-

Last year, smaller lenders were put at a slight disadvantage in terms of what they were charged in guarantee fees when they sold loans for cash.

December 15 -

There are people creating a lot of unrealistic scenarios about market risk.

December 14 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The pool of 359 loans also on average carry higher balances (over $900,000) compared to the REIT's earlier pass-through deal this year.

December 14 -

But late payments for all other investor types rose compared with the second quarter.

December 11 -

The problem in the sector boils down to a lack of portability of data, whether it’s digital or contained in documents, that can be trusted between parties, LoanLogics Chief Product Officer Dave Parker argues.

December 10 LoanLogics

LoanLogics -

But existing deals are likely to experience issues resulting from higher defaults, faster prepayment speeds.

December 9 -

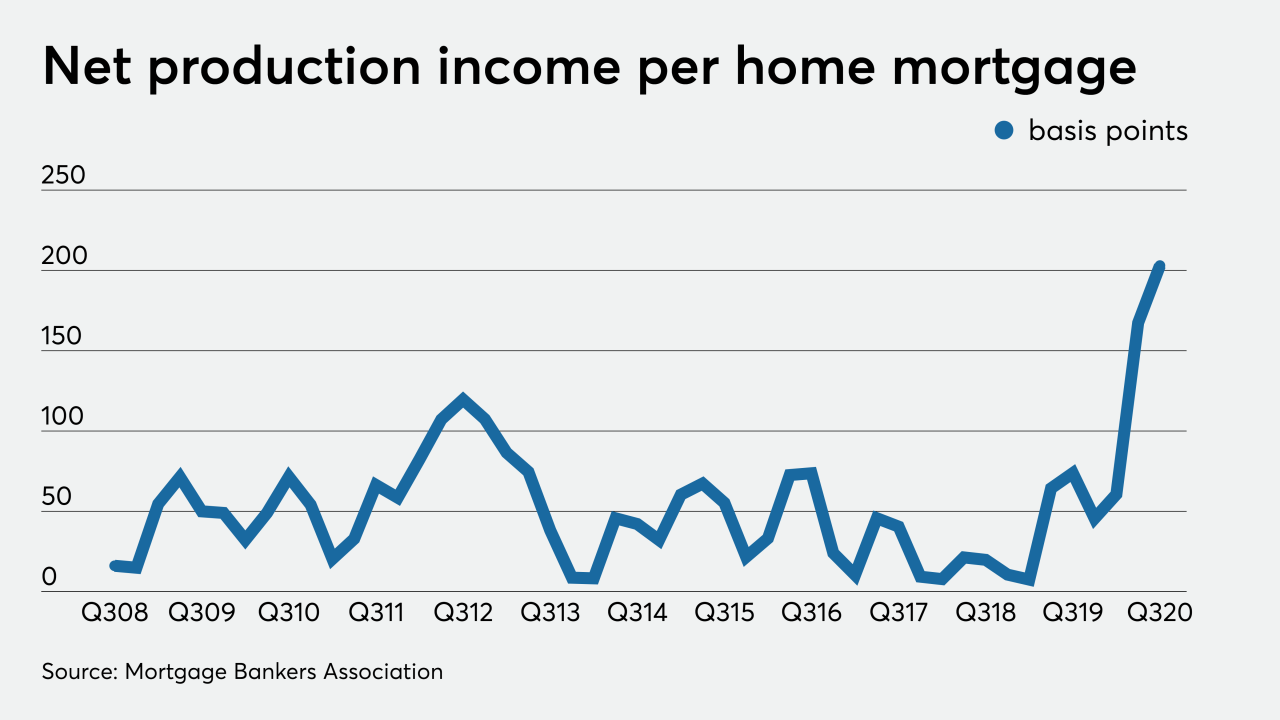

The average per-loan profit margin remains incredibly strong, but the share of senior executives expecting it to fall has risen markedly.

December 9 -

Whether Ginnie issuance increases in the future may depend in part on the extent to which the Biden administration wishes to tap the FHA to promote affordable housing and homeownership.

December 8 -

If CMBS litigation picks up in earnest in the aftermath of the pandemic, lessons gleaned from over a decade of RMBS litigation could pay dividends, Bilzen Sumberg lawyers Philip Stein and Kenneth Duvall say.

December 8 Bilzin Sumberg

Bilzin Sumberg -

The single-family, duplex and multi-unit condo properties have an average age of 60 years, more than double the age of other rated SFR securitizations.

December 7 -

The money lenders are making on each home loan hit another survey-record high in the third quarter, but it may not be quite as high going forward.

December 3 -

The economic fallout from COVID-19 has highlighted systemic concerns about commercial real estate exposure, business debt and short-term wholesale funding, the Financial Stability Oversight Council said in an annual report.

December 3 -

The results are in the middle of the range provided before the company went public in October.

December 3 -

The transaction involving 345 high-balance mortgages is just the third sponsored by Morgan Stanley's mortgage acquisition and trading arm since the financial crisis more than a decade ago.

December 3 -

Originations from all sources, including commercial and reverse mortgages, total $9.2 billion.

December 2 -

Even government-sponsored enterprise loans, which have seen forbearance rates drop for 24 weeks in a row, saw a slight uptick.

December 1 -

Experts in the field predict how some aspects of the market will develop in the coming year.

November 30 -

Other portions of the casino-property loan have been previously assigned to nine other commercial-mortgage securitizations.

November 30 -

Bee Mortgage App will use blockchain and automation provided by Elphi to create "a COVID tool for real estate agents" to get fully digital mortgage approval in under three minutes.

November 25 -

Citigroup's realty arm is sponsoring a $1.06 billion RMBS of highly seasoned mortgage loans with troubled histories. All of the loans were acquired via a Fannie whole-loan auction.

November 25