Paul Centopani is an editor for National Mortgage News. Prior to joining Arizent, he worked as an editor at a private equity publication and freelances as a sports writer in his spare time. Paul grew up in Connecticut, graduated from THE Binghamton University and now resides in Chicago after seven years as a New Yorker.

-

Home retention actions from Fannie Mae and Freddie Mac through the first three quarters of 2018 already eclipsed 2016 and 2017 while forfeitures kept declining, according to the Federal Housing Finance Agency.

December 21 -

As home prices continue their ascent, affordability fell for four straight quarters, according to Attom Data Solutions.

December 20 -

From Ohio to Utah, here's a look at the 12 housing markets with the highest percentage of millennial purchasers.

December 19 -

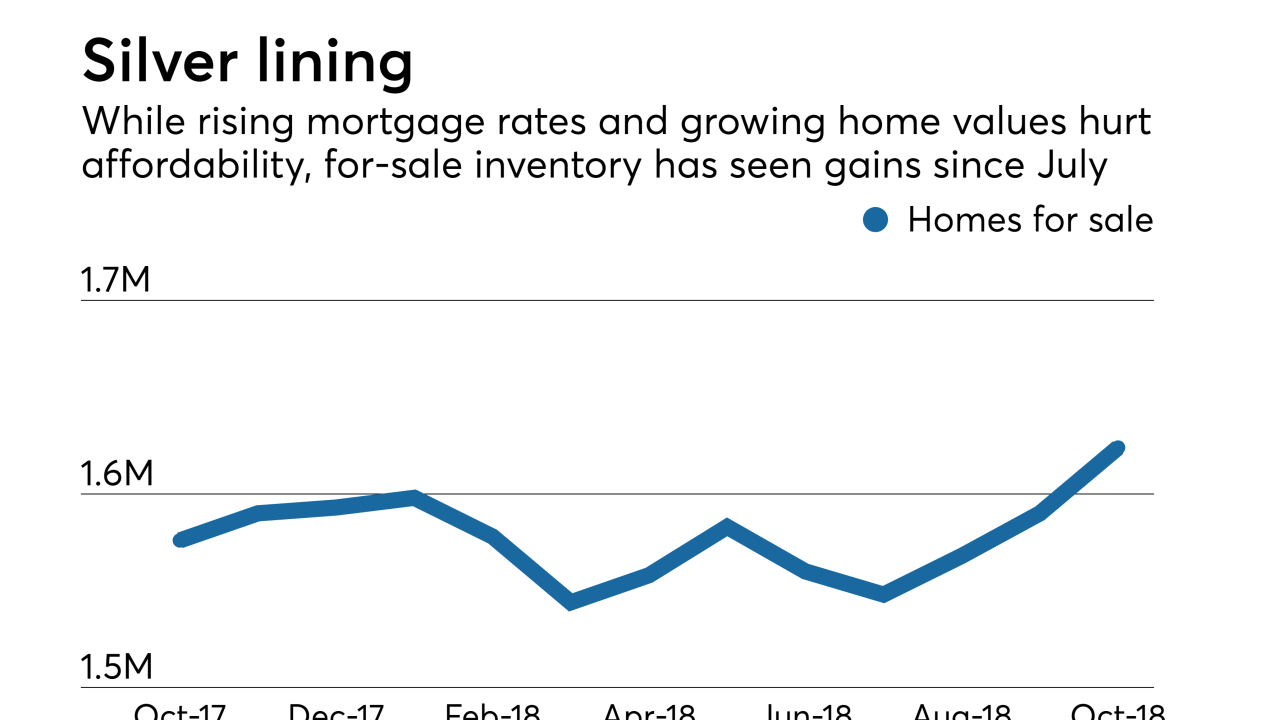

Rising rents combined with growing housing inventory could lead to increased purchase mortgage originations in the near future.

December 18 -

October's rise in the supply of homes for sale could signal the housing market getting closer to equal footing for buyers and sellers, according to Remax.

December 17 -

Putting down 20% of the sales price has been the industry standard when buying a house, but less than half of consumers do that much, according to Zillow.

December 14 -

Intense competition among homebuyers remains as shown by the continual growth of median down payments, according to Attom Data Solutions.

December 13 -

Average mortgage rates plunged after the United Kingdom first voted to leave the European Union. With uncertainty now growing about how Brexit will actually happen, here's a look at the implications for the housing market and mortgage lending.

December 12 -

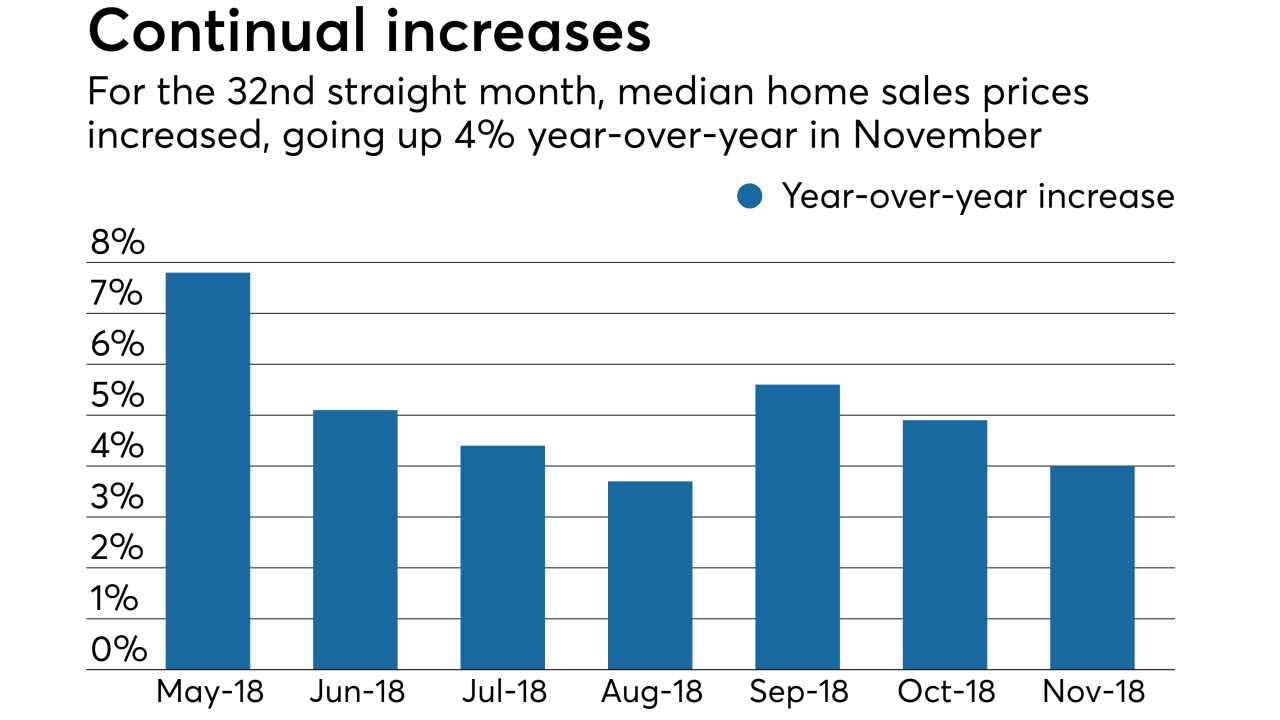

While home values rose over 5% in November, air is getting let out of the home price balloon, as the growth rate remains low compared to the past few years, according to Quicken Loans.

December 11 -

Weakening prices from the most expensive metro areas caused the first decline in available equity since the market started recovering from the housing crisis, according to Black Knight.

December 10 -

Despite increasing mortgage rates and a tepid housing market, positive consumer perception of the economy carried over to home buying during November, according to Fannie Mae.

December 7 -

As home value appreciation slowed, gains in home equity for the third quarter fell to the lowest level in two years, according to CoreLogic's homeowner equity report.

December 6 -

Growing home prices and climbing interest rates didn't stop millennials from buying houses in October, Ellie Mae said.

December 5 -

It's in lenders' best interests to show first-time homebuyers how to avoid overextending themselves, which is easy to do in a housing market short on inventory and long on big down payments, the CEO of Freedom Mortgage says.

December 4 -

The lack of housing affordability, caused by rising home prices and mortgage rates, remains a roadblock to homeownership.

December 4 -

Clayton Properties Group, a builder specializing in prefabricated modular and manufactured homes, acquired Mungo Homes in a move to bolster the scale of its site-built housing.

December 3 -

Hometown Lenders Inc. will acquire TotalChoice Mortgage in a move to expand its geographic footprint and meet its goal of growing annual originations from $1 billion to $5 billion.

November 30 -

Volatility in the stock market caused the growth in the top 5% of average home sale prices to slow more than the rest of the market, according to Redfin.

November 29 -

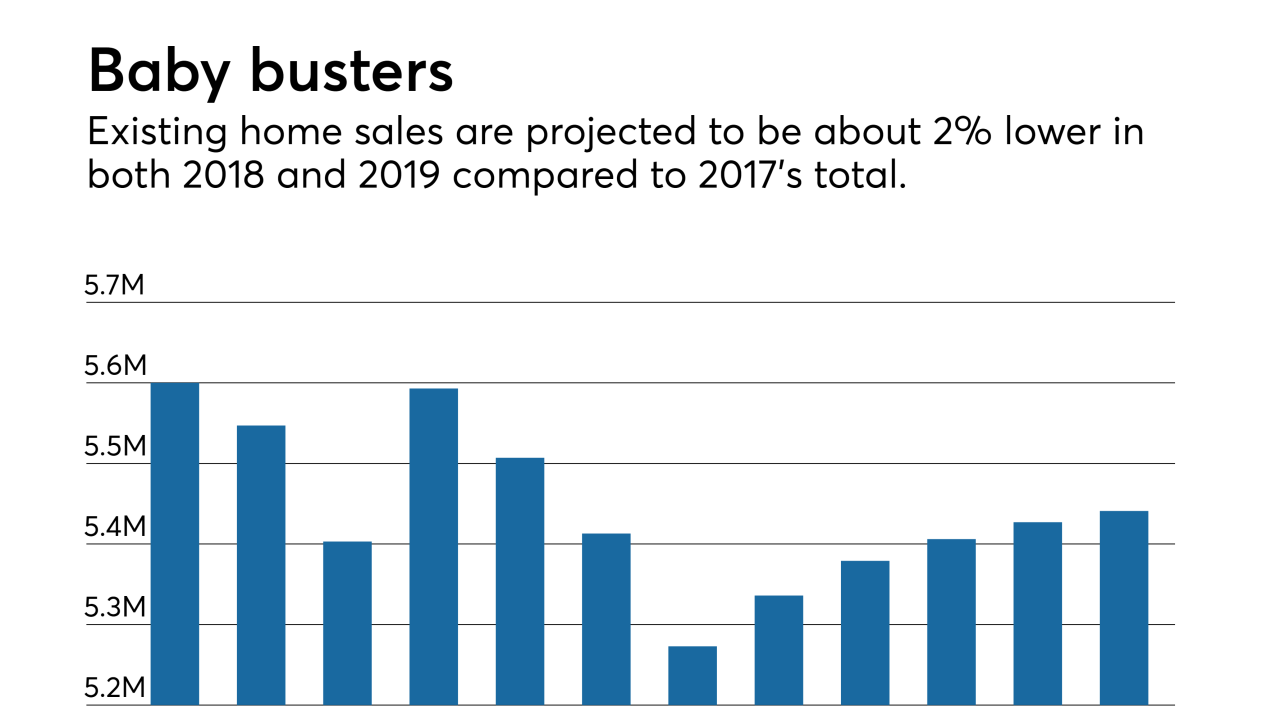

Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomer generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan.

November 29 -

Affordability will take a hit and rent prices are expected to go higher next year behind rising mortgage rates, but they'll bring positive developments, according to Zillow.

November 28