-

Despite rising mortgage rates and a dismal start to the fall, homebuilders in the Twin Cities are picking up the pace.

October 29 -

Sales of previously owned homes eased in September to the weakest pace in almost three years, a sign rising prices and mortgage costs are keeping potential buyers on the sidelines, National Association of Realtors data showed.

October 19 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

One report found that 95% of homebuyers searched websites before buying a home, and that number jumps to 99% among millennials. In short, almost everyone starts shopping online, and a vast majority are going to Zillow.

October 10 J.D. Power

J.D. Power -

Millennials are targeting homeownership within the next few years, but many are buying into certain house-purchasing myths, according to Bank of America.

October 10 -

Property values for homes that were foreclosed on during the Great Recession are outpacing the nation's average house price appreciation, according to Zillow.

October 5 -

The state's red-hot housing market may be cooling a bit, according to the head of the New Hampshire Housing Authority.

October 5 -

While digital expansion of the mortgage application process increases convenience, it inherently comes with the downside of heightened fraud risk.

October 3 -

Homebuyers put about 15% toward a down payment on house, spend $40,000 in one-time fees and thousands in closing costs, presenting an opportunity for lenders to leverage education and product offerings to prepare them for a purchase.

October 2 -

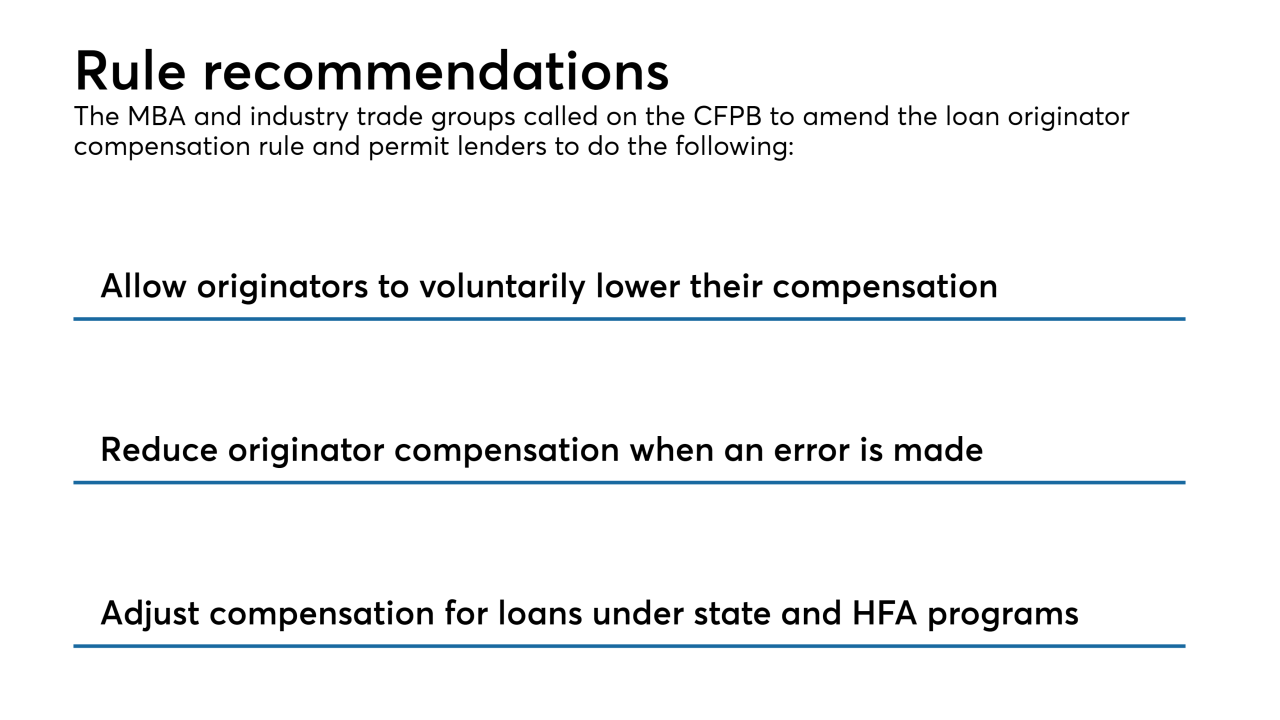

The mortgage industry is calling on the Consumer Financial Protection Bureau to revise its Loan Originator Compensation rule in favor of better protection for consumers and lesser regulatory burdens for lenders.

October 1 -

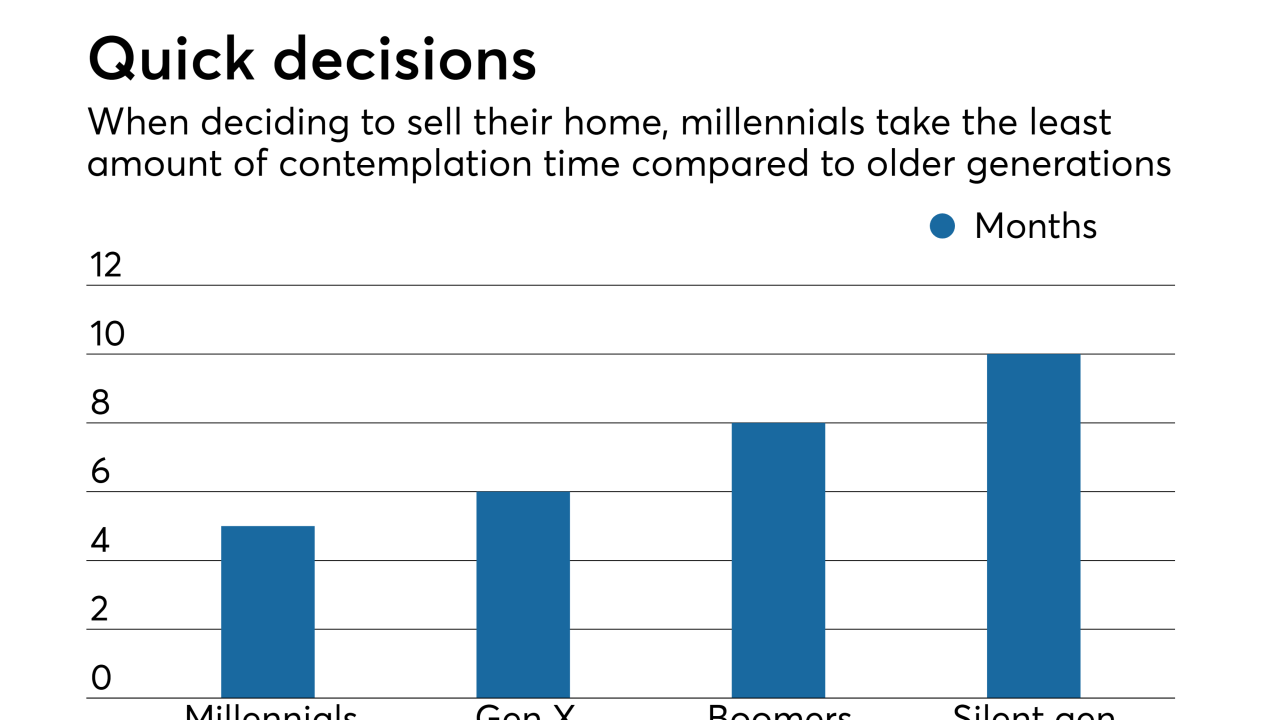

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

With hundreds of digital mortgage products on the market, lenders must focus on their core business objectives to avoid getting overwhelmed by all the bells and whistles, says Teresa Blake, managing director of business optimization at KPMG.

September 25 -

Home-price gains in 20 U.S. cities grew in July at the slowest pace in almost a year, a sign demand is increasingly bumping up against affordability constraints.

September 25 -

A supply-demand mismatch has continued to chill housing sales in metro Atlanta, according to a report from Remax of Georgia.

September 24 -

Sales of previously owned homes were unchanged in August, indicating buyers are balking at higher prices and leaving more inventory on the market for the first time in three years, a National Association of Realtors report showed.

September 20 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

The housing market's long-running trend of fewer sales and higher prices has intensified, adding to worries about affordability in the region.

September 14 -

Staggering home prices and steep tax rates are pushing people from expensive cities along the coasts to more affordable locales.

September 12 -

Homebuyers are seeking financing options first before even looking for a house, according to loanDepot.

September 12