Home Equity Lines of Credit (HELOCs)

Home Equity Lines of Credit (HELOCs) are experiencing a resurgence due to both homeowners having trillions in tappable equity as well as many being locked into low-rate mortgages. Borrowers are seeking liquidity without refinancing. Banks and independent mortgage lenders are responding to this by expanding HELOC products, increasing limits, and embracing new technology and digitization. Current areas of focusing include securitizations gaining momentum, rising fraud threats, and intensifying competition is intensifying. HELOCs have re-emerged as a strategic growth lever for mortgage professionals.

-

Bank of America's total first-mortgage originations rose while its home equity production decreased in the third quarter.

October 16 -

Most home sellers are stressed around issues involving time and money — two things they can't control — because those affect the purchase and financing of their next home, a Zillow survey found.

October 11 -

With housing affordability still a prominent hurdle to homeownership, prospective buyers — especially millennials — now get creative in order to find suitable homes, according to Chase and the Property Brothers.

October 4 -

The number of mortgage holders with refinancing potential dropped by 1.5 million as the average long-term rate for home loans continued to rise, according to Black Knight.

September 20 -

Home equity lenders expect origination activity to remain dreary through next year even though consumers can potentially access more proceeds now than in 2006, a Mortgage Bankers Association survey found.

September 3 -

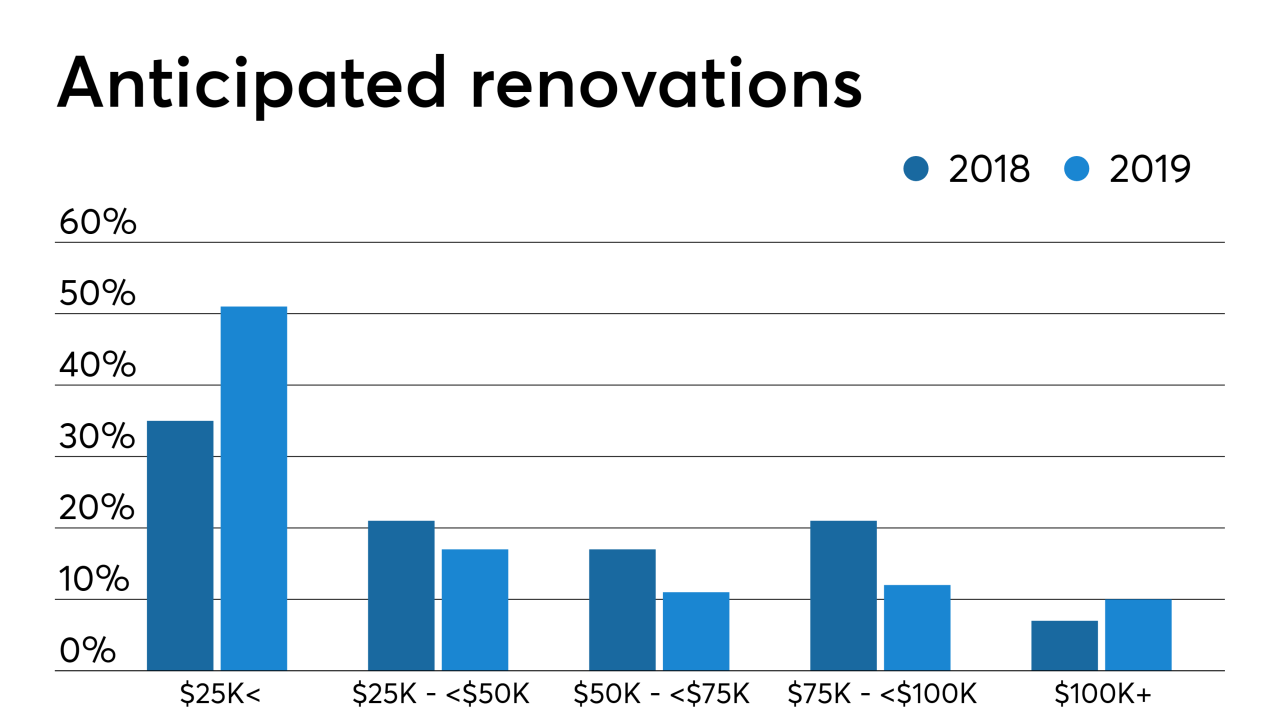

With nearly half of homeowners renovating in the next two years, HELOCs stand as the most likely form of lending sought out by consumers, according to TD Bank.

July 10 -

Cerberus affiliate FirstKey Mortgage will pool outstanding first- and second-lien loans totaling $277.7 million drawn from 1,732 seasoned and performing HELOCs.

June 14

The first three months of the year coincide with the start of President Donald Trump's second term in office. Investors are likely to be more interested in banks' outlooks amid swings in tariff policy than the first-quarter results.