-

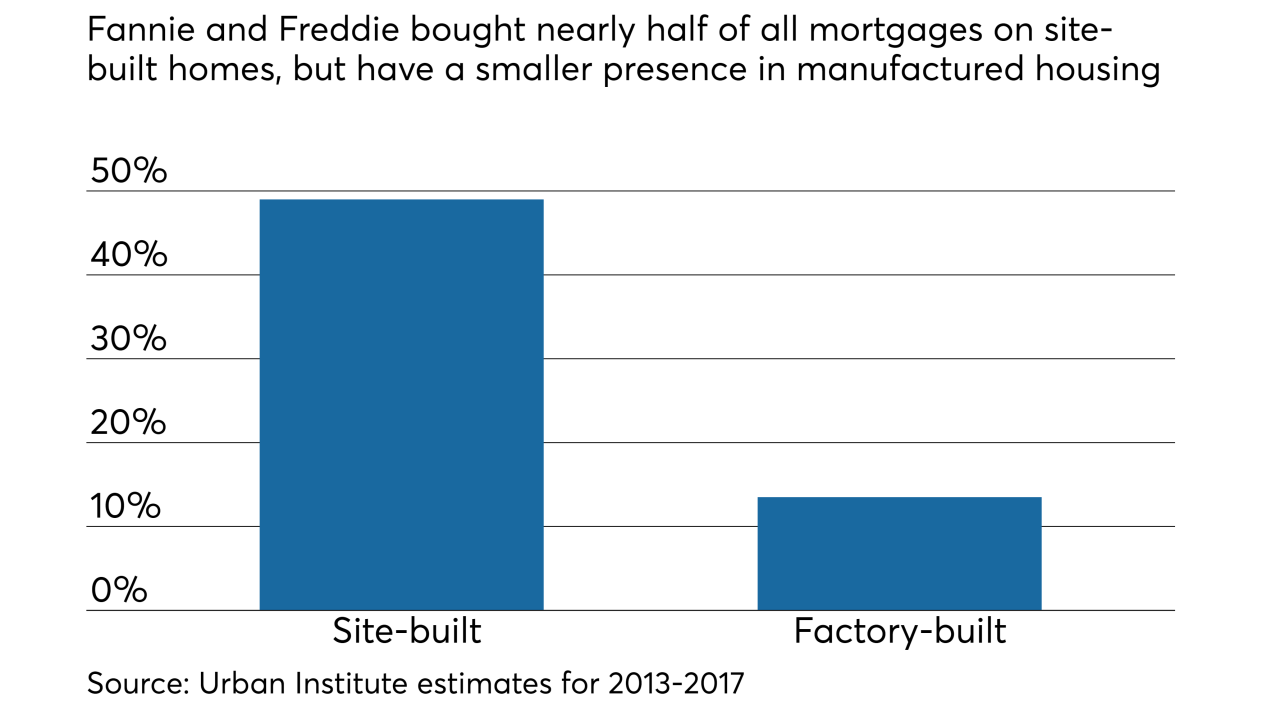

A new Freddie Mac pilot program will offer mortgages on manufactured housing with terms that more closely resemble conventional financing for site-built homes.

November 30 -

The sustained rise in home values will boost Fannie Mae and Freddie Mac's loan limits for 2019, marking the second consecutive year in which it increased by nearly 7%.

November 27 -

Greenway Mortgage, a New Jersey lender that pledges to support charitable causes, is launching a consumer-direct digital mortgage division that will specialize in one-stop shopping for home renovations.

November 27 -

The proposal by Fannie and Freddie’s regulator to impose bank-like capital requirements would be relevant only if the companies leave conservatorship. But that hasn’t stopped lenders from requesting changes.

November 26 -

Freddie Mac is expanding its Home Possible loan program to allow borrowers in rural locations to use "sweat equity" for down payments and closing expenses.

November 20 -

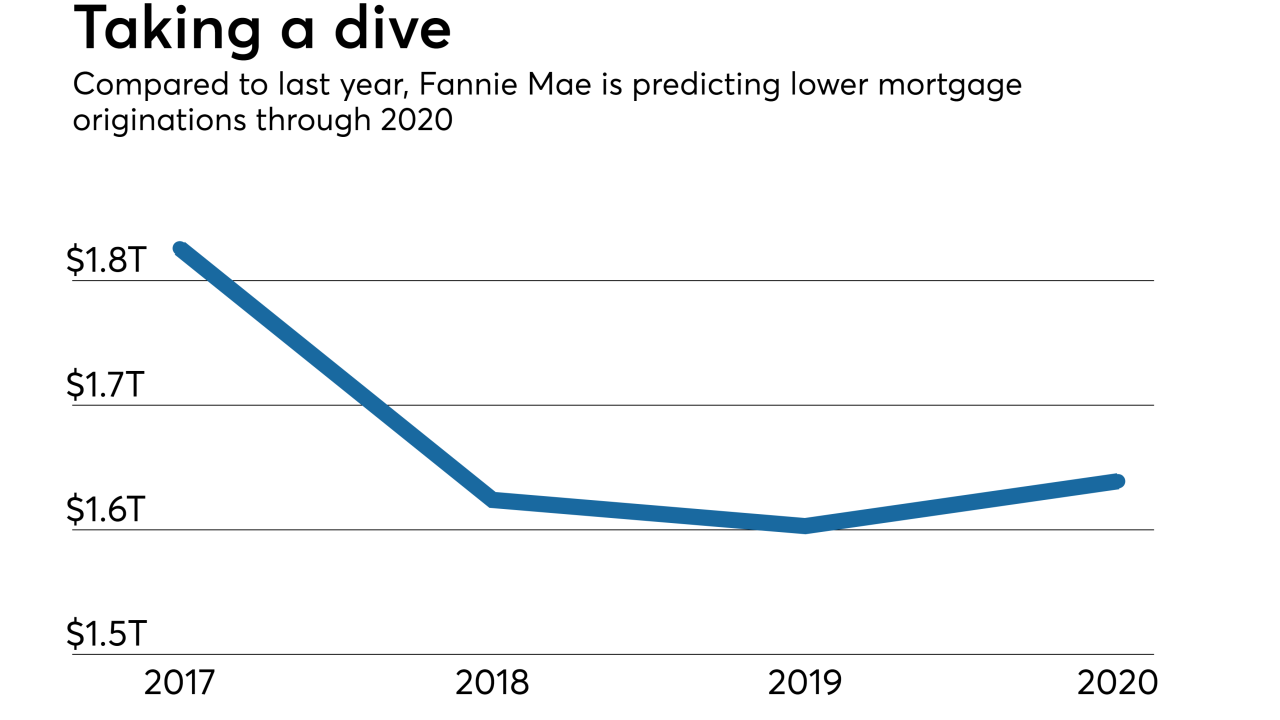

Fannie Mae's economic growth forecast for 2018 inched up slightly, but a strong labor market won't mean the same positive results for housing.

November 20 -

Carrington Mortgage Services has created a nondelegated correspondent channel, looking to build on relationships it has with originators that currently broker loans to the company.

November 20 -

The end of one-party rule in Washington could move the needle on efforts to devise a new housing finance framework.

November 18 -

A U.S. regulator's plan to boost capital in the mortgage-finance giants won't work unless investors get "compensated" for the billions of dollars the government has collected from the companies in recent years, one shareholder said.

November 16 -

Borrowers buying new homes produced fewer loan applications than they did a year earlier due to October's rising interest rates.

November 16 -

Fannie Mae completed 10 traditional and front-end credit risk insurance transactions during 2018, sharing $2.6 billion of risk, including $192 million in its final deal of the year.

November 15 -

Borrowers will get more leeway to finance energy- and water-efficient improvements under a new program coming from Freddie Mac.

November 14 -

The revised blueprint by Moelis & Co. LLC incorporates a pending regulatory capital plan for the mortgage giants.

November 9 -

The Federal Housing Finance Agency is leaving the government-sponsored enterprises' multifamily caps for 2019 unchanged at $35 billion per agency, but is making other changes to prerequisites for excluded loans.

November 6 -

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

November 6 -

The unique approach Fannie Mae and Freddie Mac are each taking with their credit-risk transfer products is quickly becoming a key point of differentiation that's rekindling competition between the government-sponsored enterprises.

November 2 -

Laurel Davis, VP, credit risk transfer at Fannie Mae, explains why the switch to a REMIC structure for CAS is important, and why it took so long.

November 2 -

Fannie Mae and Freddie Mac transferred a substantial amount of credit risk to the private sector through both single-family and multifamily market transactions in the first half of the year, with activity expected to rise in 2019, according to the Federal Housing Finance Agency.

November 1 -

When the mortgage giant will be released from government control is anyone's guess, but the company's third-quarter report shows signs of an easier transition.

October 31 -

Fannie Mae has priced more securities that support a transition away from the London interbank offered rate.

October 26