-

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Incenter Mortgage Advisors is facilitating the sale of $3.7 billion in mortgage servicing rights tied to Fannie Mae and Freddie Mac loans, roughly one-third of which have private mortgage insurance.

October 19 -

Donald Layton, who has run the mortgage giant since 2012, discussed the busy agenda leading up to his departure and says Freddie can serve as a "technical adviser" in GSE reform talks.

October 18 -

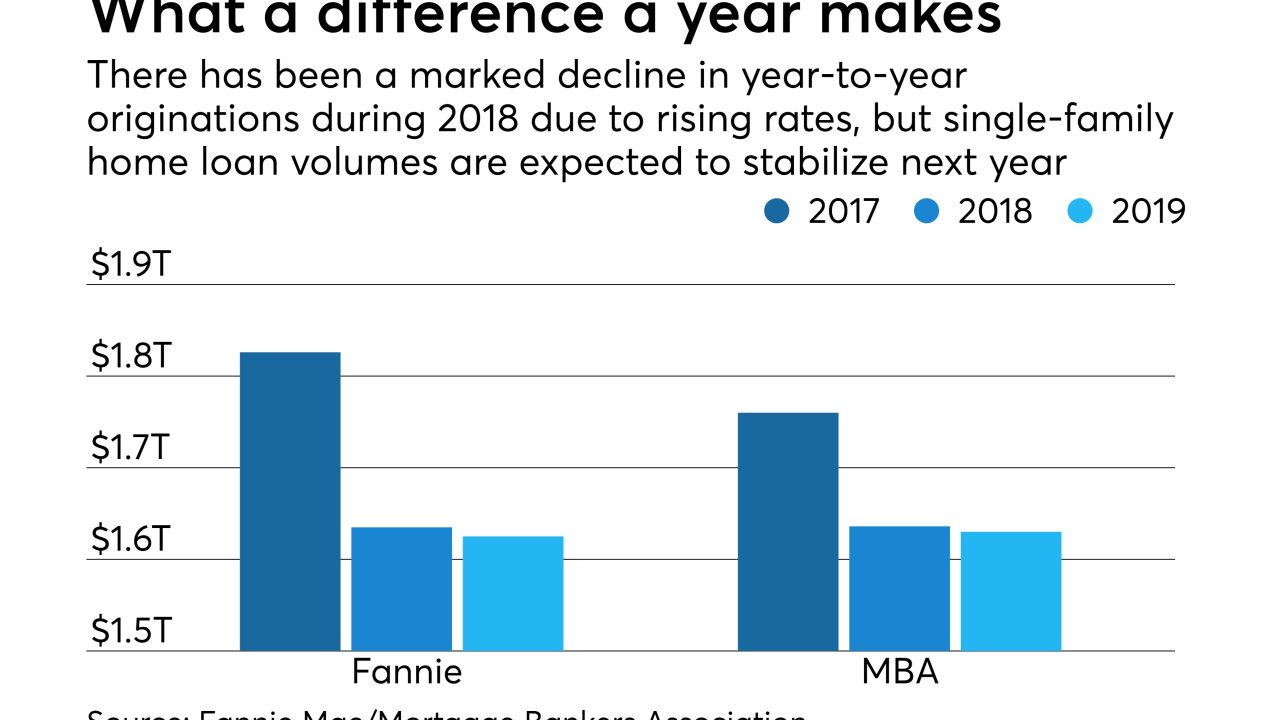

Increasing pessimism about housing is driving Fannie Mae's estimates for originations this year down a little further.

October 18 -

MGIC Investment Corp.'s quarterly earnings were again driven by better-than-expected loss development, and those favorable results should be seen in the other private mortgage insurers' results as well, an industry analyst said.

October 17 -

Exploration and adoption of new technologies is essential for achieving strategic goals and satisfying the needs and expectations of mortgage borrowers.

October 16 Freddie Mac

Freddie Mac -

The departing CEOs of Fannie Mae and Freddie Mac oversaw significant cultural and operational shifts that made the housing finance system safer and more responsive to market needs, but a tough job lies ahead for their successors.

October 16 -

The Federal Housing Finance Agency, Fannie Mae and Freddie Mac have launched an online clearinghouse with resources to assist lenders in serving borrowers with limited English proficiency.

October 15 -

It's a critical time in Washington, with many key institutions in the mortgage and housing industries getting new leaders. At the Mortgage Bankers Association, there's a renewed focus on maintaining effective influence with decision makers on initiatives like housing finance reform, innovation and the evolving needs of home buyers.

October 14 -

Home price index swaps, treated as a second lien on a property, will be used to reduce the default risk associated with low down payment mortgages, one of the program's creators said.

October 10 -

Fannie Mae has appointed Hugh Frater, a member of its board of directors, to serve as its interim chief executive officer after Timothy Mayopoulos steps down next week, the company said in a statement on Monday.

October 9 -

Freddie Mac made its first equity investment into a low-income housing tax credit fund in nearly a decade, through a partnership with Enterprise Community Investment.

October 5 -

Lenders offered fewer government-guaranteed mortgage programs in September, leading to an overall decline in mortgage credit availability, according to the Mortgage Bankers Association.

October 4 -

Commercial and multifamily mortgage debt outstanding grew by 1.6% during the second quarter, benefiting from improved property values and low interest rates, according to the Mortgage Bankers Association.

September 28 -

Fannie Mae and Freddie Mac issued new capital requirements for private mortgage insurers that will create big swings in carriers' asset reserves.

September 27 -

After a run-up in the latter half of last year, delinquencies on mortgages sold to Fannie Mae and Freddie Mac look fairly stable for the time being.

September 27 -

As the House Financial Services Committee prepares to hold a hearing Thursday on oversight of the Federal Housing Finance Agency, the exact focus of the hearing remains somewhat in flux.

September 25 -

Lower corporate tax rates weakened the incentive for developers to use the Low-Income Housing Tax Credit program, which could prompt affordable housing construction to fall by as much as 40% by 2022, according to data aggregator Reis.

September 25 -

Increased competition among non-qualified mortgage lenders leading to lower starting interest rates for borrowers should result in fewer of these loans prepaying within one year of origination, said Standard & Poor's.

September 24 -

A stronger economy, easing house price appreciation and slightly improving inventory conditions aren't enough to push up home sales this year, according to Freddie Mac.

September 24