-

Student housing and assisted/independent living centers were small portions of Freddie's multifamily securitizations prior to COVID, but Kroll noticed they've been missing in most rated deals since spring.

September 30 -

The net share of mortgages in Ginnie Mae securitizations with suspended payments appears to be stabilizing, but the number of new requests creates doubt about whether it will subside.

September 29 -

The Charlotte, N.C., company recently closed on a sale of its Cohen Financial platform to SitusAMC.

September 23 -

The percentage of borrowers who have asked to temporarily suspend payments due to coronavirus-related hardships is down overall, but in the Ginnie Mae market, they're still inching up.

September 21 - LIBOR

The restrictions on the pooling of loans with any interest term based on Libor will be effective for traditional mortgage-backed securities issued starting Jan. 21, 2021, and earlier for reverse-mortgage securitizations.

September 21 -

This proposed Libor replacement is an imaginary, backward-looking benchmark dreamed up by the economists at the Fed with no discernible market.

September 2 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

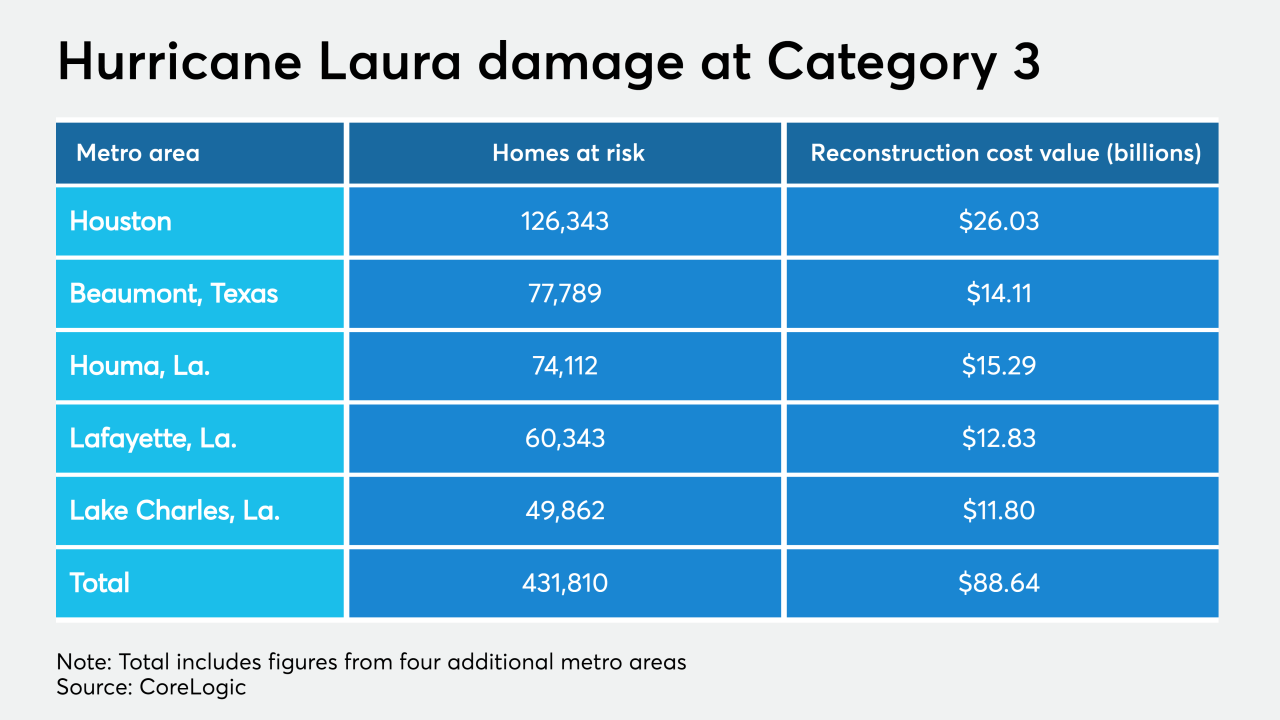

If it makes landfall as a Category 3 storm as was initially projected, damage from Hurricane Laura's surge could potentially devastate 432,810 residential properties in Texas and Louisiana, according to CoreLogic.

August 25 -

Banks and other lenders have found a way to potentially make billions of dollars from the coronavirus-fueled upheaval in the U.S. mortgage market — yet it risks burning bond investors in the process.

August 20 -

The new “adverse market fee” for refinanced mortgages resembles steps the companies took to combat the 2008 mortgage crisis. But critics charge it isn’t necessary and will hurt borrowers’ ability to tap into low rates.

August 13 -

After receiving a third-party stamp of approval, Fannie Mae announced July 27 completing the latest two issuances of a single-family green mortgage backed security as part of an ongoing program that started in April and expands its long-time multi-family green MBS program.

July 28 -

The company lost $8.9 million in the second quarter, but its origination and servicing businesses were profitable.

July 22 -

FHFA, HUD and Ginnie Mae should let the rate of prepayments on MBS dictate bond prices and market rates.

July 1 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

The government agency's restrictions on issuer options for pooling loans go into effect immediately. Here's one thing it could mean for the secondary market.

July 1 -

The REIT will add $500 million in capital through a senior secured loan, and it received a $1.65 billion term facility.

June 16 -

Mortgage rates increased slightly for the second consecutive week, buoyed early on by positive economic news such as the jobs report that came out last Friday, according to Freddie Mac.

June 11 -

The Federal Reserve pledged to maintain at least the current pace of asset purchases and projected interest rates will remain near zero through 2022, as Chairman Jerome Powell committed the central bank to using all its tools to help the economy recover from the coronavirus.

June 10 -

Mortgage investors can take heart knowing the Federal Reserve considers agency MBS a primary arena through which to conduct monetary policy.

June 10 -

The FHFA looks to shed light on the amount of funds Fannie and Freddie will need to hold for their risk-sharing deals.

June 3 -

The firm also predicts that the coronavirus pandemic will delay the GSEs' release from government control.

June 3 -

Just like volatility begets volatility, calmness helps support continued calm.

June 2 Vice Capital Markets

Vice Capital Markets