-

Add continued growth in commercial and multifamily mortgage debt outstanding to the list of things that the economic fallout from the coronavirus might affect.

March 16 -

With the return of volume and profitability to mortgage lending, it is no surprise that commercial banks are coming back to the market.

March 11 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Fannie Mae and Freddie Mac coming out of conservatorship and transitioning into public utilities would be the ideal for small mortgage lenders, according to trade-organization representative Robert Zimmer.

March 10 -

Fannie Mae completed its first two Credit Insurance Risk Transfer transactions of 2020, shifting $1 billion of single-family loan credit risk to insurers and reinsurers.

March 4 -

An effort by the Federal Housing Finance Agency to examine membership rules for the Federal Home Loan Bank System is reigniting an argument over whether to allow more nonbanks in or impose tougher barriers.

March 1 -

From increased consumer engagement to new forms of payment, mortgage servicers are finding themselves faced with new trends in the market that they need to address.

February 28 -

The Federal Housing Finance Agency authorized the government-sponsored enterprises to contribute $502.2 million to two funds that help preserve and build affordable housing.

February 27 -

Freddie Mac elevated Corley to executive vice president and head of its single-family business, putting her permanently in the role she occupied since last October.

February 20 -

Freddie Mac saw a decline in net profit in 2019 due to decreased interest rate income, lower amortization revenue and risk-reducing investment costs, but its consecutive-quarter results improved.

February 13 -

Fannie Mae identified the adoption of hedge accounting and regular issuance of multifamily Connecticut Avenue Securities deals as among strategies it could continue to pursue while navigating regulatory uncertainties and change.

February 13 -

Five MBS pools of predominantly non-QM mortgages have been launched into the market by originators and loan aggregators, according to ratings agency presale reports published since Monday.

February 13 -

Whether a deal involves a minority stake or a whole company carve-out, buyers and sellers should be aware of five issues that may pose transaction risk in the mortgage market.

February 11 Mayer Brown

Mayer Brown -

The unsuccessful scheme has become the focus of a legal battle involving two former Federal Home Loan Bank of San Francisco employees against that government-sponsored enterprise, which fired them in 2018.

February 11 - LIBOR

The government-sponsored enterprises’ plan to cease accepting loans pegged to the London interbank offered rate a year ahead of its scheduled expiration is expected to hasten action in securitized markets.

February 10 -

To paint nonbanks as a source of systemic risk, particularly given the track record of commercial banks in causing the 2008 subprime mortgage fiasco, seems absurd.

February 7 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

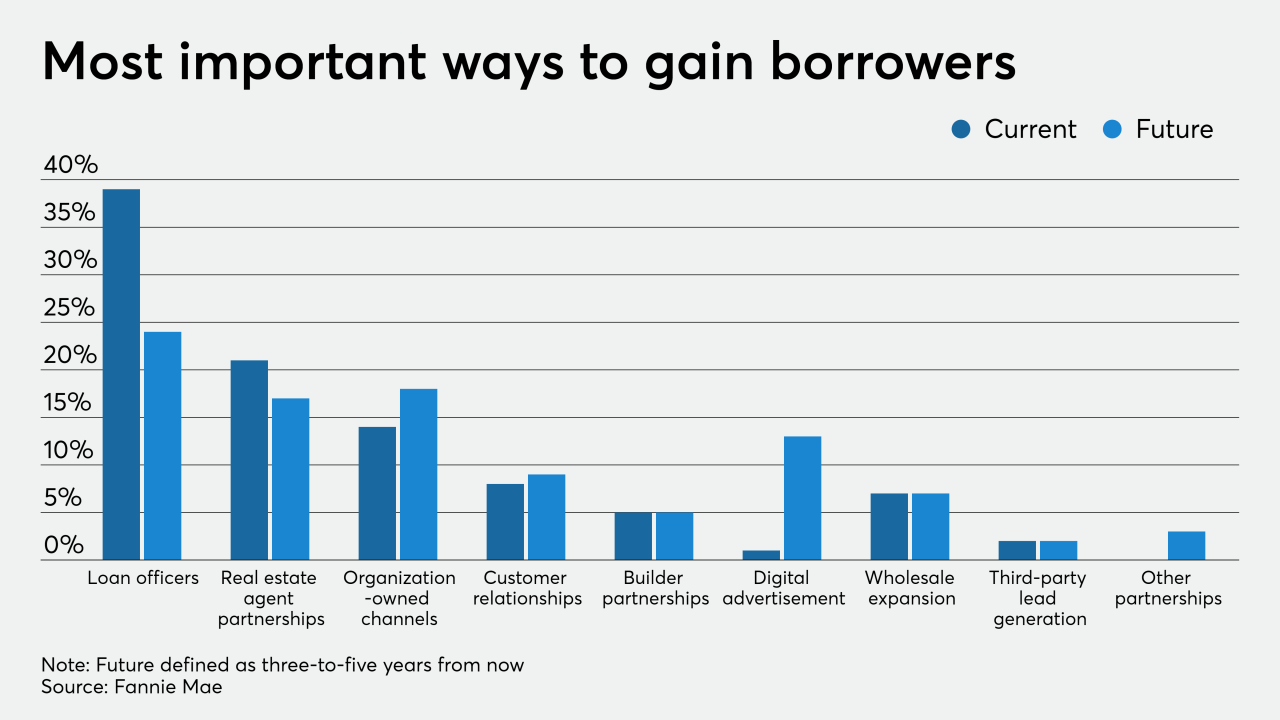

While loan officers will remain mortgage lenders' leading business development tool in the future, those originators believe business will come from a more diversified source pool, a Fannie Mae survey found.

February 7 -

Debt-to-income doesn't perfectly measure a borrower's likelihood of making timely mortgage payments, but it shouldn't be replaced as the ability-to-repay rule evolves, it should be made more flexible instead.

February 5 Platinum Home Mortgage Corp.

Platinum Home Mortgage Corp. -

The Federal Housing Finance Agency plans to increase liquidity standards for nonbank conforming loan servicers, and at the same time raise the net worth requirements for those that also perform the function for Ginnie Mae.

February 5 -

In letters to Freddie Mac and Fannie Mae, six Democrats asked how the mortgage giants are factoring extreme weather into their risk modeling.

February 4 -

With policymakers focused on ending Fannie Mae and Freddie Mac’s conservatorship, their regulator is reorganizing key units and adding staff to position itself for the long term.

February 4