-

The company also reported a large fourth-quarter loss that reflected a significant increase in its loan-loss provision.

February 1 -

Issuance of securitizations backed by these loans is becoming more dependable, and Fannie will need more mortgages that finance newly-built energy-efficient homes to keep it going.

February 1 -

The transaction consisting of $24 million in securitized Ginnie pools followed a 265% jump in broader industry eNote registrations last year.

January 29 -

Thirty-one of 39 shopping malls linked to a key commercial real estate credit derivatives index are currently impaired.

January 29 -

Federal Reserve officials left their benchmark interest rate unchanged near zero as they flagged a moderating U.S. recovery and reiterated a pledge to use all available tools to support the economy during the coronavirus pandemic.

January 28 -

DLJ and Nomura Corporate are sponsoring portfolios of mostly previously modified, well-seasoned mortgages that have at least two years of clean-current payment status.

January 27 -

For a surprising number of companies pursuing an IPO is a mistake, Endurance Advisory Partners CEO Stephen Curry says.

January 27Endurance Advisory Partners -

The Financial Stability Oversight Council could determine that a broad range of mortgage companies should be subject to “heightened prudential standards,” said Andrew Olmem, a partner at Mayer Brown and a former senior economic adviser to the White House.

January 25 -

At least 25 properties that Columbia Sussex Corp. has financed with loans packaged into commercial-mortgage backed securities are in special servicing or on servicer watch lists.

January 25 -

The auto finance company, which had stumbled in forays into the credit card business, is now seeing rapid growth in mortgage and unsecured consumer lending.

January 22 -

The former president and CEO of GE Capital’s restructuring and strategic ventures group was named executive vice president and chief risk officer soon after the departure of Fannie EVP Andrew Bon Salle.

January 22 -

Despite that decline, the company notched its second-best quarterly earnings ever over that period.

January 21 -

The investments, part of a post-merger effort to wring out more profits, include new commercial and mortgage lending platforms.

January 21 -

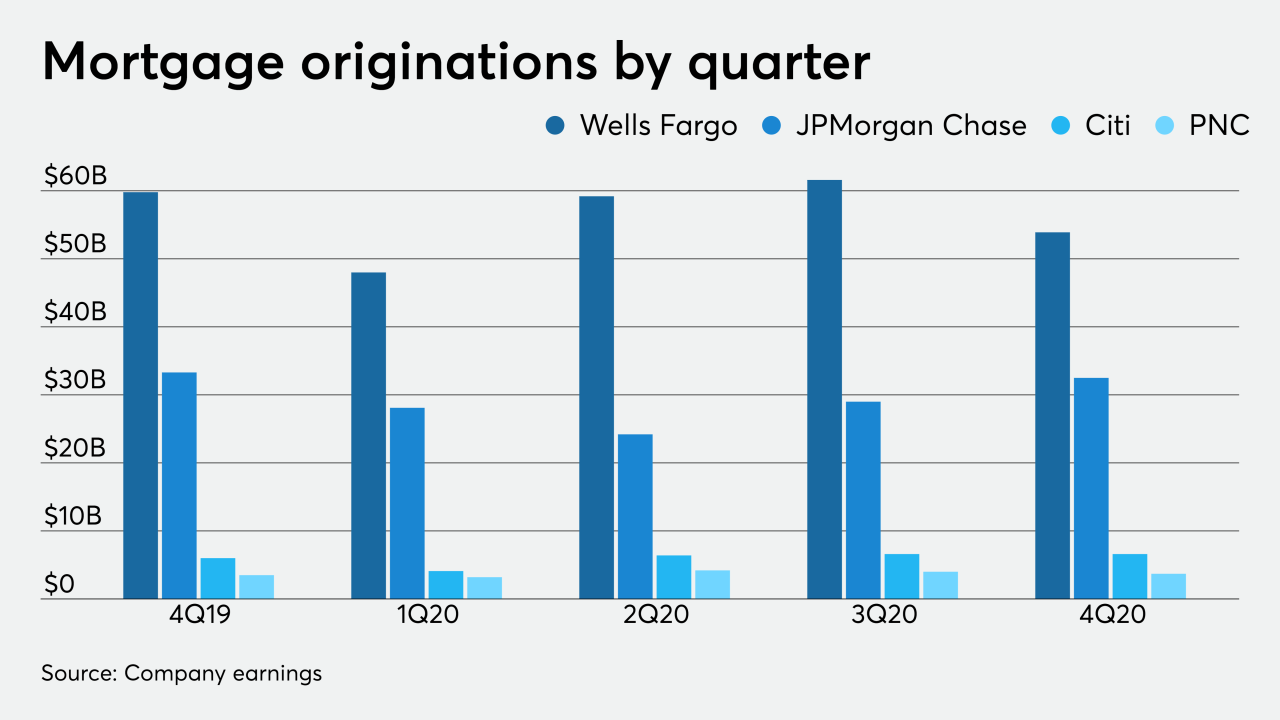

The company’s 4Q originations were down from the same time in 2019 and the number of overall loans for 2020 marked a decline from the year before.

January 19 -

Upcoming changes to underwriting regulations, as well as the end of the QM patch, in addition to growing home values, all add up for this market to have a good year.

January 19 -

While some industry forecasts predicted origination volumes would fall 7% quarter-to-quarter in 4Q, early earnings numbers from Wells Fargo, JPMorgan Chase, Citi and PNC Bank show they were down just 3% when purchased loans are excluded.

January 15 -

The weighted average seasoning is 34 months, well above that of prior Invictus-sponsored deals on the Verus shelf that are typically new originations under 10 months.

January 13 -

After doubling its valuation in five months, Blend plans to use its latest funding to strengthen its digital lending experiences for banking and mortgages.

January 13 -

The transaction finances the loan portion of a $989.5 million acquisition of warehouse and distribution properties located in nine states.

January 13 -

But will the company's second attempt to go public come to fruition in a market where two lenders already put their offerings on hold?

January 12