-

Not so long after Treasury bond yields experienced an unprecedented drop, the average 30-year mortgage rate rose, reflecting volatility related to the coronavirus as well as capacity issues on multiple levels.

March 12 -

Fidelity National Financial, the nation's largest title insurance underwriter, added a new digital title insurance opening package to its WireSafe homebuyer and seller program.

March 2 -

From increased consumer engagement to new forms of payment, mortgage servicers are finding themselves faced with new trends in the market that they need to address.

February 28 -

There is a real possibility of a large, nonmortgage brand coming into the industry and consolidating a disjointed loan origination process.

February 27 LodeStar Software Solutions

LodeStar Software Solutions -

CoreLogic's fourth-quarter earnings reflect the success of the transformation to an appraisal management company business model accelerated in the prior-year period.

February 27 -

It is the start of a new decade, and here are six trends that will play a critical role in reshaping the mortgage industry.

February 19 Ally Home

Ally Home -

Low mortgage rates are setting the stage for growth, not just in refinancings, but in purchase volume as well during 2020, according to Ellie Mae.

February 19 -

State and local governments are clearing the policy hurdles that stand in the way of mortgage e-closings and that could pave the way for more progress toward this goal.

February 14 -

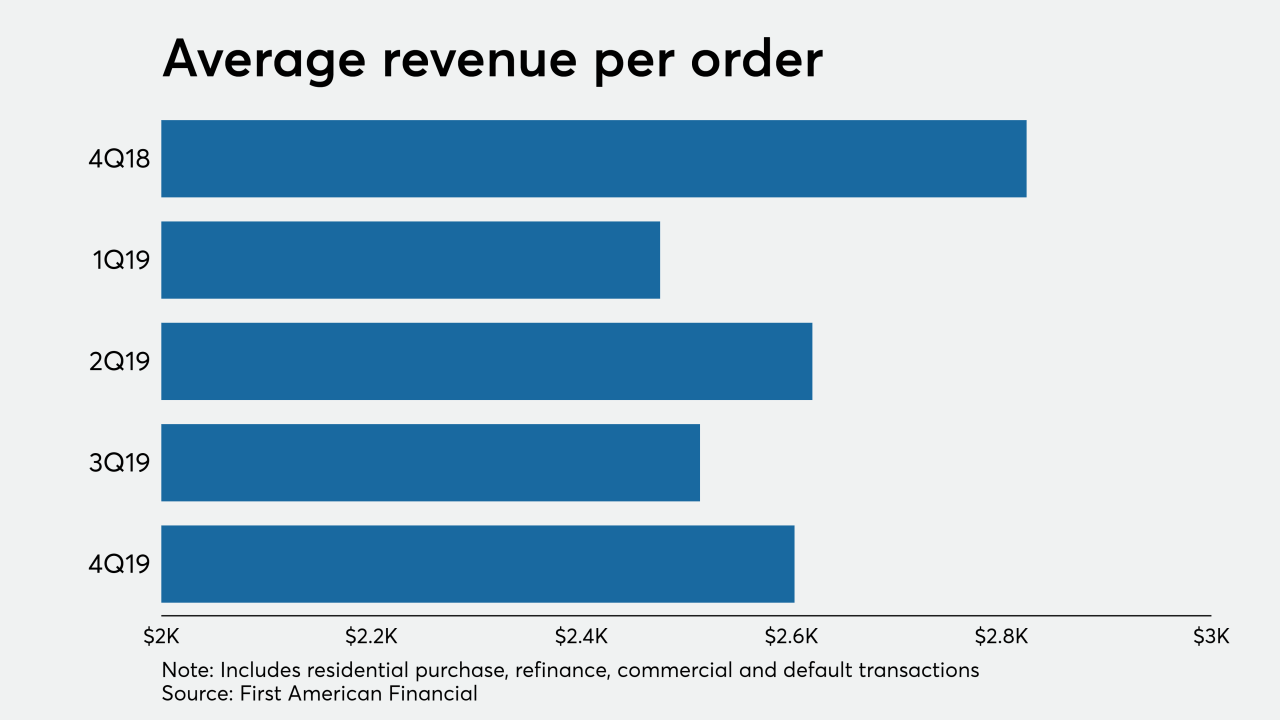

First American Financial, a title insurance underwriter and settlement services provider, is acquiring mortgage document firm Docutech for $350 million in cash.

February 13 -

Digitization presents opportunities for lenders to streamline the mortgage process in ways that benefit them and their borrowers, but three things stand in the path to full adoption.

February 12 Fiserv Inc.

Fiserv Inc. -

NMI Holdings saw its insurance-in-force grow 38% over the past year as 90% of its clients used its black box pricing module during the fourth quarter.

February 12 -

PMI Rate Pro lets users compare mortgage insurance premium quotes from all six companies in the market.

February 10 -

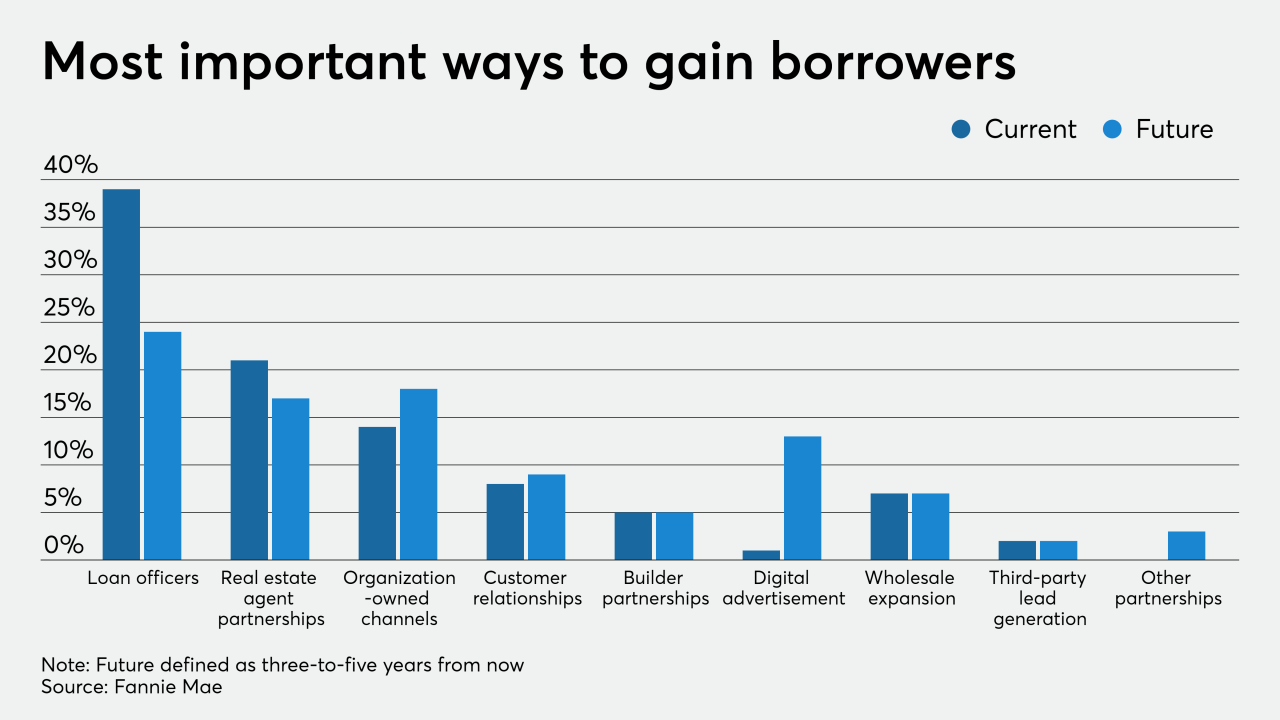

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

The prevention of wire fraud and cybercrime being perpetrated against the mortgage business is the latest passion for Regina Lowrie, longtime industry executive and the first woman to head up the Mortgage Bankers Association.

February 3 -

United Wholesale Mortgage invested in regional Super Bowl advertising for the first time and local competitor Quicken Loans added to its longstanding national marketing ties to the game.

January 31 -

The mortgage securitization market can expect some changes, particularly in the specified pool and to-be-announced markets, alongside a continuation of trends in other areas.

January 31 Vice Capital Markets

Vice Capital Markets -

Rooted in increased regulations and general customer backlash, there is a growing emphasis on collecting consent and ensuring privacy of customer data, especially following enactment of the California Consumer Privacy Act.

January 28 PossibleNOW

PossibleNOW -

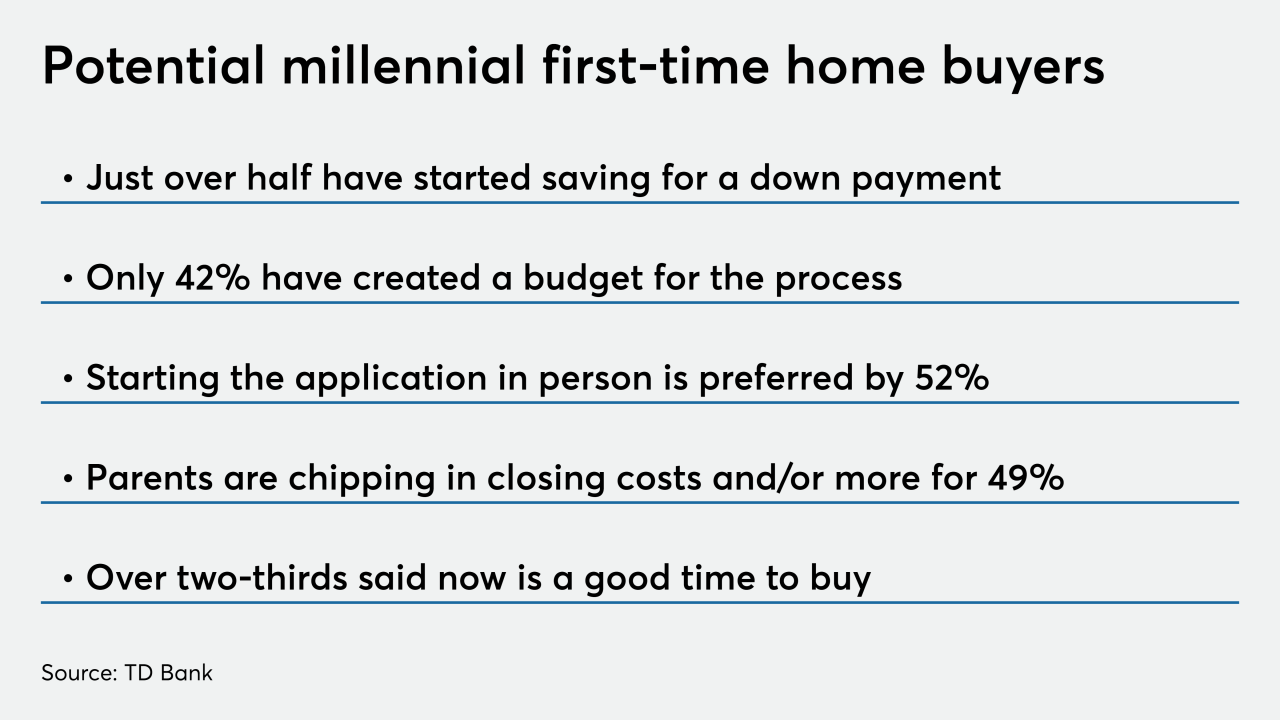

A significant number of millennials planning to purchase their first home during 2020 have not yet taken the financial steps necessary to successfully complete the process, a TD Bank survey found.

January 27 -

Blend, a vendor that outfits some of the biggest banks and other lenders with consumer-facing digital mortgage technology, has released a new mobile application for mortgage professionals.

January 17 -

Dan Gilbert has been back in the office and could soon be making his first public appearance since suffering a stroke last May, Quicken Loans CEO Jay Farner said.

January 16