-

While the hot market’s actual and forecast home price gains were key drivers of Fannie’s results, they also present a challenge to the affordable housing mission that it’s working to address.

August 3 -

The dynamic between housing market players diverged to an even greater degree amid intense demand and surging home prices, according to Fannie Mae.

July 7 -

The justices on Wednesday threw out a key part of a challenge brought by firms including Paulson & Co., Pershing Square Capital Management and Fairholme Funds to the government’s collection of more than $100 billion in profits from Fannie Mae and Freddie Mac.

June 23 -

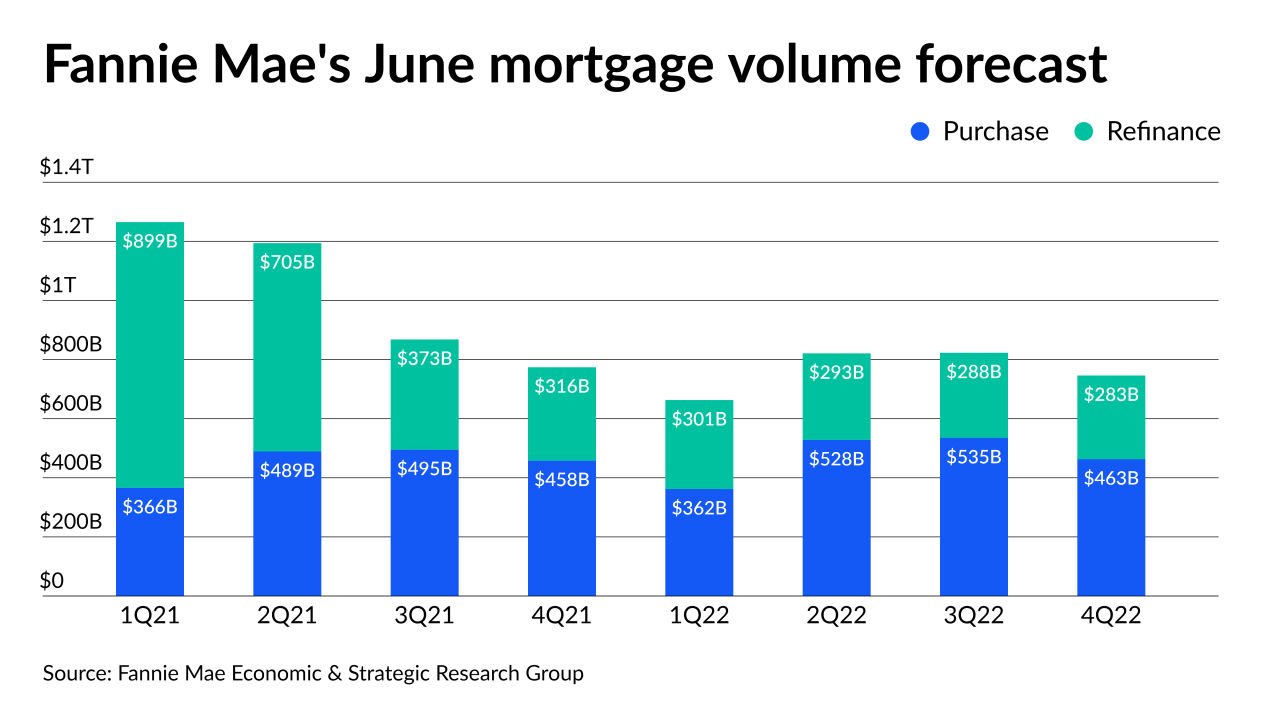

But the government-sponsored enterprise raised its total origination volume forecast for 2021 based on slightly stronger than expected refinance activity.

June 16 -

More than two-thirds surveyed said they expect to make less money over the next three months as price reductions ramp up along with a market shift to purchases.

June 10 -

The government-sponsored enterprises have been returning to normal underwriting and are buying more loans than last year, but annual limits they have in place could become a concern.

June 8 -

While a growing share of consumers feel optimistic about the economic recovery underway, the extreme seller’s market made the majority of prospective borrowers pessimistic for only the second time in 10 years, according to Fannie Mae.

June 7 -

For two decades, Alfred Pollard served as the general counsel for Fannie Mae and Freddie Mac’s regulator. He had a front-row seat for the establishment of the Federal Housing Finance Agency, the government’s subsequent seizure of the mortgage giants amid mounting losses in 2008 and the more recent legal dispute over the FHFA’s authority.

June 7 -

The former senior vice president and credit officer takes over the role that Andrew Bon Salle left at the end of 2020.

May 27 -

In spite of an improving economy, acute competition and supply scarcity soured homeshoppers on the purchase market in April, according to Fannie Mae.

May 7 -

The government sponsored enterprise’s latest forecast calls for a nearly $4 trillion year for 2021.

April 16 -

Vaccinations and a third round of stimulus payments are boosting consumers views on the housing market, according to Fannie Mae.

April 7 -

Also: Fannie sets early limits, servicing retention rates fade to record lows and loan broker inquiries rise as competition heats up.

March 12 -

After a booming 2020, more mortgage lenders than ever before expect diminishing margins in the coming months as climbing interest rates set up heightened competition.

March 11 -

Some applaud the agency's recent delay of the mandatory compliance date for a new Qualified Mortgage standard. Others say it leads to more uncertainty for lenders, opens the door to additional changes and enables some companies to loosen their underwriting.

March 7 -

The agency issued a proposal moving the compliance date for the Qualified Mortgage rule revamp to October 2022.

March 3 -

While its net income declined annually for the second consecutive year, CEO Hugh Frater touted Fannie Mae’s resiliency in a record year for providing mortgage liquidity.

February 12 -

The former president and CEO of GE Capital’s restructuring and strategic ventures group was named executive vice president and chief risk officer soon after the departure of Fannie EVP Andrew Bon Salle.

January 22 -

The Biden administration could encourage the FHFA to increase the caps or restore exclusions for certain types of loans, which would boost overall volumes.

January 20 -

Despite mortgage rates expected to rise modestly in 2021, a bolstered Biden administration stimulus package and COVID-19 vaccination efforts bring promise for economic recovery.

January 15