Fintech

Fintech

-

But unless lenders make fundamental shifts in how they use this technology, change isn't going to happen.

June 5 -

With no way of knowing just how many borrowers will need the mods after the coronavirus forbearance period ends, lenders are deploying artificial intelligence and servicing protocols to tame the ferocious piles of paperwork awaiting them.

June 2 -

The social distancing related limitations on home appraisals is inspiring some companies to find new ways to advance the process.

May 29 -

The temporary approval of remote ink-signed notarizations gives mortgage companies another tool for closing deals during coronavirus lockdown.

May 27 -

The company will still offer the product it is most known for, Point.

May 27 -

The funds will allow the company to make further investment in its machine language technology.

May 21 -

Other safety measures taken to protect settlement agents and consumers include drive-up closings and overnight mail.

May 19 -

Now is the time for mortgage servicers to prioritize customer care for the homeowners they serve.

May 15 -

The upstarts enjoyed rapid growth during the long economic expansion. Now they are on the ropes.

May 14 -

Previously, mortgage firms concentrated on borrower-facing systems at the expense of internal experience.

May 13 -

Bisignano, who engineered a technology-driven recovery at First Data before it was acquired by Fiserv last year, will take Fiserv's top job as the company forges its coronavirus strategy.

May 7 -

Almost 10 years after it became the business world's biggest buzzword, cloud technology is everywhere, but few mortgage companies have fully capitalized on its efficiency and flexibility advantages.

April 29 -

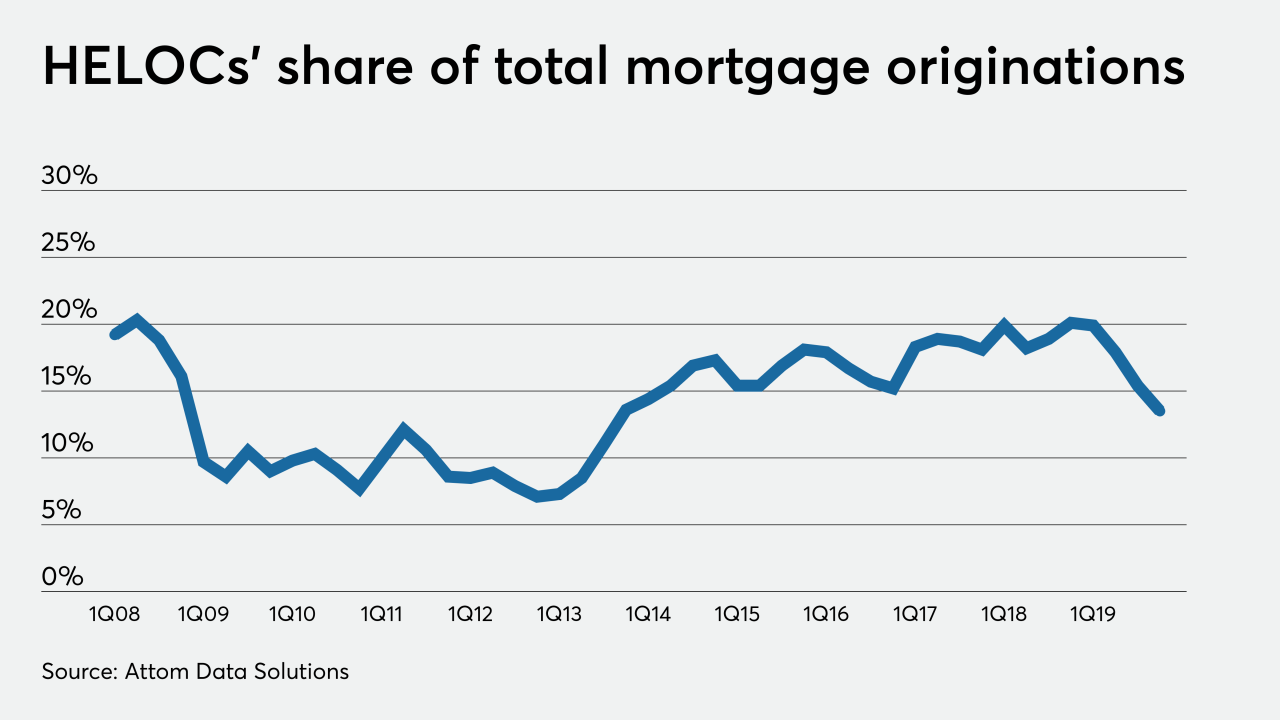

Is JPMorgan Chase an outlier or the canary in the coal mine when it comes to home equity lending during the coronavirus spread?

April 28 -

To keep up with demand during the coronavirus pandemic, the mortgage industry must push other initiatives to the side in favor of ramping up the use of tech tools, according to Planet Home Lending.

April 16 -

As the mortgage and real estate industries traverse the challenges of the increasingly digital coronavirus landscape, title agents and their integral part of the process can get overlooked.

April 3 -

Joe Welu, CEO and founder of Total Expert, provides his perspectives on how the coronavirus pandemic impacts the mortgage industry and ways lenders can push forward.

April 1 -

Real estate crowdfunding company Sharestates launched a program Wednesday offering liquidity to private lenders and loan aggregators contending with margin calls as a result of market volatility related to the coronavirus outbreak.

April 1 -

As delving further into digitization becomes more the standard, loan officers across the country know artificial intelligence is the next evolution in mortgage technology.

March 31 -

As the world practices social distancing to counteract spreading the virus further, it forces lenders to move as close as possible to an all-digital model, as quickly as possible.

March 27 -

Women are becoming more and more empowered in home purchasing, thanks in part to the digitization of the mortgage and real estate industries, according to a report from Compass and Better.com.

March 4