-

The delinquent loan inventory more than doubled compared with the prior year.

August 5 -

An industry coalition wants to ensure borrowers who took out certain types of loans to fund their education aren’t locked out of access to historically low mortgage rates.

August 5 -

With over 4 million millennials entering prime home buying age each year through 2023, purchase activity will be driven much higher, according to Ellie Mae.

August 5 -

Rates are forecasted to remain at the current low levels for the rest of 2020, driving steady refinance volume.

August 5 -

Housing prices continued to grow in June, maintaining a streak in monthly increases that began in February 2012. But the trend could be reversed in 2021 with the resurgent effects of the coronavirus, according to CoreLogic.

August 4 -

After a floundering start to the summer home-buying season, record-low mortgage rates helped make July one of the best in several years for homebuilders in the Twin Cities metro.

August 4 -

Wyoming's average home price has risen nearly 10% since early last year, marking the fastest rate of increase in the state's real estate valuations since the third quarter of 2007.

August 2 -

While low interest rates drove up new insurance written, the increased defaults stymied overall performance.

July 30 -

Mortgage rates fell 2 basis points this week, remaining near their historic lows as they have for the past month with the markets roiled by uncertainty, according to Freddie Mac.

July 30 -

But refis bring overall mortgage application fraud risk back to its record low, First American said.

July 29 -

An index of pending home sales exceeded forecasts in June as borrowing costs fell, adding to evidence that the housing market is the bright spot in an economy stunted by COVID-19.

July 29 -

Miami-Dade and Broward experienced a dip in year-over-year residential transactions in June. But it's not all gloom and doom: Pending sales increased year-over-year, a sign of activity increasing since April.

July 28 -

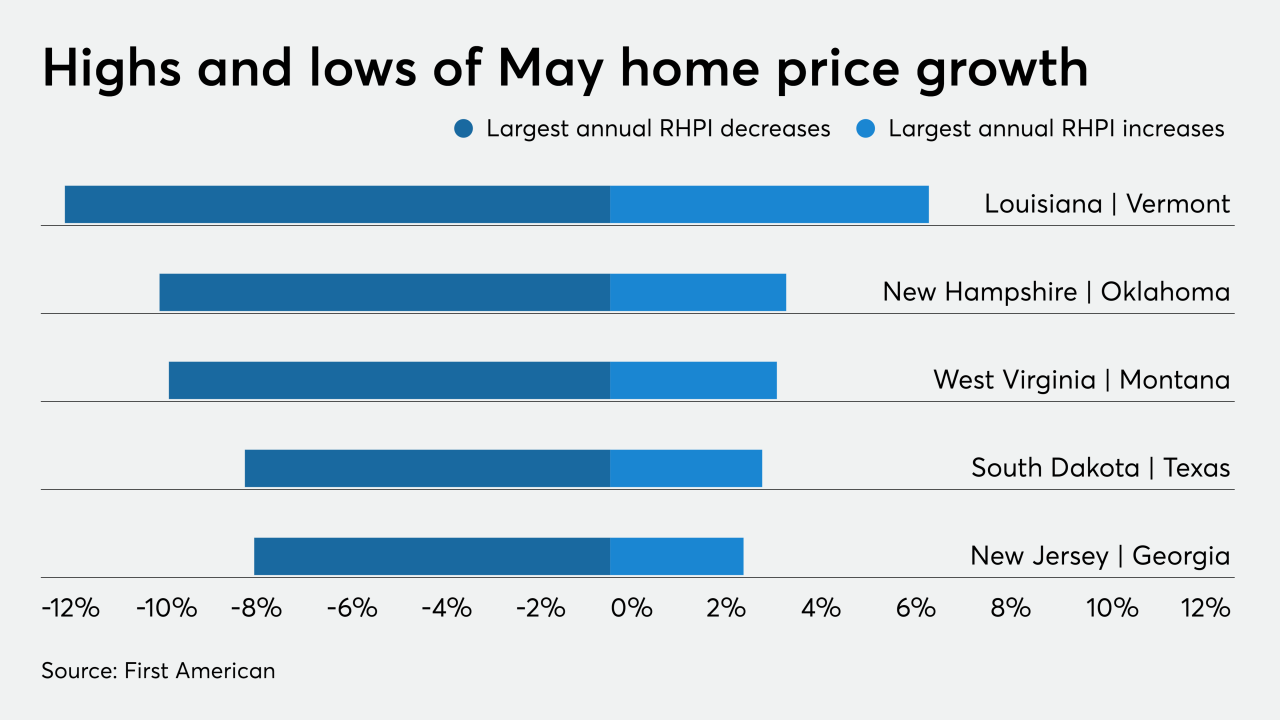

Tight inventory is expected to drive home prices higher over the summer, according to First American.

July 27 -

The Southern California housing market is showing signs of heating up following a coronavirus-induced slump.

July 27 -

New-home sales in the U.S. increased to an almost 13-year high in June, fueled by record-low borrowing costs and adding to evidence that residential real estate is a bright spot for the economy.

July 24 -

While the COVID-19 pandemic has hammered other areas of the Albuquerque, N.M., economy, it's becoming clear that it hasn't stopped residential real estate momentum.

July 24 -

After two months of steep drops, home sales leveled off in the Sarasota-Manatee, Fla., region in June.

July 23 -

Mortgage rates rose for the first time in six weeks, going back the above the 3% mark, as spreads to the 10-year Treasury yield widened again, according to Freddie Mac.

July 23 -

COVID-19 could not stop the upward pressure on home prices in San Diego County which reached a new high of $600,250 in June.

July 22 -

Home sale prices are up while sales numbers are way down in metro Detroit's real estate market, which has yet to experience any collapse in values from the coronavirus-caused recession.

July 22