-

First-time buyers comprised just 26% of November transactions, down from 32% a year ago and matching the lowest share since 2014, the National Association of Realtors report showed.

December 22 -

“Rent of shelter” — a category that makes up a third of the CPI basket of goods and services prices — is up 3.9% from November 2020. That’s the most in 14 years but still pales in comparison to many private-sector metrics.

December 13 -

Sales are on track to exceed 6 million this year, which would be the strongest since 2006.

November 22 -

Only eight states experienced annual appreciation viewed as sustainable, according to Fitch Ratings.

November 17 -

U.S. home prices jumped 19.8% in August, the latest in a string of massive gains in the pandemic real estate market.

October 26 -

Listing times, price appreciation and inventory of for-sale homes all made incremental gains in favor of buyers, according to Zillow

October 19 -

The lack of inventory pushed the median housing price to double-digit annual growth for the 14th straight month, according to Redfin.

October 15 -

The state, which has grappled for years with a shortage of affordable housing, will see prices rise 5.2% to a median of $834,000 in 2022, according to a forecast by the California Association of Realtors.

October 8 -

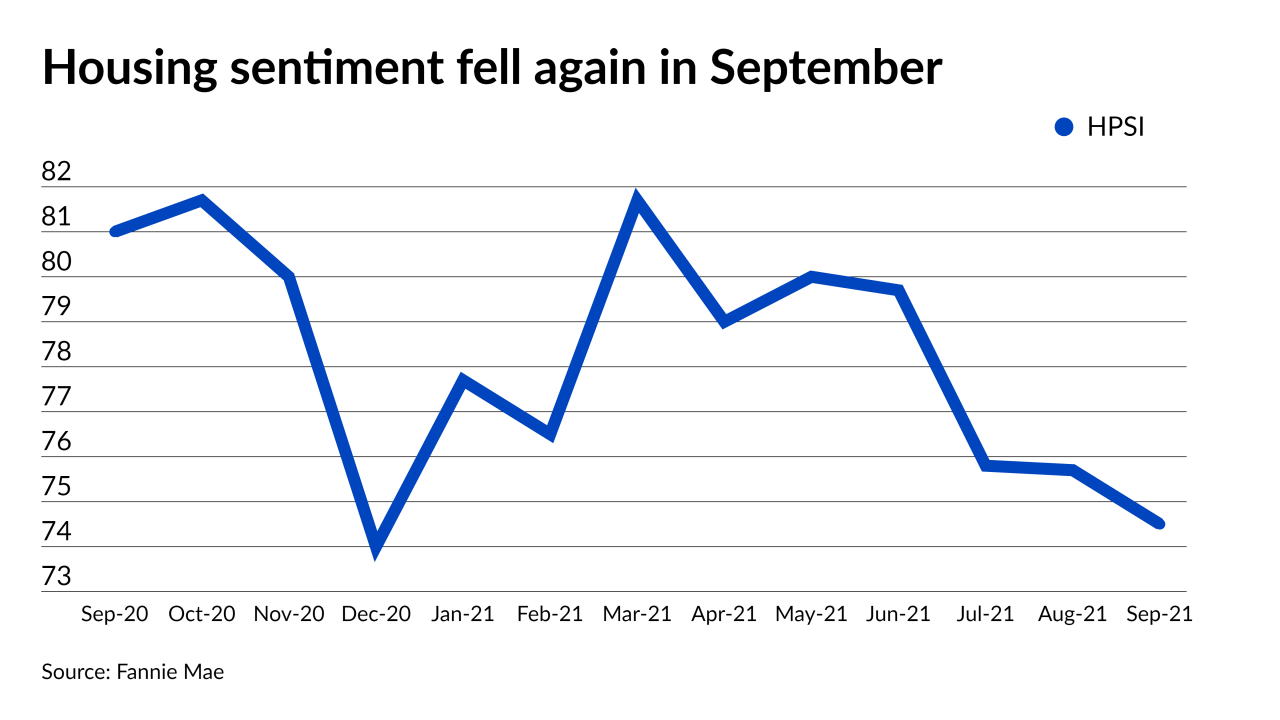

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

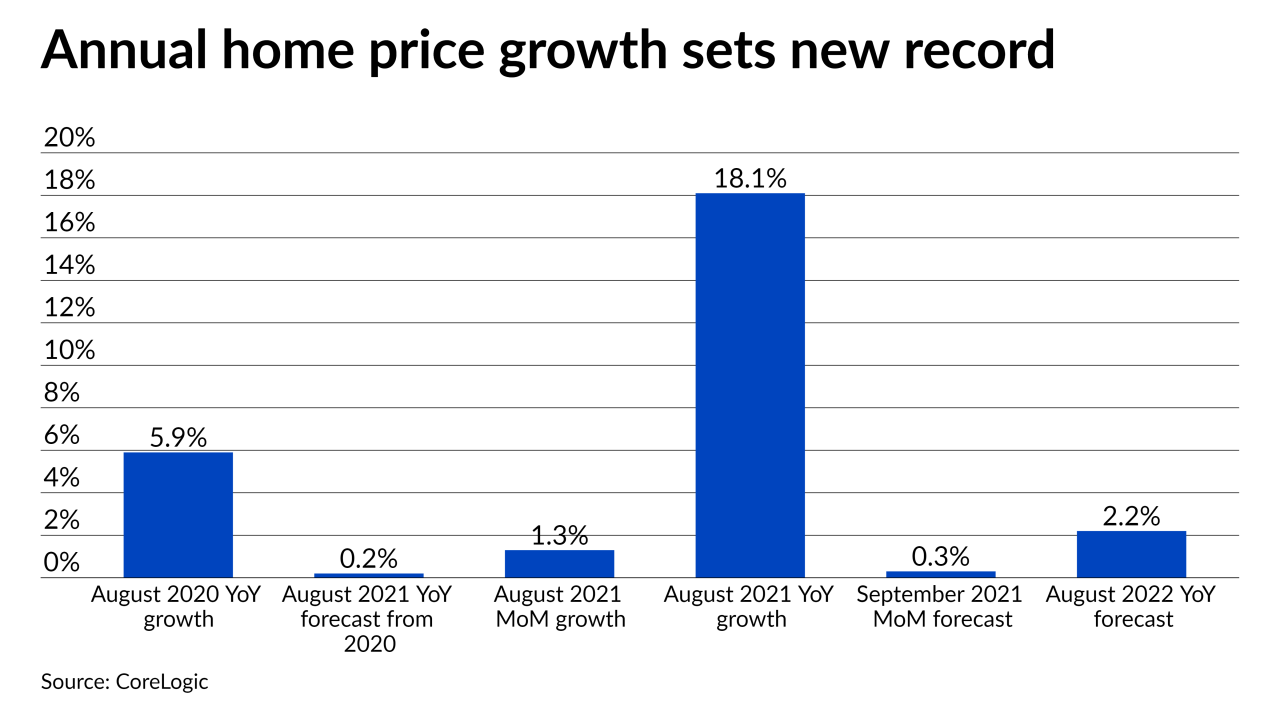

Appreciation more than tripled the year-ago rate, according to CoreLogic.

October 5 -

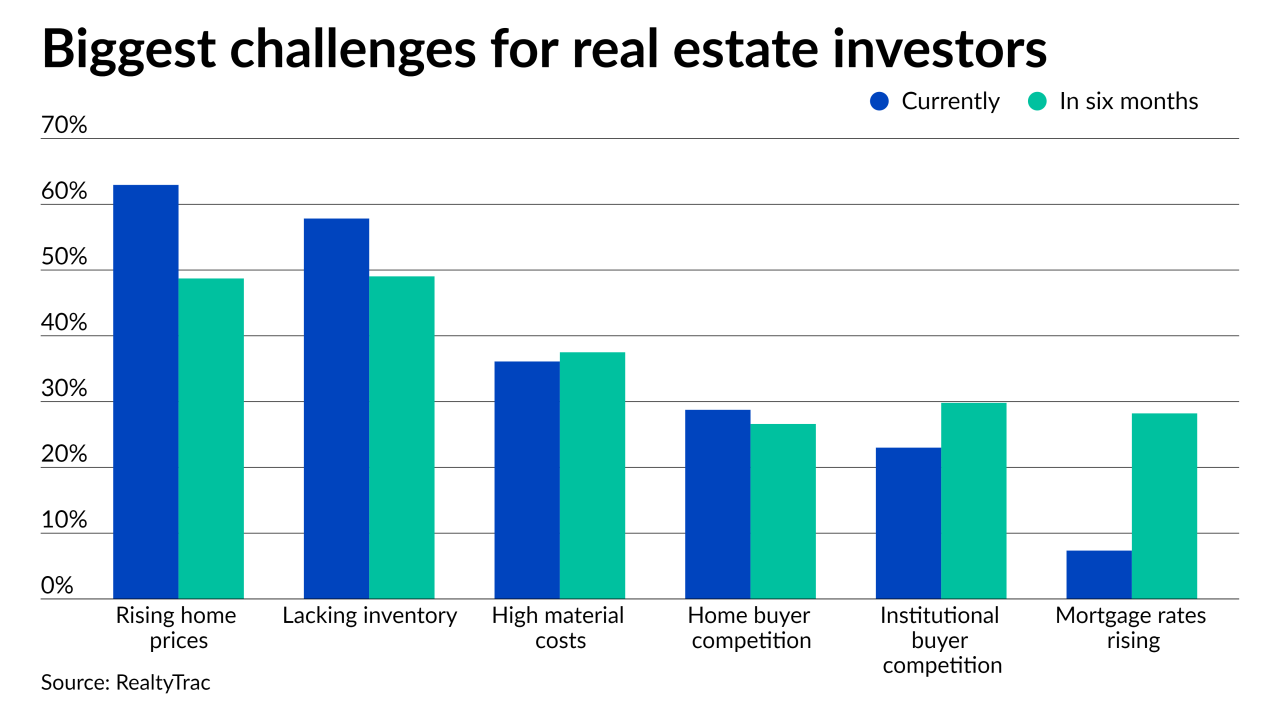

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

The U.S. housing market has been on fire, with the pandemic fueling intense demand for suburban homes. A shortage of affordable properties has pushed up prices and kept some potential buyers on the sidelines.

September 28 -

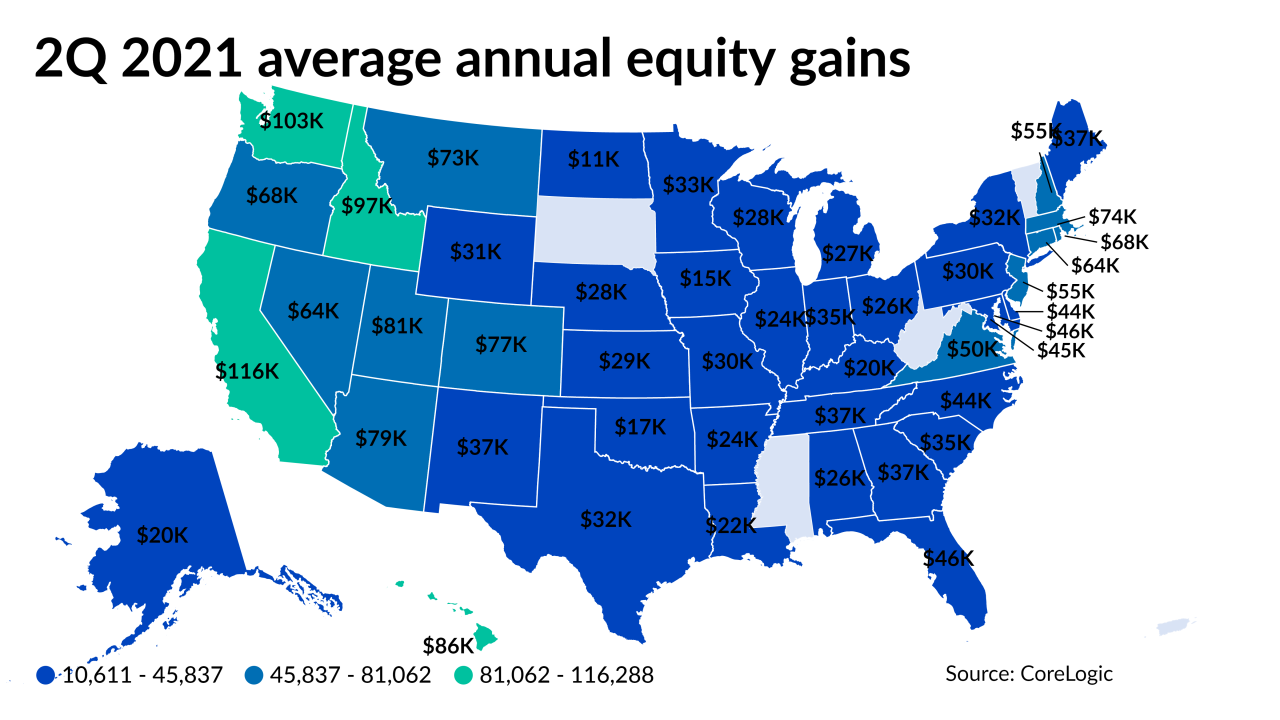

Price appreciation over the past year also dropped the share of underwater mortgage borrowers to an all-time low, according to CoreLogic.

September 23 -

Last month’s housing market reversed a trend in purchases, but it wasn’t enough to stop the double-digit price growth, according to Redfin.

September 16 -

Southwestern housing markets had the largest annual changes in median monthly home loan payments, with one increasing more than 30%, according to Redfin.

September 10 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

The jump is the largest 12-month gain in the index since the series began 45 years ago.

September 7 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

The S&P CoreLogic Case-Shiller index of property values nationwide surged 18.6% in June from a year earlier, according to a statement on Tuesday.

August 31 -

However, with mortgage rates down and household income increasing, consumers have 129% more buying power today than they did 16 years ago, according to First American.

August 30