-

Lenders who employ a technology stack that tracks, collects and analyzes homebuyer behavior will have a distinct advantage as application volume rises.

July 9 NestReady

NestReady -

Mandate for loan officers is to be able to inform on customers' specific financial needs in areas that extend well beyond the home loan.

July 9 -

The post-crisis operational improvements at both Fannie Mae and Freddie Mac have resulted in stronger mortgage loan performance, a Fitch Ratings report said.

July 3 -

Amazon's reputation is built on customer fulfillment and technology innovation, but are those enough to guarantee success in the mortgage business?

July 3 AI Foundry

AI Foundry -

Mortgage and real estate professionals need to do a better job of educating consumers and themselves about the growing vulnerability to wire fraud schemes during the home buying process.

July 3 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

After hiring half the laid-off staff from Live Well Financial, Open Mortgage plans to engineer a careful transition to operating as a larger-scale business.

June 25 -

Blend, a mortgage technology firm that named former Fannie Mae CEO Tim Mayopoulos its president early this year, has raised $130 million in Series E funding for an expansion.

June 24 -

Because automated valuation models have not been subjected to a stressed housing market, their increased use holds negatives and positives for residential mortgage-backed securities credit quality, a Moody's report said.

June 24 -

Real value comes from the wholesaler using a hands-on approach to ensure that a mortgage broker's customers are treated to the best experience for the life of the loan.

June 21 Home Point Financial

Home Point Financial -

As Amazon looms over the mortgage industry, expert views differ on the retail monolith claiming its stake in the sector.

June 18 -

Ally wants to increase productivity and improve the use of analytics to build on customer relationships.

June 13 -

A Western Union survey claims consumers are unable to tell the difference between humans and interactive voice response or artificial intelligence when needing customer or payment assistance, but their responses may say otherwise.

June 12 -

Sens. Elizabeth Warren, D-Mass., and Doug Jones, D-Ala., cited research that found algorithmic lending can lead to higher interest rates for minority borrowers.

June 12 -

Appraisals are viewed as a choke point in the mortgage process. As the ranks of appraisers dwindle and technology advances, a new, AI-driven approach may not be far off.

June 10 -

Many community banks have given up on national mortgage platforms as not worth the effort, but organizers of NXG Bank in Maryland say they have a plan to make one work.

June 4 -

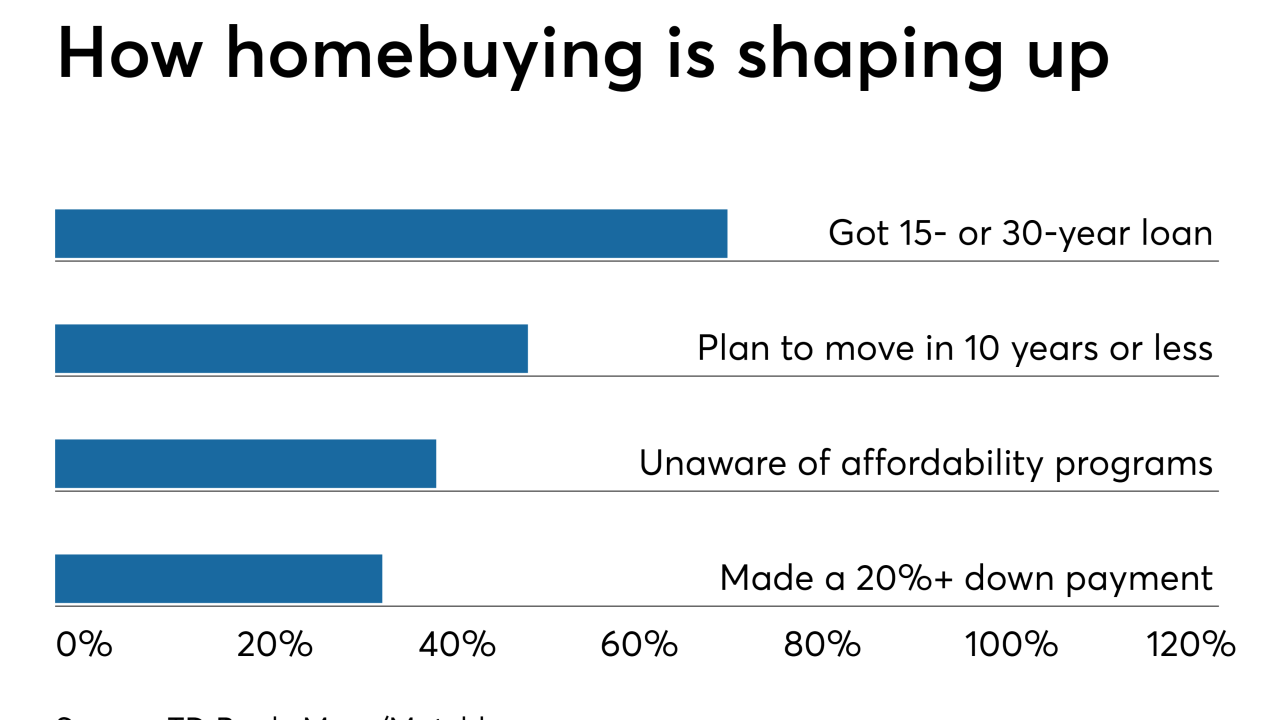

Increased use of the digital mortgage process contributes to improved closing times, but falls short when it comes to borrower education, according to a TD Bank survey.

May 30 -

Wells Fargo hired two seasoned veterans for their mortgage technology and data security expertise amid a digital era for financial industries.

May 29 -

Mortgage lending has a long way to go before most people associate it in any way with virtual reality.

May 29 -

After years of expansion as a public company, Ellie Mae went private and cut 10% of its workforce. But new ways to grow lie ahead, according to CEO Jonathan Corr.

May 28