Home Equity Lines of Credit (HELOCs)

Home Equity Lines of Credit (HELOCs) are experiencing a resurgence due to both homeowners having trillions in tappable equity as well as many being locked into low-rate mortgages. Borrowers are seeking liquidity without refinancing. Banks and independent mortgage lenders are responding to this by expanding HELOC products, increasing limits, and embracing new technology and digitization. Current areas of focusing include securitizations gaining momentum, rising fraud threats, and intensifying competition is intensifying. HELOCs have re-emerged as a strategic growth lever for mortgage professionals.

-

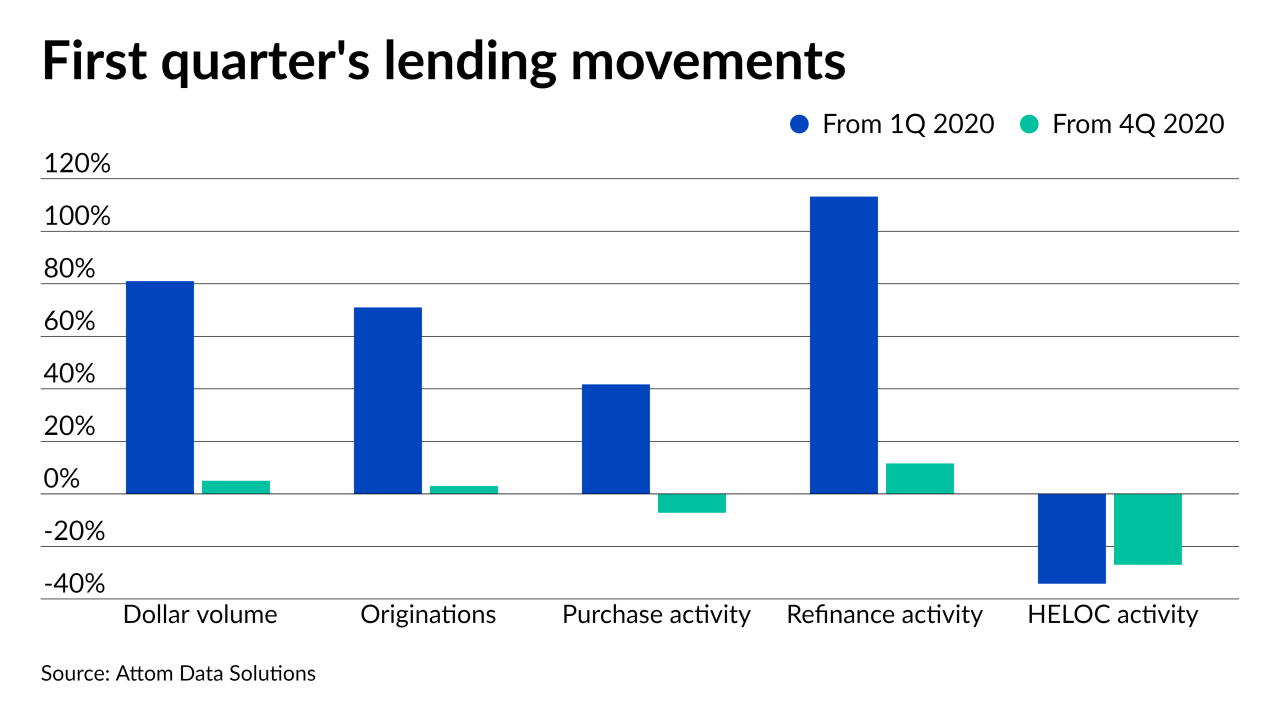

Refinancings more than doubled the year-ago amount and made up for the slowed purchase activity, according to Attom Data Solutions.

June 3 -

As mortgage rates stayed below 3% in the third quarter, originations spiked to the highest quarterly total since 2007 and highest dollar volume since 2005, according to Attom Data Solutions.

November 20 -

The two companies first started collaborating last year, but now BBVA has white-labeled Prosper’s technology on its own website.

November 10 -

With mortgage rates tumbling near 3% in the second quarter, refinance originations spiked 400% in some housing markets, pushing overall volume to its highest point since 2009, according to Attom Data Solutions.

August 20 -

Home-renovation loans to add features such as offices and pools could be one source of lending as credit unions struggle with overall sluggish loan demand.

July 24 -

The Consumer Financial Protection Bureau seeks to address challenged posed by the sunset of the London interbank offered rate at the end of 2021.

June 4 -

With mortgage rates reaching all-time lows in the opening quarter, refinance originations were up in 97% of housing markets during 1Q, according to Attom Data Solutions.

May 21

The first three months of the year coincide with the start of President Donald Trump's second term in office. Investors are likely to be more interested in banks' outlooks amid swings in tariff policy than the first-quarter results.