Earnings

Earnings

-

But profitability may have peaked. Rocket reported a 4.41% profit margin on newly originated loans last quarter but told investors on Thursday to expect margins on new loans this quarter to be around 3.6% to 3.9%.

February 26 -

As its mortgage origination volume delivered another quarter of strong earnings, Mr. Cooper’s banking on its "enormous backlog" of REO orders to generate further profitability once the foreclosure moratorium is lifted.

February 23 -

The newly public digital mortgage giant is relying on a diverse set of loan channels to take on competitors in an increasingly crowded field, CEO Anthony Hsieh said in an earnings call this week.

February 18 -

Also: New Residential, Fannie Mae and Freddie Mac release Q4 earnings reports

February 12 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The company purchased $1.1 trillion of single-family mortgages and $83 billion of multifamily loans during 2020.

February 11 -

The growing popularity of the company’s websites and apps has earned the company record profits during the fourth quarter, with adjusted earnings before interest, taxes, depreciation and amortization of $170 million, according to a statement on Wednesday.

February 11 -

The agreement would generate $250 million in proceeds, which the nonbank mortgage company plans to use to pay down and refinance existing debt, while also investing in its servicing and origination businesses.

February 10 -

But the company sees reasons to be optimistic about the second half of the year, CEO and Chairman Michael Nierenberg said during its fourth quarter earnings call

February 9 -

Even as the company posted record numbers, it could have originated more loans if it had not stopped buying FHA and jumbo mortgages from brokers.

February 4 -

Pretax operating margins came in much narrower than what is projected for the three stand-alone underwriters.

February 1 -

The company also reported a large fourth-quarter loss that reflected a significant increase in its loan-loss provision.

February 1 -

For a surprising number of companies pursuing an IPO is a mistake, Endurance Advisory Partners CEO Stephen Curry says.

January 27 -

The auto finance company, which had stumbled in forays into the credit card business, is now seeing rapid growth in mortgage and unsecured consumer lending.

January 22 -

Despite that decline, the company notched its second-best quarterly earnings ever over that period.

January 21 -

The investments, part of a post-merger effort to wring out more profits, include new commercial and mortgage lending platforms.

January 21 -

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

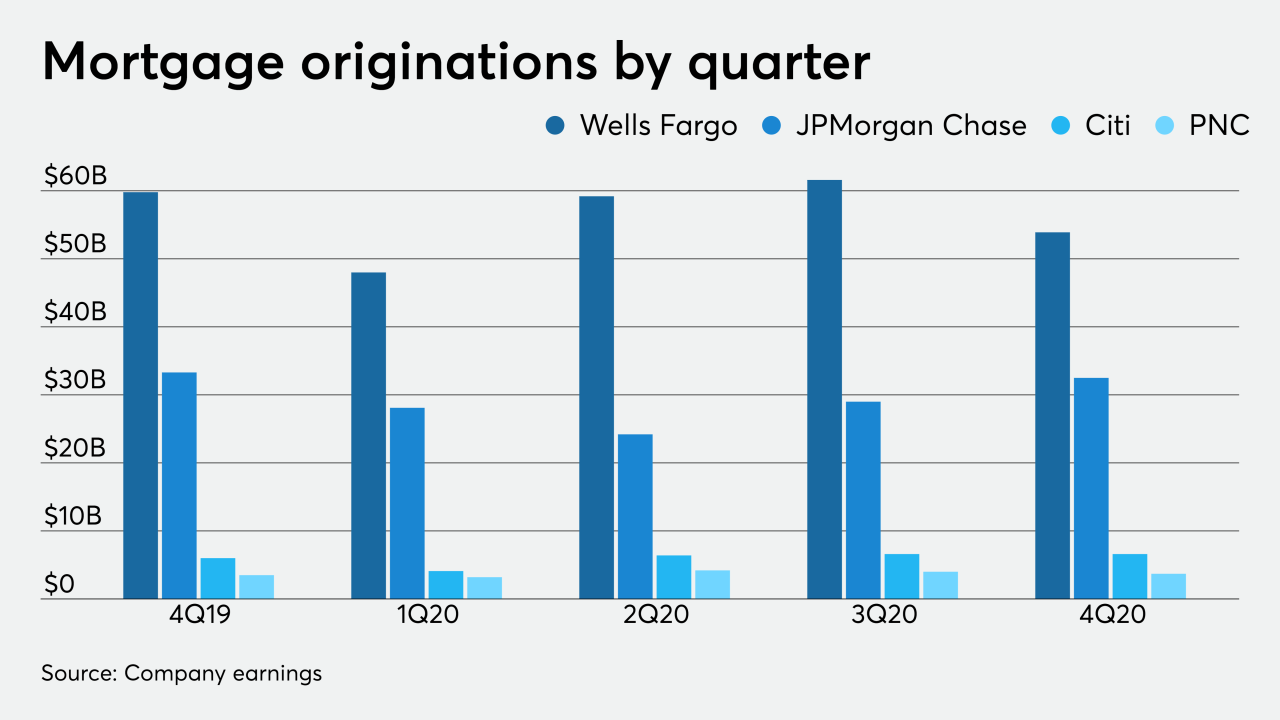

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

But will the company's second attempt to go public come to fruition in a market where two lenders already put their offerings on hold?

January 12 -

The company had canceled its planned pricing of the deal at the end of October over stock market volatility.

January 5