-

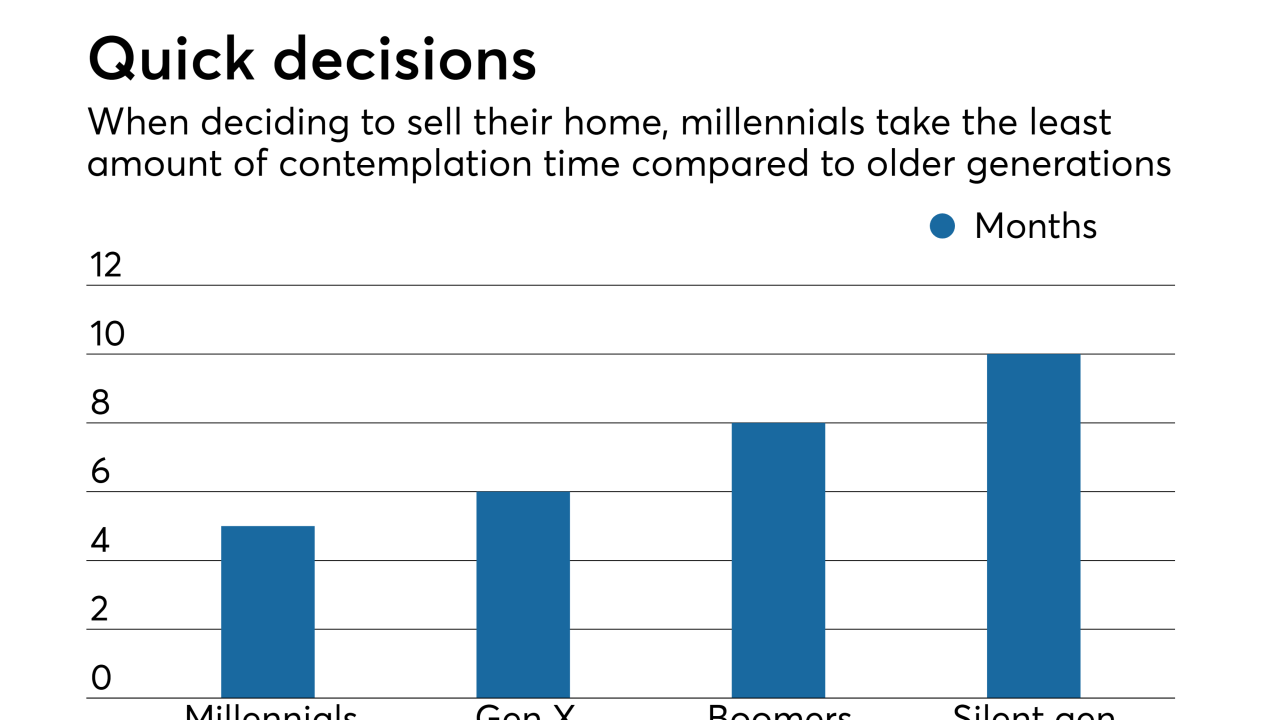

Millennials make up the largest constituent group for both homebuyers and sellers, which could put a squeeze on lending and eventually shift the market.

September 28 -

With hundreds of digital mortgage products on the market, lenders must focus on their core business objectives to avoid getting overwhelmed by all the bells and whistles, says Teresa Blake, managing director of business optimization at KPMG.

September 25 -

Home-price gains in 20 U.S. cities grew in July at the slowest pace in almost a year, a sign demand is increasingly bumping up against affordability constraints.

September 25 -

A supply-demand mismatch has continued to chill housing sales in metro Atlanta, according to a report from Remax of Georgia.

September 24 -

Sales of previously owned homes were unchanged in August, indicating buyers are balking at higher prices and leaving more inventory on the market for the first time in three years, a National Association of Realtors report showed.

September 20 -

Bill Emerson, the vice chairman of Quicken Loans, said mortgage lenders need to give time to consider innovation and not be deterred by naysayers.

September 18 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

The housing market's long-running trend of fewer sales and higher prices has intensified, adding to worries about affordability in the region.

September 14 -

Staggering home prices and steep tax rates are pushing people from expensive cities along the coasts to more affordable locales.

September 12 -

Homebuyers are seeking financing options first before even looking for a house, according to loanDepot.

September 12 -

The typical homeowner spends 17.5% of their income on monthly mortgage payments, according to Zillow's second quarter affordability report.

September 6 -

Housing construction in the Twin Cities increased slightly last month, with most of the gain coming from a hefty increase in apartment construction.

September 6 -

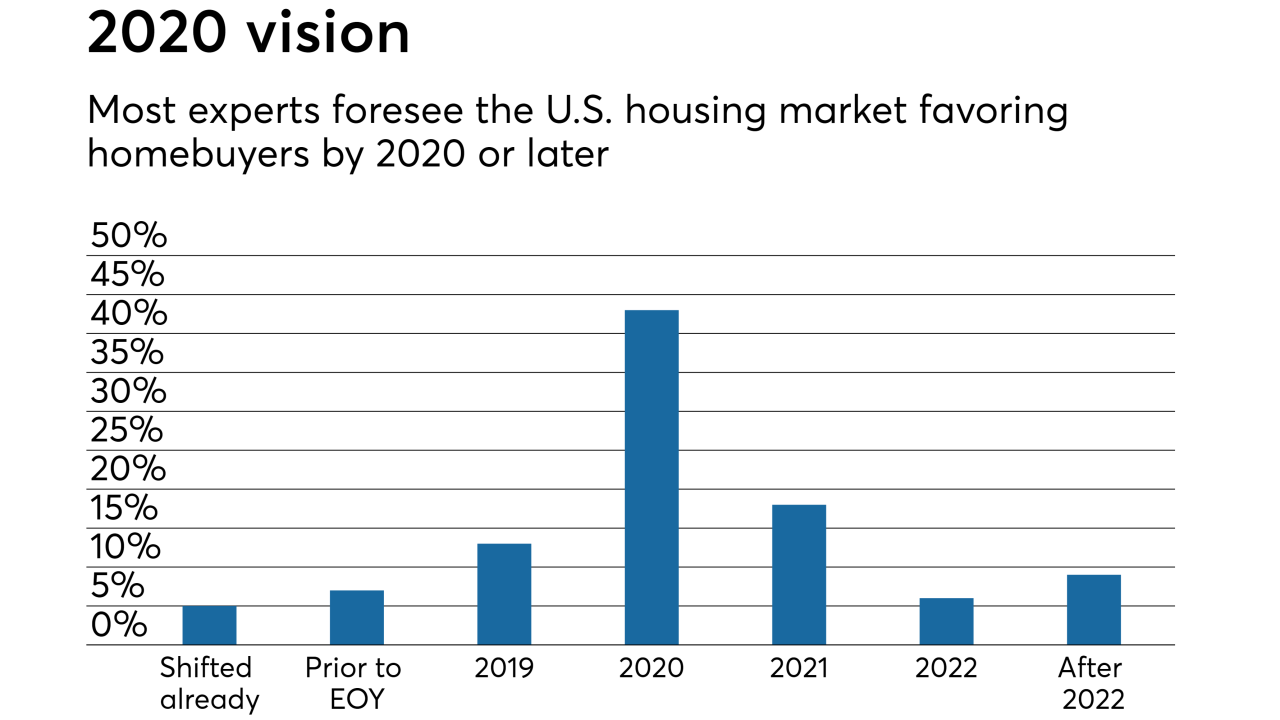

After home prices soared due to a lack of inventory and a recovering economy, three-quarters of experts believe the shift to a buyer's housing market should come in two years.

September 5 -

Nearly half of July's millennial homebuyers were single, a sign that they are not waiting for certain milestones like marriage before deciding to become homeowners, according to Ellie Mae.

September 5 -

Growth in home prices remained churning at a steady pace, with sellers holding out for better returns and suppressing the supply of available housing.

September 4 -

Private mortgage insurance was the largest source of credit enhancement for new homeowners in the second quarter making a low down payment for the first time ever, according to Genworth Mortgage Insurance.

August 29 -

The vast majority of consumers start the mortgage process with internet research, but when it comes time to initiate contact with a lender, borrowers are nearly as likely to pick up the phone as they are to connect online.

August 29 -

Almost $50 billion. That's how much Spokane County, Wash., is worth, according to this year's property assessments, up $4.1 billion over last year.

August 23 -

Sales of previously owned homes unexpectedly slumped for a fourth month to the weakest in more than two years, signaling higher prices and tight supplies continue to squeeze demand, a National Association of Realtors report showed.

August 22 -

Here's a look at the cities where house hunters and sellers have been the busiest during this summer's home buying season.

August 16