-

Mortgage application activity dropped to its lowest level since December 2014 as interest rates reached an eight-year high, according to the Mortgage Bankers Association.

November 7 -

Mortgage applications decreased 2.5% from one week earlier as purchase activity compared with 2017 fell for the first time in nearly three months, according to the Mortgage Bankers Association.

October 31 -

An increase in refinance activity in the period after Columbus Day drove mortgage applications 4.9% higher from one week earlier, according to the Mortgage Bankers Association.

October 24 -

Despite mortgage rates at a seven-year high and rising home prices and low inventory that are keeping consumers from buying homes, rental prices are declining in many markets.

October 18 -

Mortgage applications decreased sharply from one week earlier as key interest rates stayed above 5%, although purchase volume grew from a year ago, the Mortgage Bankers Association reported.

October 17 -

Hurricane Michael is putting mortgage transactions with a combined value of over $400 million in jeopardy, according to ClosingCorp estimates.

October 11 -

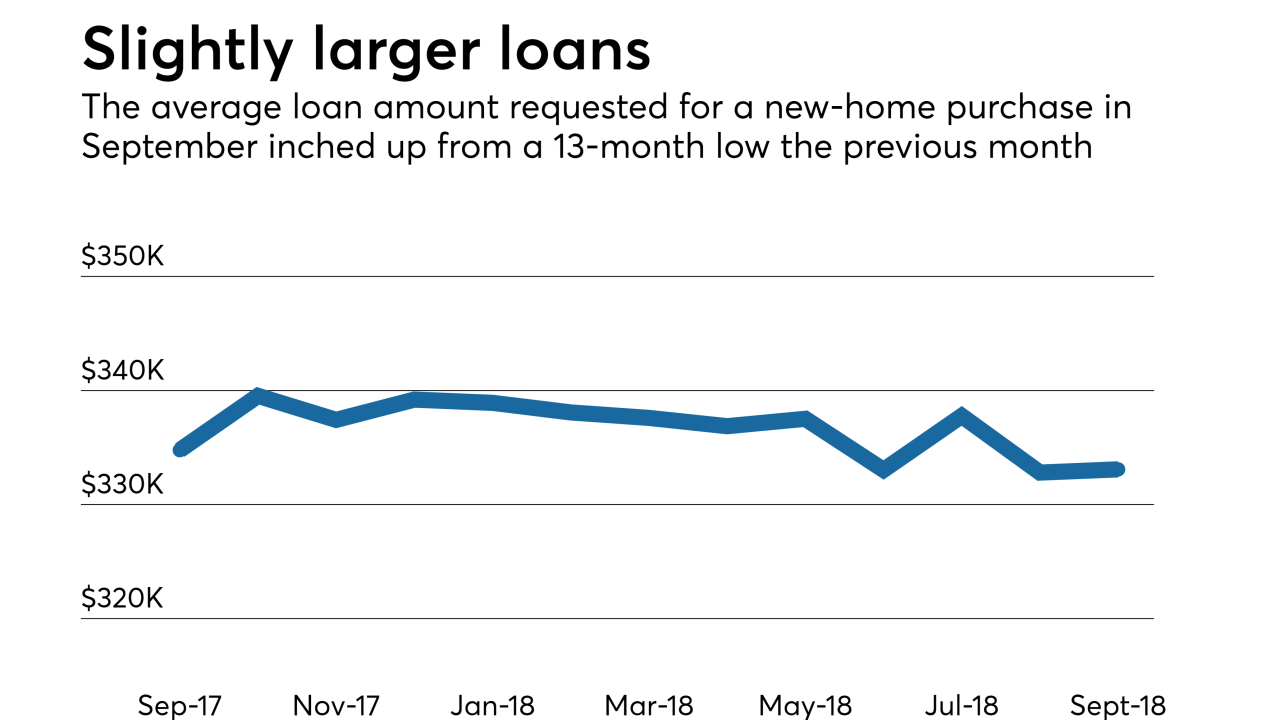

Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

October 11 -

Mortgage applications fell last week as rates for the 30-year fixed conforming loan topped 5% for the first time since 2011, the Mortgage Bankers Association reported.

October 10 -

Mortgage application activity was relatively flat compared with the previous week, as long-term interest rates held steady following the recent Fed rate hike, according to the Mortgage Bankers Association.

October 3 -

Mortgage applications were up 2.9% from one week earlier, even as the rate for the 30-year conforming mortgage reached its highest point in over seven years, according to the Mortgage Bankers Association.

September 26 -

Mortgage applications were up 1.6% from one week earlier, marking only the second increase of the past two months despite key interest rates rising, according to the Mortgage Bankers Association.

September 19 -

An AI-powered virtual assistant could be used in a variety of ways, including helping customers to prequalify for mortgages, easing compliance and detecting problems.

September 18 -

A new study from Pentagon Federal Credit Union finds a sizable portion of consumers will be shopping for a mortgage within two years, but it also revealed some major misconceptions surrounding the process.

September 18 -

Increased sales of lower-priced newly built homes was not enough to counter a decline in mortgage application volume for the segment in August, according to the Mortgage Bankers Association.

September 14 -

Mortgage applications decreased 1.8% from one week earlier as refinance submissions fell to their lowest in nearly 18 years, according to the Mortgage Bankers Association.

September 12 -

Mortgage applications decreased 0.1% from one week earlier, dropping for the seventh time in eight weeks even with scant movement in interest rates, according to the Mortgage Bankers Association.

September 5 -

After their first increase in six weeks, mortgage applications declined despite lower interest rates, according to the Mortgage Bankers Association.

August 29 -

Mortgage applications increased 4.2% from one week earlier, rising for the first time in over a month, according to the Mortgage Bankers Association.

August 22 -

Here's a look at the cities where house hunters and sellers have been the busiest during this summer's home buying season.

August 16 -

Mortgage applications waned for the fifth week in row, hitting their lowest levels in six months, as the summer's growing interest rates plateaued.

August 15