-

Social Finance, the lending and refinancing startup valued at more than $4 billion, is cutting about 7% of its staff, according to a person familiar with the matter.

December 3 -

Minorities are still charged more for mortgages when all other applicable credit factors are equal — both in person and online, according to a new study by the University of California, Berkeley.

November 26 -

Online personal lending pioneer Prosper is developing a home equity line of credit product that it will offer in partnership with banks. The embrace of traditional depositories marks a departure from fintech lenders that typically seek to disrupt and displace legacy institutions.

November 14 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

LendingClub, Marlette and others are looking at additional changes to both their securitization and whole-loan-sale programs that could further broaden their investor bases.

March 1 -

In an interview during his first day on the job, Anthony Noto also spoke about improving the firm's culture and the prospects for an IPO.

February 26 -

The New York bank has begun marketing Marcus loans as a way to pay for home improvements, while also raising the maximum loan size to $40,000.

January 16 -

CMG Financial is offering a new affinity marketing portal on its crowdfunding platform for down payments and positioning it as a way for employers to retain millennials.

January 10 -

Competition between fintech, marketplace and traditional mortgage lenders often focuses on borrower-facing automation and other technology. What gets overlooked is how differences in their funding sources create another area of competition.

October 17 -

Fintech and marketplace lender LendingHome is getting more than $450 million in investment and funding from different channels to help support mortgage production growth and technology improvements.

October 16 -

Entrepreneurs like LendingHome's Matt Humphrey are upending mortgage finance with tactics borrowed from fintech, marketplace lending and the traditional mortgage playbook.

October 16 -

With issuance of marketplace securitizations now exploding — rising 300% cumulatively in the past two years — the idea of online lending as a niche is quickly deteriorating.

October 13 -

CMG Financial is trying out a platform that gives borrowers the ability to raise funds for down payments in conjunction with Fannie Mae loans.

October 3 -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

As distressed inventory dries up and home prices soar, more investors are borrowing to buy flip houses. Here's a look at the 12 states with the largest share of financing for flipping houses.

September 20 -

The online lender has accelerated its search for a permanent CEO and is said to be seeking someone with a history of success in banking.

September 15 -

Mike Cagney’s eventual successor will have to decide whether to continue his focus on rapid growth. Also on the table are strategic decisions about when to go public and whether to pursue a bank charter.

September 12 -

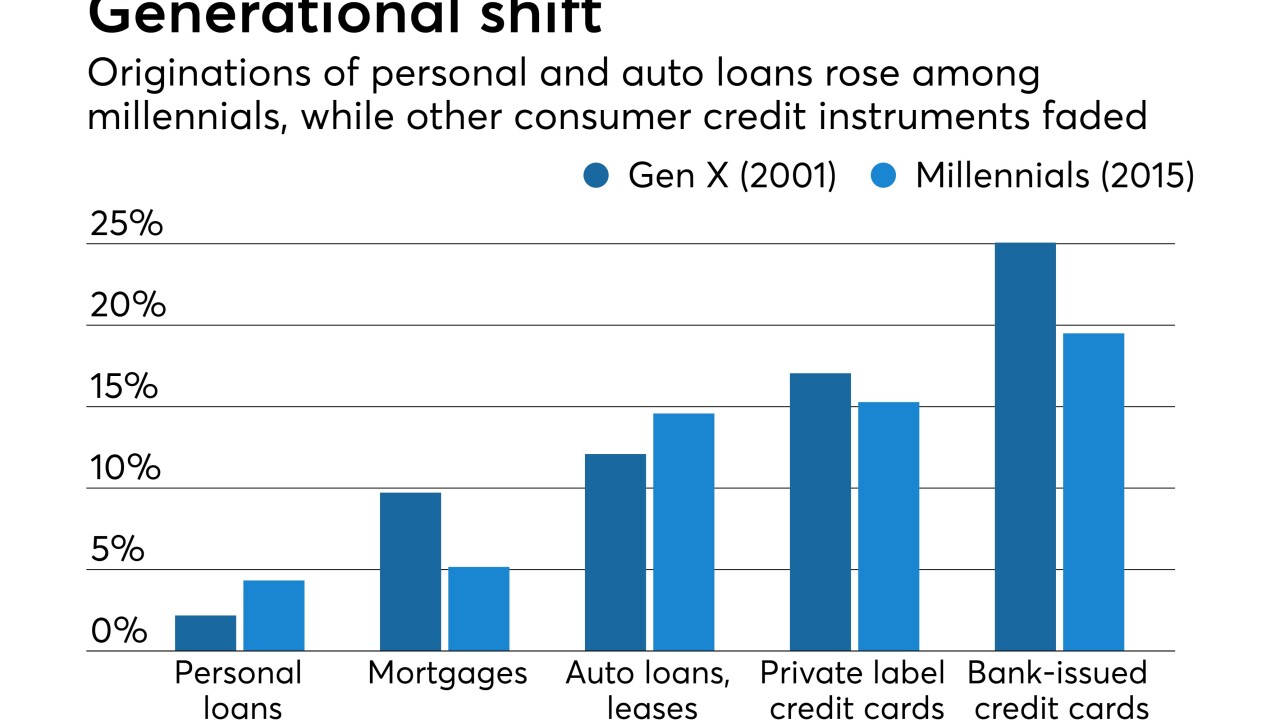

Millennials — many of whom joined credit unions in recent years as the movement's membership expanded — are relying more heavily on personal loans than their Gen X predecessors while paring back on credit cards and mortgages.

September 11 -

It’s highly debatable whether the artificial intelligence engines that online lenders typically use, and that banks are just starting to deploy, are capable of making credit decisions without inadvertent prejudices.

September 7 -

The marketplace lender's application for an industrial bank charter is under fire from small banks and progressives, who say it could violate the barrier between banking and commerce and shut out middle-class and lower-income consumers.

July 19