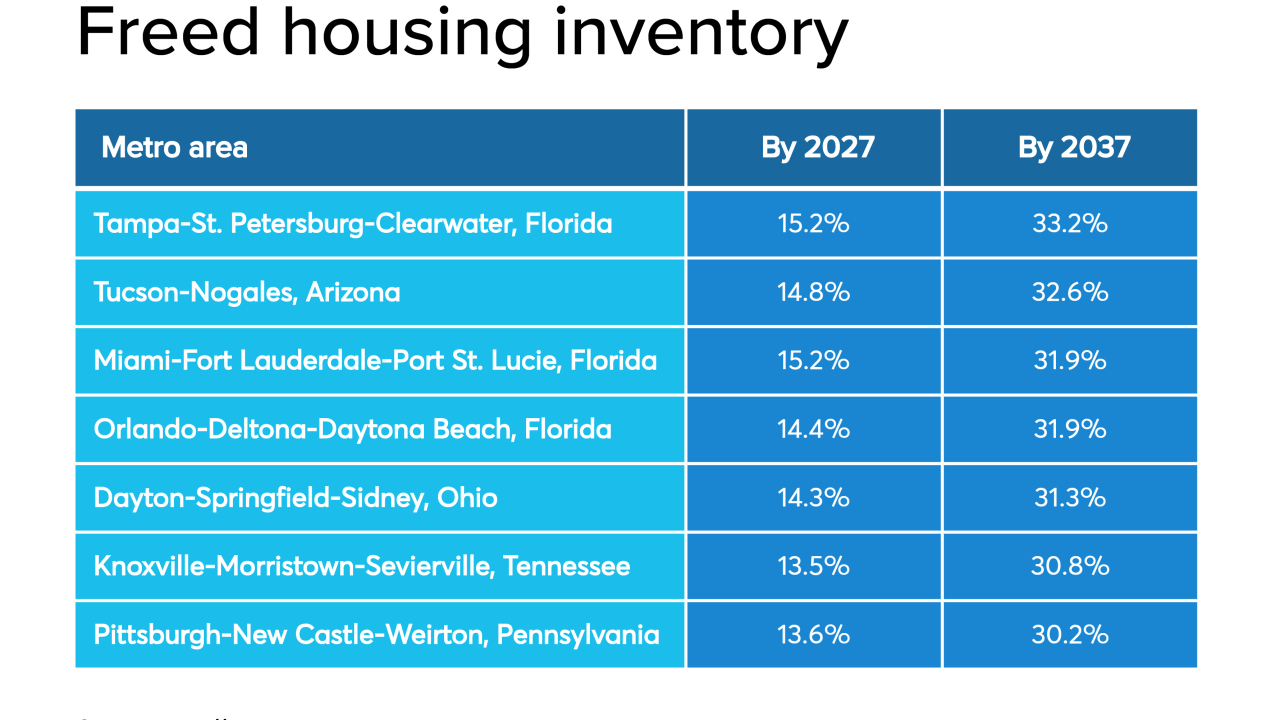

Over a quarter of occupied homes are expected to become available in the next two decades with baby boomers aging out, according to Zillow.

November 25 -

With unemployment still hovering close to all-time lows, the already limited supply of housing is getting bought up faster and lifting rent and home prices around the country, according to Zillow.

November 22 -

Median home prices rose annually by more than the national average of 8.3% in nearly half of low-income areas with certain tax advantages, according to Attom Data Solutions.

November 21