Consumer banking

Consumer banking

-

The investments, part of a post-merger effort to wring out more profits, include new commercial and mortgage lending platforms.

January 21 -

Join Jim McKelvey, co-founder of Square as he offers his insights into where the Fintech industry is headed next year. Will a Biden administration insist on greater regulation? What will happen in the cryptocurrency markets? What will be the big IPOs in the sector? Will GooglePlex make a big splash? What new technologies or applications should we be expecting?

-

Bank and credit union groups are pushing to include the industry’s front-line workers in the next priority group, but even as a recommendation is coming soon from a CDC advisory panel, the decision ultimately will be made state by state.

December 18 -

The architects of two major loan deals featuring Black banks, one involving multiple lenders and a pro sports franchise and another backed by Citigroup, say more transactions like these are in the works.

December 13 -

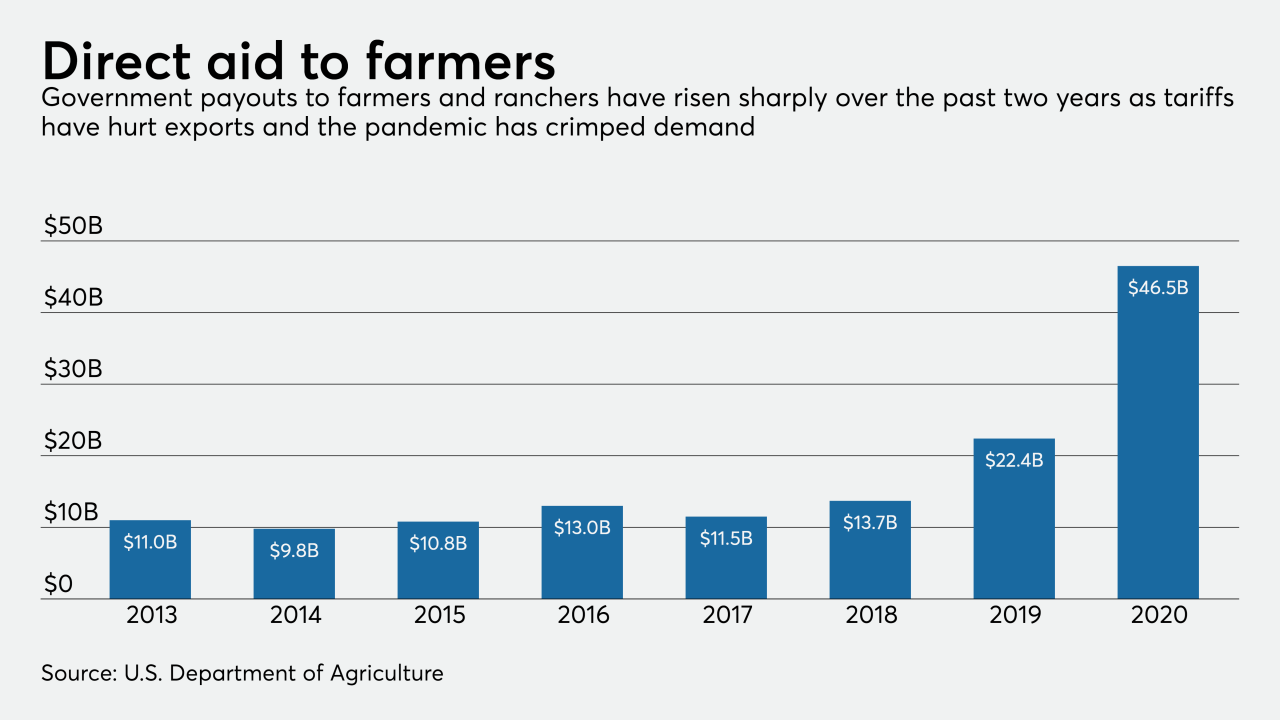

The Biden administration could curtail federal support for farmers, even with bankruptcies and requests for loan workouts on the rise. Banks are hoping that increases in crop prices and exports to China could help avert a credit crisis.

December 10 -

With many Americans and members of Congress questioning the results of the presidential election, financial services trade associations quickly vowed to work with the incoming administration.

November 11 -

The two companies first started collaborating last year, but now BBVA has white-labeled Prosper’s technology on its own website.

November 10 - LIBOR

The statement comes after multiple small and midsize institutions earlier this year warned the agencies that the secured overnight financing rate was ill-suited to them.

November 6 -

The company is looking to tap into a surge of homebuying tied to historically low interest rates.

November 3 -

The digital bank is on a larger mission to attract younger customers. It's inserting itself into the popular video game in the hope that game players will learn about its products and have fun at the same time.

October 30 -

The agency found a 40% error rate in the 2016 data submitted by the Seattle bank. In addition to the fine, the institution is required to improve its compliance systems.

October 27 -

The bank said the move will give it more flexibility for raising capital.

October 23 -

As the pandemic speeds digital adoption at financial institutions, the technology giants are pitching products that scan in data from mortgage documents and provide security and compliance controls used by in-house tech developers.

October 22 -

Banks, lenders, and fintechs have been on a path toward digitizing the mortgage process from end-to-end — long before the term coronavirus entered our daily lexicon. How has the pandemic affected progress?

October 22 -

Strong mortgage and capital markets activity helped offset credit costs and one-time items in the third quarter at Citizens Financial Group. In a period of low rates, CEO Bruce Van Saun says he’d like to buy more fee-generating businesses.

October 16 -

The events of 2020 have only served to accelerate a number of potentially disruptive trends among consumers when it comes to banking and financial services — What does the emerging future of consumer and retail banking now look like?

October 16 -

Customers' needs and expectations changed drastically in 2020, overturning conventional thinking about their experience in the process. How can we strike the right balance between embracing digital channels and recognizing the value of human touch?

October 15 -

CEO Charlie Scharf disappointed investors by failing to provide either a detailed road map for long-term expense reductions or say when he might release such a plan.

October 14 -

Deferrals may be hiding credit issues, leading lenders to track deposit flows, property maintenance and other factors to gauge the true health of their portfolios.

October 8 -

The company says it plans to originate 40,000 mortgages for Black and Hispanic households and finance 100,000 affordable rental units over five years.

October 8